Total return reflects the complete gain or loss on an investment, combining both capital appreciation and income such as dividends or interest. Understanding this metric is crucial for evaluating your portfolio's overall performance and making informed financial decisions. Explore the rest of the article to learn how total return impacts your investment strategy and wealth growth.

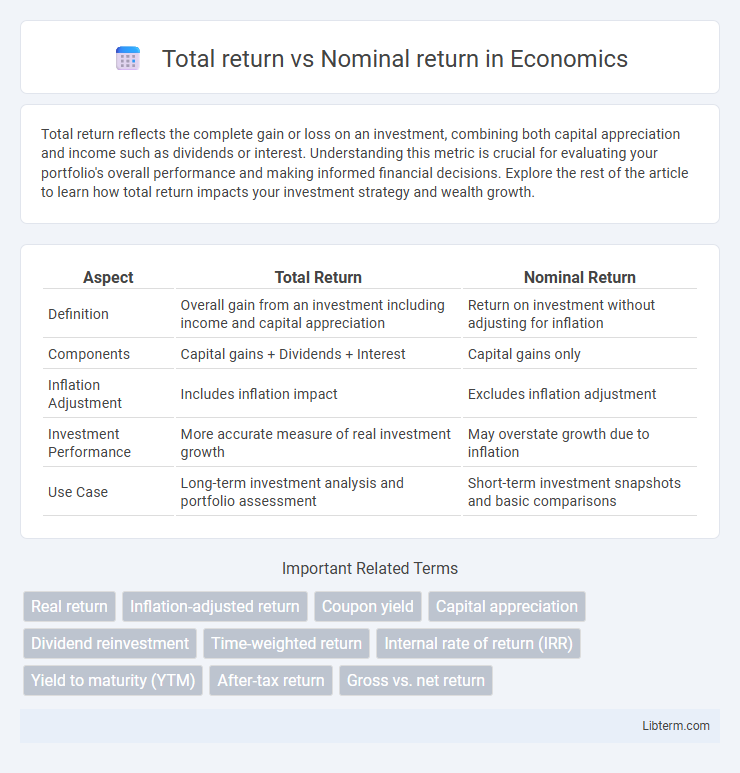

Table of Comparison

| Aspect | Total Return | Nominal Return |

|---|---|---|

| Definition | Overall gain from an investment including income and capital appreciation | Return on investment without adjusting for inflation |

| Components | Capital gains + Dividends + Interest | Capital gains only |

| Inflation Adjustment | Includes inflation impact | Excludes inflation adjustment |

| Investment Performance | More accurate measure of real investment growth | May overstate growth due to inflation |

| Use Case | Long-term investment analysis and portfolio assessment | Short-term investment snapshots and basic comparisons |

Understanding Total Return and Nominal Return

Total return measures the overall gain from an investment, including capital appreciation and income such as dividends or interest, providing a comprehensive view of investment performance. Nominal return reflects the percentage increase in the value of an investment without accounting for factors like inflation or reinvested earnings, offering a raw measure of profit. Understanding the difference helps investors evaluate real growth versus apparent gains, ensuring more accurate assessments of portfolio performance.

Key Differences Between Total Return and Nominal Return

Total return accounts for all earnings from an investment, including capital gains, dividends, and interest, providing a comprehensive measure of performance. Nominal return represents the percentage increase in the investment's value without adjusting for inflation or reinvested income. The key difference lies in total return's inclusion of reinvested income and inflation effects, offering a more accurate reflection of an investment's actual profitability over time.

Components of Total Return

Total return consists of capital gains, dividends, and interest income, providing a comprehensive measure of an investment's performance over a specific period. Nominal return accounts only for the raw percentage increase in the asset's price without considering income distributions or inflation adjustments. Understanding total return components is essential for accurately assessing the true profitability and growth potential of investments in stocks, bonds, or mutual funds.

How Inflation Impacts Nominal Return

Nominal return reflects the raw percentage gain on an investment without adjusting for inflation, which can erode the actual purchasing power of those returns. Inflation reduces the real value of nominal returns by increasing the cost of goods and services, meaning investors may experience lower effective earnings even when nominal gains appear positive. Total return, by incorporating dividends, interest, and capital gains adjusted for inflation, provides a more accurate measure of an investment's true profitability over time.

Calculating Total Return: Step-by-Step

Calculating total return involves summing capital gains and income received, such as dividends or interest, over a specific period, then dividing by the initial investment amount. This comprehensive metric includes both price appreciation and reinvested distributions, reflecting the true performance of an investment. Total return is often expressed as a percentage and provides a more accurate comparison than nominal return, which only accounts for price changes without factoring in income or inflation.

The Importance of Reinvested Dividends in Total Return

Total return includes both capital gains and reinvested dividends, providing a more accurate measure of an investment's performance over time compared to nominal return, which accounts only for price appreciation. Reinvested dividends significantly enhance total return by compounding income, especially in long-term equity investments like stocks or mutual funds. Ignoring dividend reinvestment undervalues the true growth potential of investments and may lead to misleading conclusions in performance analysis.

Practical Examples: Total vs Nominal Return

Total return accounts for all income generated by an investment, including dividends, interest, and capital gains, providing a comprehensive measure of performance. For example, a stock purchased at $100 that pays $5 in dividends and rises to $110 has a total return of 15% ($10 capital gain + $5 dividend), whereas its nominal return shows only the 10% price appreciation. This distinction is crucial for investors evaluating the true profitability of assets over time since nominal return ignores income distributions and the effects of compounding.

Which Metric Should Investors Use?

Investors should prioritize total return over nominal return as it accounts for both capital gains and reinvested dividends, providing a more comprehensive measure of an investment's performance. Nominal return only reflects the percentage increase or decrease in the asset's price without considering income generated or inflation effects. By focusing on total return, investors gain a realistic picture of the actual growth and purchasing power of their investments.

Common Mistakes in Assessing Returns

Investors often confuse total return with nominal return, overlooking that nominal return excludes reinvested dividends and inflation effects, leading to an incomplete performance assessment. A common mistake is neglecting to account for taxes and fees, which can significantly reduce the actual total return realized. Misinterpreting nominal returns without considering the compounding impact and income generated can result in overestimating an investment's profitability and growth potential.

Summary: Choosing the Right Return Metric

Total return accounts for dividends, interest, and capital gains, providing a comprehensive view of investment performance. Nominal return measures only the raw percentage increase in asset value without adjusting for inflation or income gained. Choosing the right return metric depends on your investment goals: total return for assessing overall profitability and nominal return for understanding basic price appreciation.

Total return Infographic

libterm.com

libterm.com