The monetarist model emphasizes the role of government control over the money supply as the primary driver of economic activity and inflation rates. Central to this theory is the belief that managing the growth of money in circulation can stabilize prices and promote sustainable economic growth. Discover how the monetarist model can influence your understanding of economic policies by reading the rest of the article.

Table of Comparison

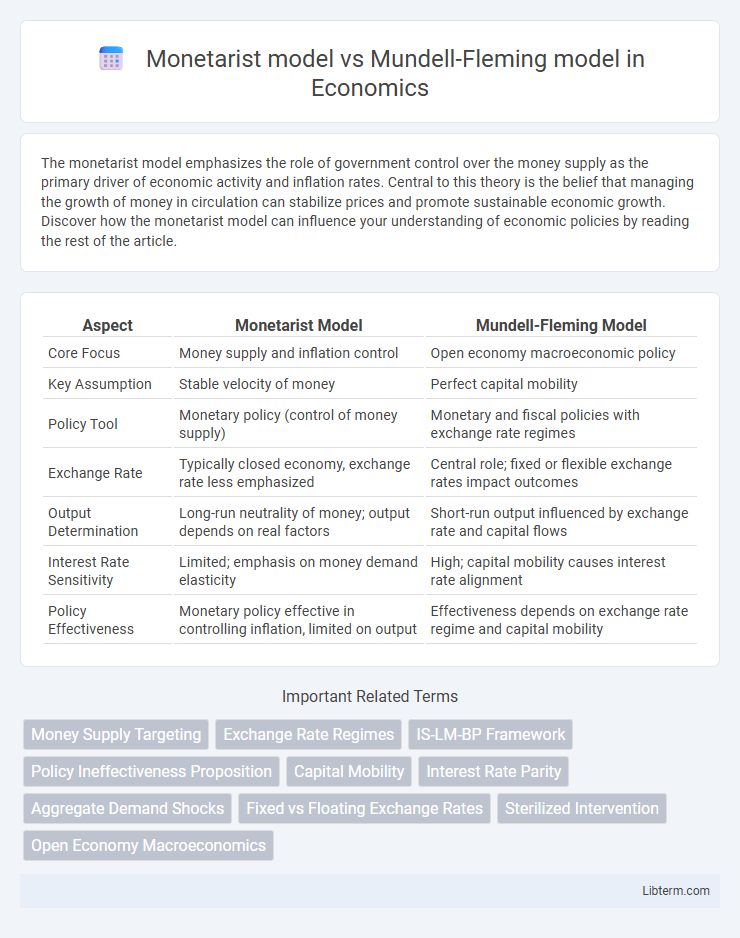

| Aspect | Monetarist Model | Mundell-Fleming Model |

|---|---|---|

| Core Focus | Money supply and inflation control | Open economy macroeconomic policy |

| Key Assumption | Stable velocity of money | Perfect capital mobility |

| Policy Tool | Monetary policy (control of money supply) | Monetary and fiscal policies with exchange rate regimes |

| Exchange Rate | Typically closed economy, exchange rate less emphasized | Central role; fixed or flexible exchange rates impact outcomes |

| Output Determination | Long-run neutrality of money; output depends on real factors | Short-run output influenced by exchange rate and capital flows |

| Interest Rate Sensitivity | Limited; emphasis on money demand elasticity | High; capital mobility causes interest rate alignment |

| Policy Effectiveness | Monetary policy effective in controlling inflation, limited on output | Effectiveness depends on exchange rate regime and capital mobility |

Introduction to Monetarist and Mundell-Fleming Models

The Monetarist model emphasizes the role of money supply in determining national income and inflation, highlighting that controlling money growth stabilizes the economy. The Mundell-Fleming model extends the IS-LM framework to an open economy, analyzing how exchange rates, capital mobility, and monetary and fiscal policies interact under fixed and flexible exchange rate regimes. Both models offer distinct perspectives on macroeconomic stabilization, with Monetarists focusing on monetary policy effects and Mundell-Fleming addressing external sector influences.

Core Principles of the Monetarist Model

The Monetarist Model emphasizes the control of money supply as the primary tool for managing economic stability, advocating that inflation is largely a result of excessive growth in money supply. It assumes prices and wages are flexible, allowing the economy to self-adjust to full employment without government intervention. This contrasts with the Mundell-Fleming Model, which focuses on output and exchange rate dynamics in an open economy with fixed or floating exchange rates.

Key Assumptions in the Mundell-Fleming Framework

The Mundell-Fleming model assumes a small open economy with perfect capital mobility, fixed or floating exchange rates, and short-run price rigidity. It emphasizes the role of exchange rate adjustments and international capital flows in determining output and interest rates. Unlike the Monetarist model, which focuses on monetary neutrality and long-term price adjustments, the Mundell-Fleming framework highlights short-run macroeconomic policy effectiveness under different exchange rate regimes.

Money Supply and Policy Impacts in the Monetarist Model

The Monetarist model emphasizes the control of money supply as the primary tool for regulating economic activity and inflation, asserting that changes in money supply have direct and predictable impacts on output and price levels in the long run. Unlike the Mundell-Fleming model, which incorporates exchange rates and capital mobility to analyze open economy dynamics, the Monetarist approach assumes a stable velocity of money and focuses on monetary policy's role in influencing aggregate demand. In this framework, policy impacts are largely determined by money supply adjustments, with expansionary monetary policy leading to increased inflation and nominal income, while long-term output remains governed by real factors rather than monetary interventions.

Open Economy Dynamics in the Mundell-Fleming Model

The Mundell-Fleming model extends the IS-LM framework to an open economy by incorporating international capital flows and exchange rate dynamics, allowing analysis of monetary and fiscal policy effectiveness under fixed and flexible exchange rates. Unlike the closed-economy Monetarist model that emphasizes the role of money supply in controlling inflation and output, the Mundell-Fleming model highlights the trade-offs between exchange rates, interest rates, and capital mobility in shaping aggregate demand. Open economy dynamics in the Mundell-Fleming model underscore currency depreciation effects on net exports and the challenges of pursuing independent monetary policy in a highly integrated global capital market.

Exchange Rate Regimes and Model Predictions

The Monetarist model emphasizes the importance of controlling money supply to influence domestic inflation and output, predicting that under fixed exchange rate regimes, monetary policy becomes ineffective while fiscal policy strongly impacts output. The Mundell-Fleming model highlights how exchange rate regimes determine the effectiveness of monetary and fiscal policies, asserting that monetary policy is potent under flexible exchange rates but neutralized under fixed rates, whereas fiscal policy performs oppositely. Both models underscore that under flexible exchange rates, exchange rate fluctuations buffer external shocks, but fixed regimes impose constraints that alter policy responses and output adjustments.

Comparative Analysis: Fiscal and Monetary Policy Effectiveness

The Monetarist model emphasizes monetary policy as the primary tool for controlling inflation and stabilizing the economy, with fiscal policy seen as less effective due to crowding-out effects. In contrast, the Mundell-Fleming model highlights the varying effectiveness of fiscal and monetary policies under different exchange rate regimes; fiscal policy is more potent under fixed exchange rates, while monetary policy is more effective under flexible exchange rates. Empirical evidence from open economies supports the Mundell-Fleming framework's nuanced approach, demonstrating that exchange rate flexibility significantly influences policy outcomes.

Real-World Applications and Empirical Evidence

The Monetarist model emphasizes controlling money supply to manage inflation and economic output, with empirical evidence showing its effectiveness in stable, closed economies like the U.S. during the 1970s and 80s. The Mundell-Fleming model, focusing on open economies with varying exchange rate regimes, provides real-world applications in understanding policy impacts on small open economies such as Canada and the Eurozone. Empirical studies confirm that while Monetarist policies work best under fixed exchange rates, the Mundell-Fleming framework better predicts outcomes in flexible exchange rate systems, guiding monetary and fiscal policy decisions globally.

Limitations and Critiques of Both Models

The Monetarist model often faces criticism for its rigid assumption of a stable velocity of money and limited accommodation of short-term economic fluctuations, which can lead to oversimplified policy prescriptions. The Mundell-Fleming model is limited by its assumption of perfect capital mobility and fixed prices, restricting its applicability in real-world scenarios where capital controls and price rigidities exist. Both models struggle to fully incorporate the complexities of open economies, including the influence of expectations, financial market imperfections, and fiscal policy interactions.

Conclusion: Choosing Between Monetarist and Mundell-Fleming Approaches

The Monetarist model emphasizes the primacy of controlling money supply to manage inflation and output in a closed economy, while the Mundell-Fleming model highlights the importance of exchange rate regimes and capital mobility in open economies. Selecting between these approaches depends on the economic openness, capital mobility, and policy objectives; Monetarist strategies suit economies with fixed exchange rates and limited external integration, whereas Mundell-Fleming is more applicable to open economies with flexible exchange rates and significant capital flows. Policymakers should assess the structural characteristics of their economies to implement effective stabilization policies tailored to either model's framework.

Monetarist model Infographic

libterm.com

libterm.com