Tax revenue constitutes the primary source of income for governments worldwide, enabling public services such as education, healthcare, and infrastructure development. Efficient tax collection and management directly impact economic stability and growth by funding essential programs and reducing budget deficits. Explore the rest of the article to understand how tax revenue influences your financial landscape and the broader economy.

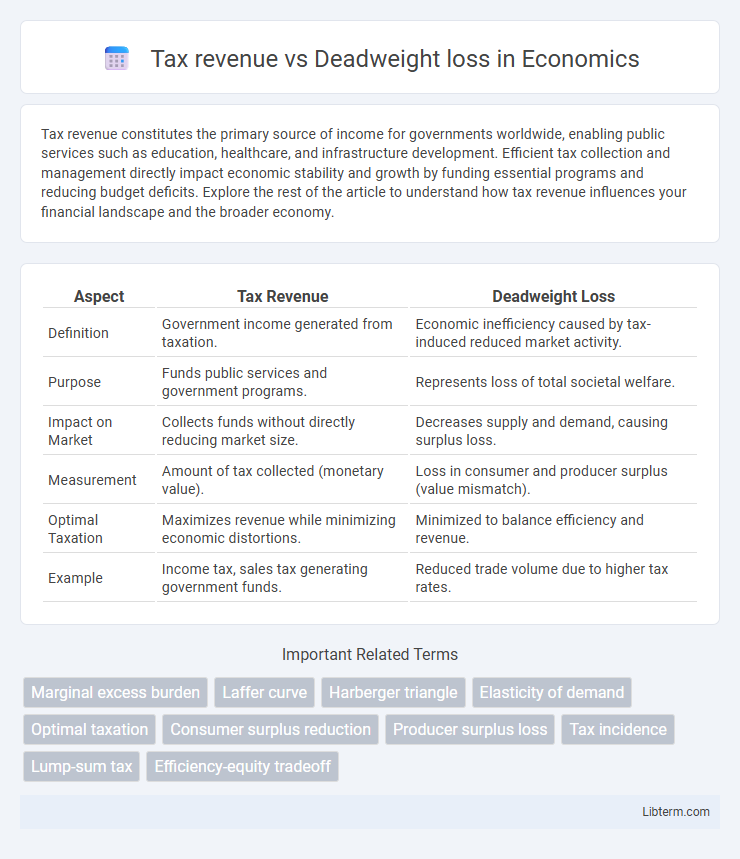

Table of Comparison

| Aspect | Tax Revenue | Deadweight Loss |

|---|---|---|

| Definition | Government income generated from taxation. | Economic inefficiency caused by tax-induced reduced market activity. |

| Purpose | Funds public services and government programs. | Represents loss of total societal welfare. |

| Impact on Market | Collects funds without directly reducing market size. | Decreases supply and demand, causing surplus loss. |

| Measurement | Amount of tax collected (monetary value). | Loss in consumer and producer surplus (value mismatch). |

| Optimal Taxation | Maximizes revenue while minimizing economic distortions. | Minimized to balance efficiency and revenue. |

| Example | Income tax, sales tax generating government funds. | Reduced trade volume due to higher tax rates. |

Understanding Tax Revenue: A Comprehensive Overview

Tax revenue represents the total income generated by governments through taxation, essential for funding public goods and services. It varies based on tax rates, economic activity, and taxpayer behavior, directly influencing fiscal policy outcomes. Understanding the balance between tax revenue and deadweight loss is crucial to optimize tax structures that maximize revenue without significantly reducing economic efficiency.

What is Deadweight Loss? Definition and Causes

Deadweight loss refers to the loss of economic efficiency that occurs when the equilibrium outcome is not achievable or not achieved, often as a result of market distortions like taxes or subsidies. When a tax is imposed, it creates a gap between what consumers pay and what producers receive, reducing the quantity of goods bought and sold below the optimal market level. This reduction leads to lost trades that would have benefited both buyers and sellers, causing deadweight loss in the form of unrealized potential gains from trade.

The Relationship Between Tax Rates and Tax Revenue

Tax revenue initially increases with rising tax rates but reaches a peak before declining, illustrating the Laffer Curve concept. Excessively high tax rates create a deadweight loss by discouraging labor, investment, and production, ultimately reducing taxable income and total revenue. Optimal tax rates balance maximizing government revenue while minimizing economic inefficiencies and welfare losses.

How Taxes Create Deadweight Loss in the Market

Taxes create deadweight loss by reducing the quantity of goods traded below the market equilibrium, leading to inefficiencies where mutually beneficial trades do not occur. This occurs because taxes increase the price buyers pay and decrease the price sellers receive, discouraging consumption and production. The gap between the pre-tax and post-tax market quantities results in lost consumer and producer surplus, reflecting the deadweight loss in the economy.

Factors Influencing Deadweight Loss Magnitude

The magnitude of deadweight loss caused by tax revenue depends significantly on the price elasticity of supply and demand; higher elasticity results in greater inefficiency as consumers and producers reduce their quantity traded more substantially. Market structure also plays a crucial role, with perfectly competitive markets exhibiting more pronounced deadweight losses compared to monopolistic or inelastic markets. Tax size is another critical factor, where larger taxes disproportionately increase deadweight loss relative to tax revenue collected, highlighting the importance of balancing tax rates to minimize economic inefficiency.

The Laffer Curve: Balancing Tax Revenue and Efficiency

The Laffer Curve illustrates the relationship between tax rates and tax revenue, showing that beyond a certain point, higher tax rates lead to a decrease in total revenue due to increased deadweight loss and reduced economic activity. Deadweight loss represents the loss of economic efficiency when taxes distort consumer and producer behavior, causing underproduction or underconsumption relative to the optimal market equilibrium. Balancing tax revenue and efficiency requires setting tax rates that maximize revenue without imposing excessive deadweight losses, ensuring sustainable government funding and maintaining economic incentives.

Examples of Tax Policies and Associated Deadweight Loss

High excise taxes on cigarettes generate substantial tax revenue but create significant deadweight loss by reducing consumer and producer surplus due to decreased demand. Value-added taxes (VAT) on consumer goods raise consistent government income while causing moderate deadweight loss by increasing prices and lowering quantity traded in the market. Income taxes with progressive rates yield large revenues for social programs but induce deadweight loss through reduced labor supply and diminished economic productivity.

Economic Efficiency: Minimizing Deadweight Loss

Tax revenue and deadweight loss are intrinsically linked, as raising tax revenue can create economic inefficiencies by reducing market transactions. Economic efficiency is maximized when the deadweight loss from taxation is minimized, allowing the government to generate necessary revenue without significantly distorting consumer and producer behavior. Optimal taxation strategies focus on tax bases with inelastic demand or supply to limit the negative impact on economic activity and preserve overall welfare.

Policy Implications: Optimizing Tax Structures

Tax revenue and deadweight loss represent critical factors in designing optimal tax structures, where policymakers aim to maximize government income while minimizing economic inefficiencies. Efficient tax design involves minimizing deadweight loss by targeting goods and services with inelastic demand, thereby reducing the distortion of market behavior and preserving welfare. Empirical studies suggest that broad-based, low-rate taxes improve revenue generation and economic growth, guiding reforms towards simplification and expansion of the tax base for sustainable fiscal policy.

Conclusion: Striking a Balance Between Revenue and Efficiency

Maximizing tax revenue requires careful consideration of the deadweight loss imposed on economic efficiency. Optimal taxation balances sufficient revenue generation while minimizing distortions in labor supply, investment, and consumption. Policymakers should design tax systems that align marginal tax rates with economic behavior to sustain growth without excessive efficiency loss.

Tax revenue Infographic

libterm.com

libterm.com