A Cournot competitor operates within an oligopoly by simultaneously choosing output quantities to maximize profit, assuming rivals' quantities remain constant. This strategic decision influences market price and individual firm profitability. Explore the full article to understand how Cournot competition shapes market dynamics and your strategic business decisions.

Table of Comparison

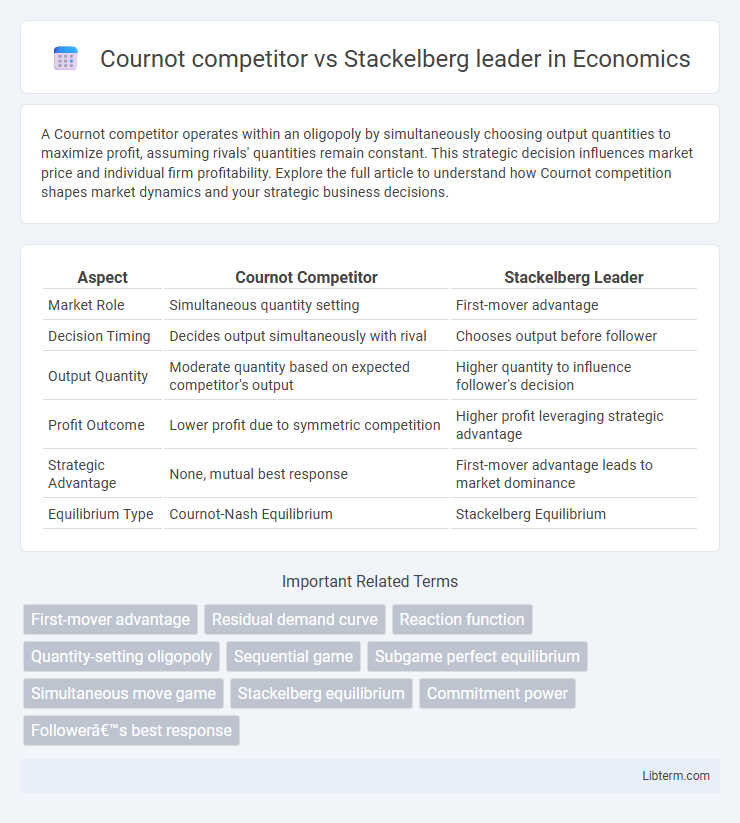

| Aspect | Cournot Competitor | Stackelberg Leader |

|---|---|---|

| Market Role | Simultaneous quantity setting | First-mover advantage |

| Decision Timing | Decides output simultaneously with rival | Chooses output before follower |

| Output Quantity | Moderate quantity based on expected competitor's output | Higher quantity to influence follower's decision |

| Profit Outcome | Lower profit due to symmetric competition | Higher profit leveraging strategic advantage |

| Strategic Advantage | None, mutual best response | First-mover advantage leads to market dominance |

| Equilibrium Type | Cournot-Nash Equilibrium | Stackelberg Equilibrium |

Introduction to Oligopoly Models

Cournot competitors choose output quantities simultaneously, each firm assuming rivals' quantities are fixed, resulting in a Nash equilibrium where no firm can increase profit by unilateral output changes. Stackelberg leaders move first and commit to an output level, influencing followers' quantities and gaining a strategic advantage by anticipating reactions in the sequential game structure. Both models capture strategic interactions in oligopoly markets, highlighting different timing and commitment effects on firm behavior and market outcomes.

Overview of Cournot Competition

Cournot competition models firms competing by simultaneously choosing quantities to maximize profit given rival outputs, leading to an equilibrium where no firm can improve profits by unilaterally changing its quantity. The Cournot competitor assumes competitors maintain fixed output levels while optimizing its own production, resulting in equilibrium quantities generally lower than monopoly but higher than perfect competition. In contrast, the Stackelberg leader moves first, strategically setting output to influence the follower's response, typically securing a higher profit by committing to a quantity before the follower decides.

Understanding Stackelberg Leadership

Stackelberg leadership involves a firm acting as a first-mover in a market, setting output levels before competitors, which contrasts with Cournot competition where firms choose quantities simultaneously. The Stackelberg leader leverages its commitment advantage to influence the follower's production, resulting in higher profits and market share. This strategic move exploits sequential decision-making, creating a distinct equilibrium that benefits the leader over the Cournot competitor.

Key Assumptions: Cournot vs Stackelberg

Cournot competition assumes firms choose quantities simultaneously, each firm believing its rival's output will remain fixed, leading to a Nash equilibrium based on mutual quantity decisions. Stackelberg competition assumes a sequential move structure where the leader firm commits to its output first, influencing the follower's quantity choice and generating a subgame perfect equilibrium. The key distinction lies in timing and strategic commitment, with Cournot firms acting concurrently and Stackelberg firms benefiting from a first-mover advantage.

Strategic Decision-Making: Simultaneous vs Sequential Moves

Cournot competitors engage in simultaneous strategic decision-making, choosing output quantities without knowing the rival's choice, which results in an equilibrium where firms' decisions are interdependent but concurrent. In contrast, the Stackelberg leader moves sequentially, committing to an output level first and forcing the follower to respond optimally, thereby gaining a strategic advantage through commitment power. This sequential move structure allows the Stackelberg leader to influence market outcomes and secure higher profits compared to the Cournot equilibrium.

Output and Pricing Differences

Cournot competitors simultaneously decide quantities, resulting in each firm producing less output and charging higher prices compared to Stackelberg leaders. Stackelberg leaders, by moving first, commit to a larger output that influences the follower's decision, leading to increased total market output and lower prices. This strategic advantage allows Stackelberg leaders to capture greater market share and profits through preemptive capacity commitment.

Profit Outcomes for Firms

Cournot competitors simultaneously choose output quantities, resulting in equilibrium profits lower than those of Stackelberg leaders who set output sequentially and strategically exploit first-mover advantage. The Stackelberg leader captures a larger market share and achieves higher profits by anticipating the follower's reaction, while the Cournot equilibrium reflects a more balanced but less profitable division of the market. Empirical studies demonstrate that Stackelberg leaders consistently outperform Cournot competitors in terms of profit outcomes due to their strategic commitment and market influence.

Game Theory Analysis of Both Models

In Game Theory analysis, the Cournot competitor simultaneously chooses output quantities without knowing the rival's decision, resulting in a Nash Equilibrium where firms react to each other's quantities. The Stackelberg leader, by contrast, moves first and commits to an output level, influencing the follower's best response and leading to a Stackelberg Equilibrium with strategic advantage. This sequential move structure typically grants the Stackelberg leader higher profits compared to the Cournot competitor due to first-mover advantage and anticipatory strategic behavior.

Real-World Examples and Applications

Cournot competition models firms simultaneously choosing quantities, exemplified by the oil production outputs of OPEC members where each country's output decisions affect global prices without prior commitment. In contrast, Stackelberg leadership occurs when one firm, like a dominant airline setting ticket prices before competitors respond, commits to its output level first, gaining a strategic advantage. The automotive industry often exhibits Stackelberg dynamics, with leaders like Toyota influencing market quantities and pricing, while rival firms react to its established production decisions.

Conclusion: Implications for Business Strategy

Choosing between Cournot and Stackelberg models significantly impacts business strategy by determining market positioning and competitive advantage. Firms adopting a Stackelberg leader role benefit from first-mover advantages, enabling them to influence market quantity and shape follower responses effectively. In contrast, Cournot competitors operate on simultaneous quantity decisions, fostering a more balanced competitive environment but potentially leading to less market control and profit maximization.

Cournot competitor Infographic

libterm.com

libterm.com