Keynesian economics emphasizes the role of government intervention in stabilizing the economy and promoting employment during downturns through fiscal policies like increased public spending and tax adjustments. It challenges classical economic theories by advocating for active demand management to address recessions and reduce unemployment. Explore this article to understand how Keynesian principles can impact Your financial decisions and economic outlook.

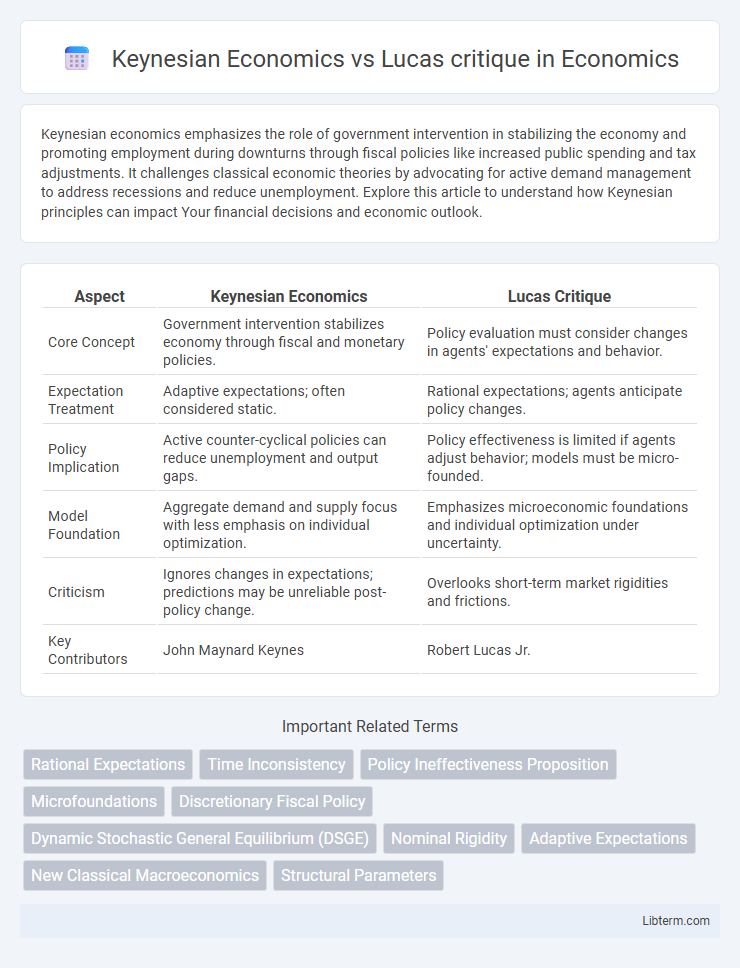

Table of Comparison

| Aspect | Keynesian Economics | Lucas Critique |

|---|---|---|

| Core Concept | Government intervention stabilizes economy through fiscal and monetary policies. | Policy evaluation must consider changes in agents' expectations and behavior. |

| Expectation Treatment | Adaptive expectations; often considered static. | Rational expectations; agents anticipate policy changes. |

| Policy Implication | Active counter-cyclical policies can reduce unemployment and output gaps. | Policy effectiveness is limited if agents adjust behavior; models must be micro-founded. |

| Model Foundation | Aggregate demand and supply focus with less emphasis on individual optimization. | Emphasizes microeconomic foundations and individual optimization under uncertainty. |

| Criticism | Ignores changes in expectations; predictions may be unreliable post-policy change. | Overlooks short-term market rigidities and frictions. |

| Key Contributors | John Maynard Keynes | Robert Lucas Jr. |

Introduction to Keynesian Economics

Keynesian Economics emphasizes government intervention to manage economic fluctuations through fiscal policies, particularly during recessions. It relies on aggregate demand to drive output and employment, suggesting that markets may not always self-correct efficiently. The Lucas critique challenges this by arguing that policy evaluations must account for changes in expectations, criticizing Keynesian models for ignoring how agents' behavior adapts to policy shifts.

Understanding the Lucas Critique

The Lucas Critique challenges Keynesian Economics by arguing that traditional macroeconomic models fail to account for changes in policy altering agents' expectations and behavior, rendering historical data unreliable for policy evaluation. Robert Lucas emphasized the need for microfoundations in economic models, where individual optimization and rational expectations are crucial for predicting policy impacts accurately. This critique revolutionized macroeconomic modeling by promoting dynamic, forward-looking frameworks that incorporate how rational agents anticipate and respond to government interventions.

Historical Context: Keynes vs. Lucas

Keynesian Economics emerged during the Great Depression, advocating for government intervention to manage aggregate demand and stabilize economies suffering from prolonged unemployment. The Lucas critique, developed in the 1970s by economist Robert Lucas, argued that traditional Keynesian models failed because they did not account for changes in policy expectations affecting economic agents' behavior. This critique prompted a reevaluation of macroeconomic modeling, emphasizing microfoundations and rational expectations to improve policy effectiveness.

Core Principles of Keynesian Economics

Keynesian Economics centers on aggregate demand as the primary driver of economic output and employment, advocating for active government intervention through fiscal policies to stabilize the economy during recessions. It emphasizes price and wage rigidities, which prevent markets from clearing efficiently, leading to prolonged unemployment and underutilized resources. The Lucas critique challenges Keynesian models by arguing that policy evaluations must consider changes in agents' expectations and behavior, which traditional Keynesian frameworks often overlook.

The Lucas Critique: Foundations and Assumptions

The Lucas Critique fundamentally challenges Keynesian Economics by arguing that traditional macroeconomic models fail to account for changes in policy rules altering individuals' expectations and behavior, rendering past data unreliable for policy prediction. It assumes rational expectations, where economic agents use all available information and understand the model governing the economy, adjusting their behavior to anticipated policy changes. This critique emphasizes that structural parameters in models are not invariant to policy shifts, demanding micro-founded, expectation-consistent frameworks for effective macroeconomic analysis.

Policy Implications: Keynesian Perspective

Keynesian economics advocates for active government intervention through fiscal policies to manage economic fluctuations and stimulate demand during recessions. Keynesians argue that prices and wages are sticky, leading to prolonged periods of unemployment that require policy measures such as increased public spending or tax cuts. This approach contrasts with the Lucas critique, which warns that policy effects may be neutralized by changes in individuals' expectations, but Keynesians maintain that timely and targeted interventions can stabilize output and employment effectively.

Rational Expectations and Economic Policy

Keynesian Economics emphasizes active government intervention to stabilize economic fluctuations through fiscal and monetary policies. The Lucas critique challenges this approach by arguing that policy evaluations based on historical data are unreliable because individuals form Rational Expectations, adjusting their behavior in anticipation of policy changes. Consequently, economic policies must consider these forward-looking expectations to avoid ineffectiveness and unintended consequences.

Strengths and Weaknesses of Each Approach

Keynesian economics excels in addressing short-term economic fluctuations through government intervention and fiscal policy, providing effective tools for managing demand during recessions. However, it faces criticism for assuming stable relationships between economic variables, which may not hold under changing expectations. The Lucas critique highlights the importance of incorporating rational expectations and structural models, warning that policy changes alter agent behavior and render traditional Keynesian predictions unreliable, though it often underestimates the complexity of real-world frictions and may overemphasize microfoundations at the expense of practical policy guidance.

Empirical Evidence and Real-World Applications

Keynesian economics emphasizes government intervention and fiscal policy to manage aggregate demand, supported by empirical evidence from the Great Depression and post-war economic recoveries demonstrating the effectiveness of stimulus measures. The Lucas critique challenges Keynesian models by highlighting how policy changes alter agent expectations, reducing model reliability, which has led to the development of dynamic stochastic general equilibrium (DSGE) models for better real-world application. Contemporary empirical studies blend Keynesian insights with micro-founded expectations to guide monetary and fiscal policies, reflecting a synthesis rather than outright rejection in practical economic planning.

Conclusion: Bridging Keynesian Economics and the Lucas Critique

Bridging Keynesian Economics and the Lucas Critique requires integrating expectations into macroeconomic models to improve policy effectiveness by accounting for changes in behavior following policy shifts. Incorporating rational expectations enhances the predictive power of Keynesian frameworks and addresses criticisms about policy ineffectiveness from the Lucas Critique. This synthesis promotes more adaptive economic policies that acknowledge both short-term demand management and long-term behavioral responses.

Keynesian Economics Infographic

libterm.com

libterm.com