Appreciation of the real exchange rate occurs when a country's currency increases in value relative to another currency after adjusting for inflation differences, making imports cheaper and exports more expensive. This shift can impact trade balances, competitiveness, and economic growth by altering the demand for goods and services internationally. Explore the rest of the article to understand how appreciation of the real exchange rate influences your economy and business strategies.

Table of Comparison

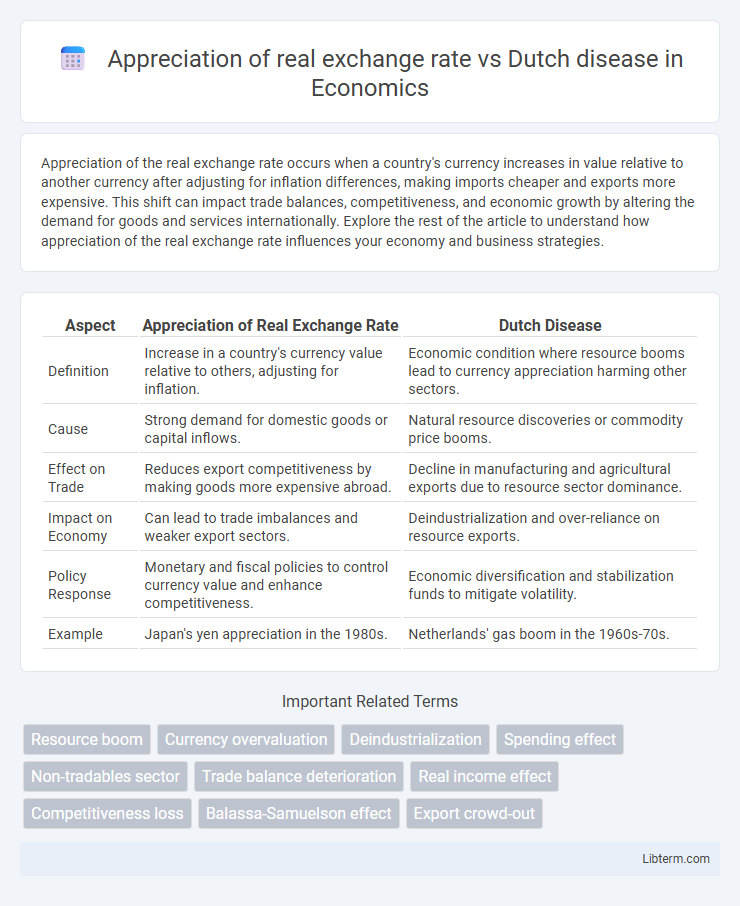

| Aspect | Appreciation of Real Exchange Rate | Dutch Disease |

|---|---|---|

| Definition | Increase in a country's currency value relative to others, adjusting for inflation. | Economic condition where resource booms lead to currency appreciation harming other sectors. |

| Cause | Strong demand for domestic goods or capital inflows. | Natural resource discoveries or commodity price booms. |

| Effect on Trade | Reduces export competitiveness by making goods more expensive abroad. | Decline in manufacturing and agricultural exports due to resource sector dominance. |

| Impact on Economy | Can lead to trade imbalances and weaker export sectors. | Deindustrialization and over-reliance on resource exports. |

| Policy Response | Monetary and fiscal policies to control currency value and enhance competitiveness. | Economic diversification and stabilization funds to mitigate volatility. |

| Example | Japan's yen appreciation in the 1980s. | Netherlands' gas boom in the 1960s-70s. |

Understanding Real Exchange Rate Appreciation

Real exchange rate appreciation occurs when a country's currency strengthens relative to trading partners after adjusting for inflation, impacting export competitiveness by making goods more expensive abroad. This appreciation often results from inflows of foreign currency, such as natural resource exports, which can trigger Dutch disease by shifting resources away from tradable sectors toward non-tradable ones. Understanding this mechanism is crucial for policymakers aiming to balance resource wealth with maintaining a competitive export sector and economic diversification.

Defining Dutch Disease

Dutch Disease refers to the negative economic impact that occurs when a country's currency appreciates due to a resource export boom, leading to a decline in the competitiveness of its manufacturing and agricultural sectors. An appreciation of the real exchange rate makes exports more expensive on the global market, causing deindustrialization and job losses in tradable goods industries. This structural imbalance often results in slower economic growth and increased vulnerability to resource price fluctuations.

Causes of Real Exchange Rate Movements

Real exchange rate appreciation often results from a surge in commodity exports or capital inflows, which boosts domestic currency value relative to trading partners. Dutch disease arises when resource booms cause a shift of labor and capital toward the booming sector, leading to an appreciation that undermines competitiveness in manufacturing and non-tradable sectors. Factors driving real exchange rate movements include terms of trade shocks, productivity differentials (Balassa-Samuelson effect), monetary policy, and external capital flows that affect currency demand and supply dynamics.

Mechanisms Behind Dutch Disease

Appreciation of the real exchange rate often results from a natural resource boom, leading to an increase in domestic currency value and a decline in the competitiveness of the manufacturing and tradable sectors. Dutch disease mechanisms involve resource windfalls causing capital and labor to shift towards the booming resource sector, reducing output in other export-oriented industries. This structural shift causes currency appreciation, higher wages in the resource sector, and a contraction of the tradable goods sector, ultimately harming economic diversification and growth.

Economic Impacts of Real Exchange Rate Appreciation

Real exchange rate appreciation often reduces export competitiveness by making domestically produced goods more expensive for foreign buyers, leading to a decline in the tradable goods sector and potential job losses. This phenomenon resembles Dutch disease, where resource booms cause currency appreciation, crowding out manufacturing and causing economic imbalances. Economic impacts include reduced GDP growth in export-driven industries and increased dependence on non-tradable sectors, raising vulnerability to external shocks.

Sectoral Shifts from Dutch Disease

Appreciation of the real exchange rate often leads to sectoral shifts characteristic of Dutch disease, where the resource boom causes a contraction in tradable manufacturing and agriculture sectors. This real appreciation elevates costs for non-resource sectors, reducing their competitiveness internationally and diverting labor and capital toward booming resource sectors. The resulting structural imbalance can stifle diversified economic growth by concentrating economic activity in volatile resource markets.

Policy Responses to Exchange Rate Appreciation

Policy responses to exchange rate appreciation often target mitigating the adverse effects of Dutch disease, which arises when resource exports inflate the currency, harming manufacturing competitiveness. Governments implement fiscal policies such as sovereign wealth funds to sterilize resource windfalls, alongside monetary interventions like foreign exchange market interventions and exchange rate management. Structural reforms promoting diversification and enhancing productivity in non-resource sectors form key strategies to sustain economic balance despite real exchange rate appreciation challenges.

Mitigating Dutch Disease Effects

Appreciation of the real exchange rate often exacerbates Dutch Disease by making non-resource sectors like manufacturing less competitive internationally. Mitigating Dutch Disease effects requires policies such as enhancing productivity in tradable sectors, implementing sovereign wealth funds to stabilize resource revenues, and promoting economic diversification to reduce dependence on natural resource exports. Strategic fiscal and monetary interventions can help maintain exchange rate stability and support balanced economic growth.

Case Studies: Real Exchange Rate vs Dutch Disease

Appreciation of the real exchange rate often leads to a decline in competitiveness of the manufacturing sector, a phenomenon observed in resource-rich countries experiencing Dutch disease. Case studies from Nigeria and Venezuela illustrate how an influx of natural resource revenues caused real exchange rate appreciation, resulting in deindustrialization and reduced export diversification. Empirical evidence highlights the need for policy interventions to mitigate adverse effects by stabilizing exchange rates and promoting economic diversification.

Long-Term Growth Implications and Strategic Recommendations

A sustained appreciation of the real exchange rate can erode export competitiveness and hinder long-term economic growth by reducing diversification and innovation capacity. This phenomenon, often associated with Dutch disease, shifts resources toward non-tradable sectors and commodity dependence, leading to vulnerabilities in global market fluctuations. Strategic recommendations include implementing fiscal policies to stabilize exchange rates, investing in technological advancement, and promoting sectors with high value-added exports to sustain sustainable growth.

Appreciation of real exchange rate Infographic

libterm.com

libterm.com