A thin market is characterized by low trading volume and limited liquidity, leading to higher price volatility and wider bid-ask spreads. In such markets, it may be challenging for You to execute large trades without significantly affecting the price. Explore the rest of the article to understand how thin markets impact investment strategies and risk management.

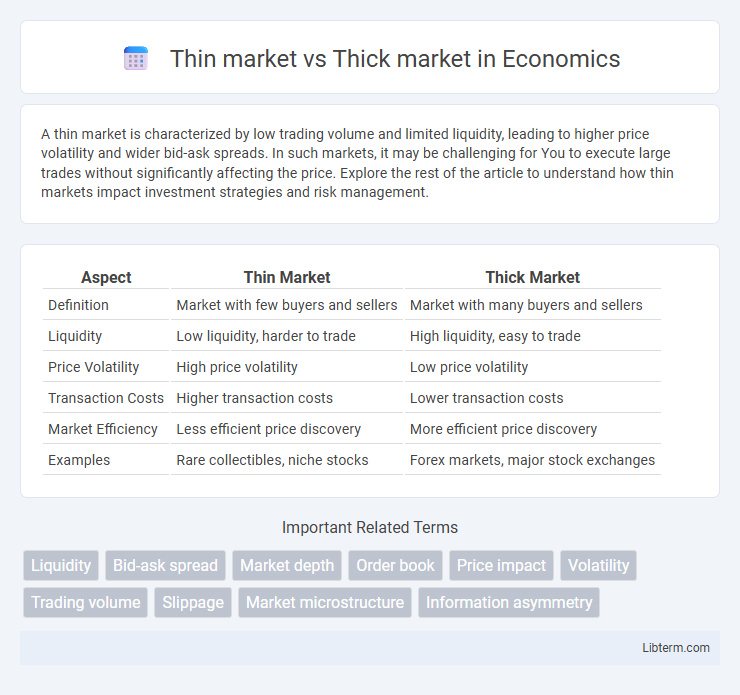

Table of Comparison

| Aspect | Thin Market | Thick Market |

|---|---|---|

| Definition | Market with few buyers and sellers | Market with many buyers and sellers |

| Liquidity | Low liquidity, harder to trade | High liquidity, easy to trade |

| Price Volatility | High price volatility | Low price volatility |

| Transaction Costs | Higher transaction costs | Lower transaction costs |

| Market Efficiency | Less efficient price discovery | More efficient price discovery |

| Examples | Rare collectibles, niche stocks | Forex markets, major stock exchanges |

Introduction to Thin and Thick Markets

Thin markets feature low trading volumes and limited liquidity, causing higher price volatility and wider bid-ask spreads. Thick markets, characterized by high trading volumes and abundant liquidity, enable smoother transactions and more stable pricing. Understanding the distinction helps investors optimize trade execution and manage market impact effectively.

Defining Thin Market: Key Characteristics

A thin market is characterized by low trading volume and limited number of buyers and sellers, resulting in reduced liquidity and higher price volatility. Key characteristics include wider bid-ask spreads, infrequent transactions, and greater difficulty in executing large orders without impacting prices. Thin markets are often observed in niche asset classes, emerging markets, or during periods of economic uncertainty.

Defining Thick Market: Key Characteristics

A thick market is characterized by a high volume of buyers and sellers actively engaging in transactions, ensuring liquidity and tight bid-ask spreads. These markets exhibit low price volatility due to continuous trading and abundant information availability. Common examples include major stock exchanges like the NYSE, where numerous participants facilitate efficient price discovery and market stability.

Liquidity Differences in Thin vs Thick Markets

Liquidity in thick markets is typically high due to a large number of buyers and sellers, facilitating quick and efficient transactions with minimal price impact. Thin markets experience low liquidity, characterized by fewer participants and lower trading volumes, leading to greater price volatility and wider bid-ask spreads. The disparity in liquidity explains why thick markets offer better price stability and lower transaction costs compared to thin markets.

Price Volatility and Market Depth Comparison

Thin markets exhibit high price volatility due to low trading volume and limited market depth, causing prices to fluctuate sharply with small orders. Thick markets benefit from substantial market depth and high transaction volumes, resulting in more stable prices and reduced volatility. The contrast in liquidity directly impacts price discovery efficiency and risk management strategies in both market types.

Participant Behavior in Thin and Thick Markets

Participant behavior in thin markets is characterized by limited trading activity, higher price volatility, and increased bid-ask spreads due to fewer buyers and sellers. In contrast, thick markets exhibit high liquidity with numerous participants, leading to smoother price discovery, lower transaction costs, and more efficient matching of orders. The disparity in market depth drives distinct strategic approaches, where participants in thin markets may face greater risk and uncertainty while thick market participants benefit from increased confidence and stability.

Examples of Thin and Thick Markets

Thin markets, such as rare art auctions or niche collectibles, experience low trading volumes and high price volatility due to limited buyer-seller interaction. Thick markets, exemplified by major stock exchanges like the NYSE or commodity markets like crude oil futures, feature high liquidity, numerous participants, and tighter bid-ask spreads. These differences impact price discovery efficiency and transaction costs significantly.

Risks and Challenges in Thin Markets

Thin markets pose significant risks including low liquidity, which leads to high price volatility and difficulties in executing large orders without impacting market prices adversely. Limited market participants increase susceptibility to manipulation and reduce market efficiency, often resulting in wider bid-ask spreads and increased transaction costs. These challenges hinder price discovery and can deter investor confidence, making capital allocation less effective and riskier compared to thick markets.

Opportunities and Advantages in Thick Markets

Thick markets offer greater liquidity, enabling faster and more efficient transactions due to a higher number of buyers and sellers. The abundance of participants in thick markets enhances price discovery, ensuring more accurate and stable market prices. Businesses benefit from increased opportunities for diversification and risk management in thick markets, supporting stronger growth and innovation.

Strategies for Trading in Thin vs Thick Markets

Trading strategies in thin markets prioritize low volume and limited liquidity by emphasizing limit orders and cautious price entry points to avoid slippage and price manipulation. In thick markets characterized by high volume and liquidity, traders leverage market orders and algorithmic trading to capitalize on tight bid-ask spreads and rapid price movements. Risk management techniques differ as thin markets demand tighter stop-loss limits due to volatility, while thick markets allow for more aggressive position sizing and frequent trade execution.

Thin market Infographic

libterm.com

libterm.com