The effective tax rate represents the average percentage of income paid in taxes and provides a clear picture of your overall tax burden compared to simply looking at marginal tax rates. It accounts for all taxes paid, including federal, state, and local taxes, offering a comprehensive view of how taxes impact your net income. Explore the rest of the article to understand how the effective tax rate is calculated and how it influences your financial decisions.

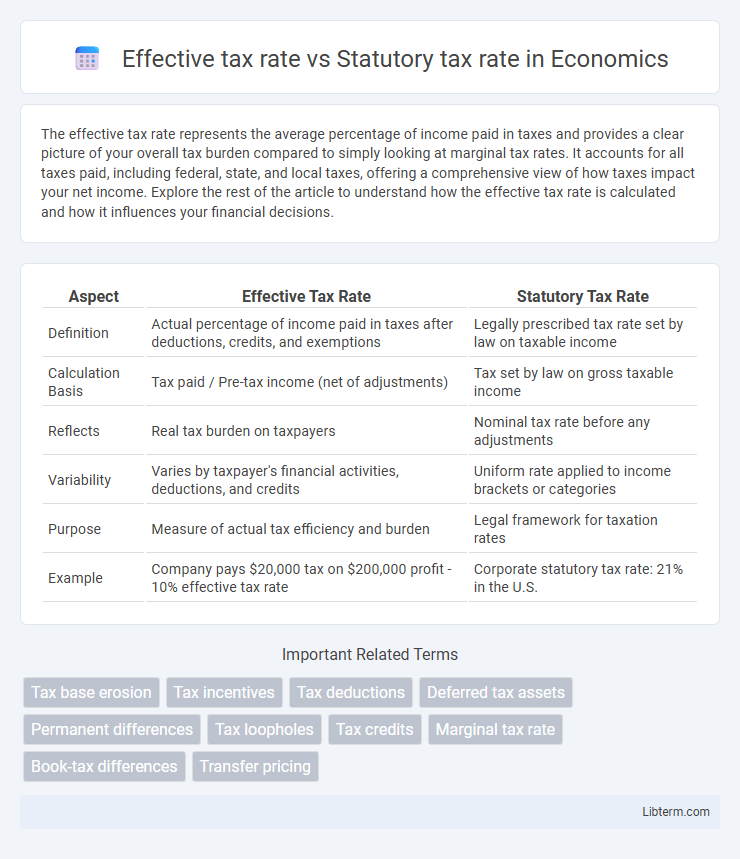

Table of Comparison

| Aspect | Effective Tax Rate | Statutory Tax Rate |

|---|---|---|

| Definition | Actual percentage of income paid in taxes after deductions, credits, and exemptions | Legally prescribed tax rate set by law on taxable income |

| Calculation Basis | Tax paid / Pre-tax income (net of adjustments) | Tax set by law on gross taxable income |

| Reflects | Real tax burden on taxpayers | Nominal tax rate before any adjustments |

| Variability | Varies by taxpayer's financial activities, deductions, and credits | Uniform rate applied to income brackets or categories |

| Purpose | Measure of actual tax efficiency and burden | Legal framework for taxation rates |

| Example | Company pays $20,000 tax on $200,000 profit - 10% effective tax rate | Corporate statutory tax rate: 21% in the U.S. |

Understanding Effective Tax Rate

The effective tax rate represents the average rate at which a corporation or individual is taxed on their pre-tax income, reflecting actual tax payments as a percentage of total earnings. It differs from the statutory tax rate, which is the legally imposed rate set by tax authorities and doesn't account for deductions, credits, or exemptions. Understanding the effective tax rate provides a clearer picture of the true tax burden by incorporating all tax-saving mechanisms and is crucial for accurate financial analysis and tax planning.

Defining Statutory Tax Rate

The statutory tax rate is the legally imposed percentage rate set by law that corporations and individuals must pay on their taxable income before any deductions or credits. It represents the official tax rate determined by government legislation, serving as the baseline for calculating income tax liabilities. Unlike the effective tax rate, the statutory tax rate does not account for tax planning strategies, exemptions, or adjustments that affect the actual taxes paid.

Key Differences Between Effective and Statutory Tax Rates

The effective tax rate represents the average rate at which an individual or corporation is taxed on their taxable income, reflecting the actual tax burden after deductions and credits, while the statutory tax rate is the legally imposed rate set by tax authorities. Key differences include the effective tax rate accounting for all tax adjustments and allowances, making it typically lower than the statutory rate, which is a fixed percentage applied to income before any modifications. Understanding this distinction is crucial for accurate tax planning and financial analysis.

How Effective Tax Rate Is Calculated

The Effective Tax Rate (ETR) is calculated by dividing the total tax expense by the pre-tax accounting income, providing a more accurate reflection of a company's actual tax burden compared to the Statutory Tax Rate. Unlike the Statutory Tax Rate, which is the official tax rate set by law, the ETR accounts for deductions, credits, exemptions, and other tax planning strategies. This calculation helps investors and analysts assess the real impact of taxes on a company's profitability and cash flow.

Calculating the Statutory Tax Rate

Calculating the statutory tax rate involves dividing the total tax liability by the taxable income as defined by law, reflecting the tax percentage imposed by government regulations before adjustments. This rate is determined by corporate tax codes and remains consistent for entities within the same jurisdiction, serving as a baseline for tax calculations. Understanding the statutory tax rate is crucial for comparing effective tax rates, which vary due to credits, deductions, and deferrals that impact the actual tax expense paid.

Factors Influencing Effective Tax Rates

Effective tax rates are influenced by various factors including tax deductions, credits, and exemptions that reduce taxable income below the statutory tax rate set by law. Corporate strategies such as income shifting, tax deferrals, and use of tax havens also significantly impact the effective tax rate by minimizing actual tax liabilities. Furthermore, industry-specific regulations and geographic tax variations play critical roles in determining the difference between statutory and effective tax rates.

Impact of Tax Deductions and Credits

The effective tax rate reflects the actual percentage of income paid in taxes after accounting for tax deductions and credits, which reduce taxable income and overall tax liability respectively. Tax deductions lower the taxable income by specific amounts, directly decreasing the tax base used to calculate the tax owed under the statutory tax rate, while tax credits provide a dollar-for-dollar reduction of the tax owed, further narrowing the difference between the statutory rate and the effective tax rate. Consequently, corporations and individuals with substantial deductions and credits often experience an effective tax rate significantly lower than the statutory tax rate set by law.

Real-World Examples: Effective vs Statutory Tax Rate

The effective tax rate represents the actual percentage of income a company or individual pays in taxes, often lower than the statutory tax rate due to deductions, credits, and loopholes. For instance, Apple's effective tax rate has historically been around 14%, significantly below the U.S. federal statutory rate of 21%, reflecting strategic tax planning and international income allocation. Similarly, multinational corporations like Amazon and Google report effective tax rates well under their countries' statutory rates, highlighting disparities between nominal tax obligations and real-world tax liabilities.

Implications for Businesses and Individuals

The effective tax rate reflects the actual percentage of income paid in taxes after deductions and credits, while the statutory tax rate is the legally imposed rate by tax authorities. Businesses benefit from understanding effective tax rates to optimize tax planning and improve cash flow management, whereas individuals use it to assess real tax burdens and plan investments or savings. Discrepancies between these rates influence financial decisions, compliance strategies, and overall fiscal responsibility for both entities.

Policy Considerations and Economic Effects

Effective tax rate reflects the actual tax burden on a company after applying deductions, credits, and exemptions, while the statutory tax rate is the legally imposed rate by tax authorities. Policymakers consider the divergence between these rates to address tax avoidance and ensure equitable revenue collection, influencing corporate investment decisions and economic growth. Economic effects include altered capital allocation, potential shifts in business location, and impacts on employment due to differences in after-tax profitability.

Effective tax rate Infographic

libterm.com

libterm.com