Risk-neutral valuation simplifies complex financial models by assuming investors are indifferent to risk, allowing asset prices to be calculated as expected values under a risk-neutral measure. This approach is fundamental in pricing derivatives and helps professionals make more accurate decisions in uncertain markets. Explore the rest of the article to deepen your understanding of how risk-neutral valuation impacts financial modeling.

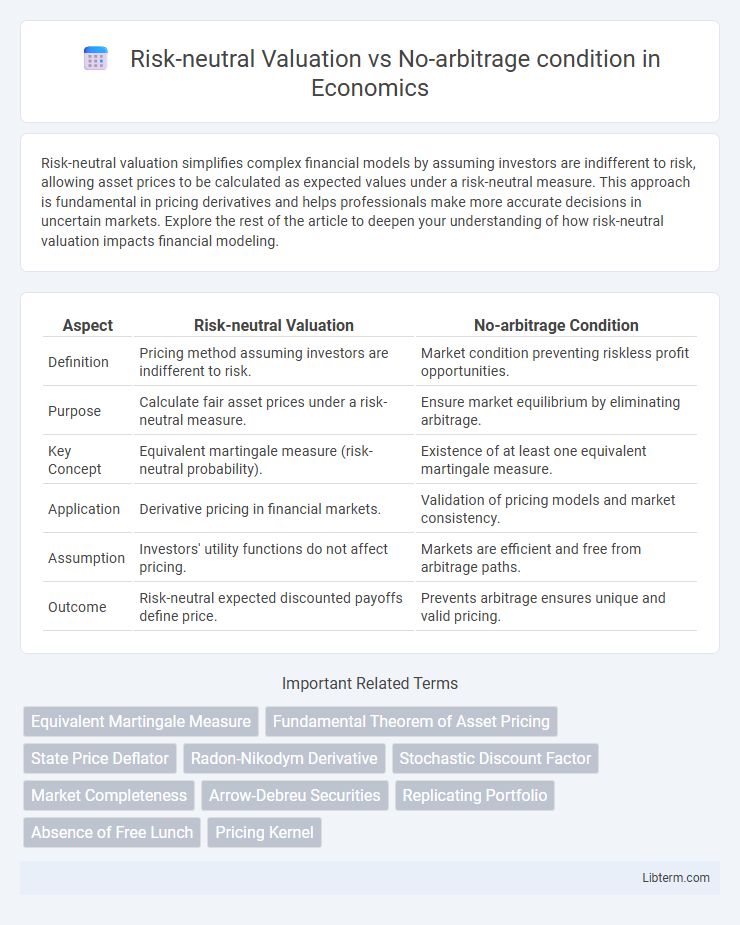

Table of Comparison

| Aspect | Risk-neutral Valuation | No-arbitrage Condition |

|---|---|---|

| Definition | Pricing method assuming investors are indifferent to risk. | Market condition preventing riskless profit opportunities. |

| Purpose | Calculate fair asset prices under a risk-neutral measure. | Ensure market equilibrium by eliminating arbitrage. |

| Key Concept | Equivalent martingale measure (risk-neutral probability). | Existence of at least one equivalent martingale measure. |

| Application | Derivative pricing in financial markets. | Validation of pricing models and market consistency. |

| Assumption | Investors' utility functions do not affect pricing. | Markets are efficient and free from arbitrage paths. |

| Outcome | Risk-neutral expected discounted payoffs define price. | Prevents arbitrage ensures unique and valid pricing. |

Introduction to Risk-neutral Valuation

Risk-neutral valuation is a fundamental concept in financial mathematics that simplifies the pricing of derivatives by assuming investors are indifferent to risk, allowing expected payoffs to be discounted at the risk-free rate. This approach relies on constructing a risk-neutral probability measure under which the discounted price processes of tradable assets are martingales, ensuring consistency with the absence of arbitrage opportunities. The no-arbitrage condition guarantees the existence of such a risk-neutral measure, making risk-neutral valuation a powerful tool for fair pricing and hedging strategies in incomplete markets.

Understanding the No-arbitrage Condition

The no-arbitrage condition ensures that there are no opportunities for riskless profit in financial markets, forming the foundation for fair pricing of derivatives. It requires that asset prices evolve in a way that prevents investors from generating guaranteed gains without risk or initial investment. This principle underpins risk-neutral valuation by enabling the construction of equivalent martingale measures that reflect the absence of arbitrage, allowing derivative prices to be computed as discounted expected payoffs under these risk-neutral probabilities.

Fundamental Concepts in Derivatives Pricing

Risk-neutral valuation is a pricing technique where all investors are assumed indifferent to risk, enabling the use of a risk-neutral probability measure to discount expected derivative payoffs at the risk-free rate. The no-arbitrage condition ensures that there are no opportunity-based profits without risk or investment, forming the foundational principle that derivative prices must prevent arbitrage in the market. Together, these concepts underpin the fundamental framework for consistent and fair derivatives pricing in modern financial mathematics.

Mathematical Foundations of Risk-neutral Valuation

Risk-neutral valuation relies on the mathematical foundation that under a risk-neutral measure, discounted asset price processes become martingales, ensuring the expected return equals the risk-free rate. This framework presupposes the no-arbitrage condition, which guarantees the existence of an equivalent martingale measure, eliminating arbitrage opportunities in the market. The Radon-Nikodym derivative plays a crucial role in transforming the real-world probability measure into the risk-neutral measure, enabling the pricing of derivatives through expected discounted payoffs.

Role of Probability Measures in Asset Pricing

Risk-neutral valuation and the no-arbitrage condition are fundamental concepts in asset pricing, both relying on the choice of probability measures to ensure consistent pricing across financial markets. The no-arbitrage condition requires the existence of an equivalent martingale measure (also called the risk-neutral measure) under which discounted asset prices follow a martingale process, eliminating arbitrage opportunities. Risk-neutral valuation leverages this risk-neutral measure to price derivatives by taking the expected value of discounted future payoffs, enabling a unified framework for asset pricing that aligns with market equilibrium and arbitrage absence.

Connection Between No-arbitrage and Risk-neutrality

The no-arbitrage condition ensures that there are no opportunities to make a riskless profit in financial markets, establishing a fundamental framework for pricing derivatives. Risk-neutral valuation relies on the existence of a risk-neutral probability measure, which emerges directly from the no-arbitrage condition, allowing expected future payoffs to be discounted at the risk-free rate. This connection guarantees that asset prices under the risk-neutral measure reflect fair values consistent with the absence of arbitrage opportunities.

Practical Implications for Financial Markets

Risk-neutral valuation simplifies pricing by assuming investors are indifferent to risk, enabling the use of discounted expected payoffs under a risk-neutral measure, which is crucial for derivative pricing models like the Black-Scholes framework. The no-arbitrage condition ensures market consistency by excluding opportunities for riskless profits, establishing equilibrium prices that prevent mispricing and market inefficiencies. In practical financial markets, combining risk-neutral valuation with the no-arbitrage condition allows traders and risk managers to price and hedge complex instruments accurately, promoting market stability and transparent valuation methodologies.

Common Misconceptions and Clarifications

Risk-neutral valuation assumes investors are indifferent to risk, enabling asset prices to be modeled using a risk-free probability measure, while the no-arbitrage condition ensures no riskless profit opportunities exist in the market. A common misconception is that risk-neutral valuation implies risk neutrality in actual investor preferences, but it is merely a mathematical tool consistent with no-arbitrage principles for pricing derivatives. Clarifying this distinction is essential for understanding that risk-neutral probabilities facilitate fair pricing under no-arbitrage without reflecting true market risk aversion.

Applications in Option Pricing Models

Risk-neutral valuation simplifies option pricing by assuming investors are indifferent to risk, allowing expected payoff computations discounted at the risk-free rate, which streamlines models like Black-Scholes. The no-arbitrage condition ensures that prices remain consistent and prevents the possibility of riskless profits, establishing a fundamental arbitrage-free framework critical for the validity of option pricing models. Together, these principles enable accurate and robust pricing of derivatives by aligning theoretical valuations with market equilibrium.

Conclusion: Comparing Risk-neutral Valuation and No-arbitrage

Risk-neutral valuation and the no-arbitrage condition both serve as foundational principles in derivative pricing, ensuring market consistency and fair pricing mechanisms. Risk-neutral valuation simplifies the calculation of expected payoffs by assuming investors are indifferent to risk, thereby facilitating the use of a risk-neutral probability measure for pricing. The no-arbitrage condition guarantees that prices do not allow for riskless profits, maintaining equilibrium and reinforcing the validity of risk-neutral pricing frameworks in financial markets.

Risk-neutral Valuation Infographic

libterm.com

libterm.com