Marginal tax rate refers to the percentage of tax applied to your last dollar of income, showing how much tax you will pay on any additional earnings. Understanding this rate helps you make informed financial decisions and plan your income effectively. Explore the rest of the article to learn how marginal tax rates impact your taxes and savings.

Table of Comparison

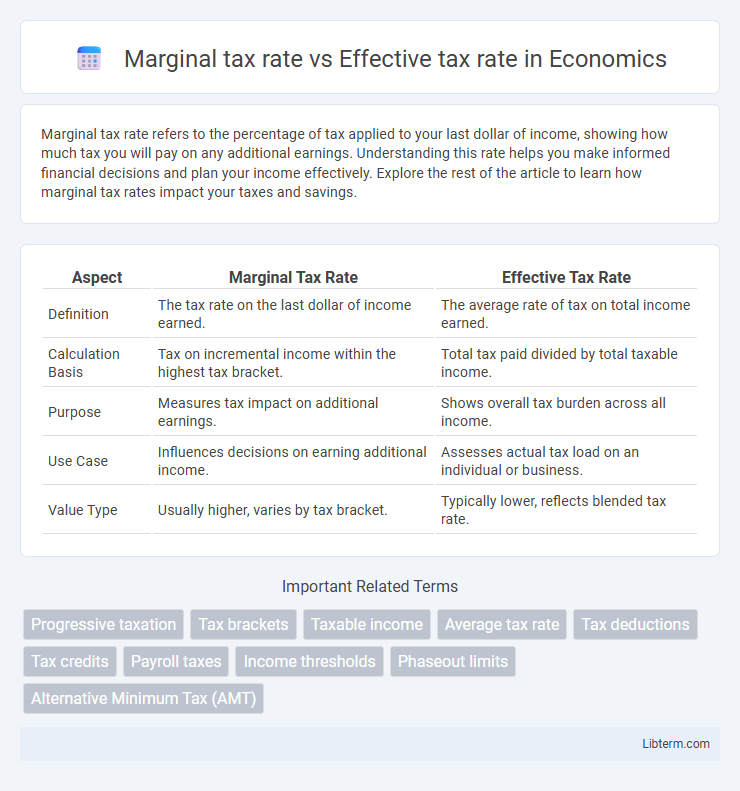

| Aspect | Marginal Tax Rate | Effective Tax Rate |

|---|---|---|

| Definition | The tax rate on the last dollar of income earned. | The average rate of tax on total income earned. |

| Calculation Basis | Tax on incremental income within the highest tax bracket. | Total tax paid divided by total taxable income. |

| Purpose | Measures tax impact on additional earnings. | Shows overall tax burden across all income. |

| Use Case | Influences decisions on earning additional income. | Assesses actual tax load on an individual or business. |

| Value Type | Usually higher, varies by tax bracket. | Typically lower, reflects blended tax rate. |

Introduction to Tax Rates

Marginal tax rate refers to the percentage of tax applied to the last dollar of income earned, influencing decisions on additional earnings and investments. Effective tax rate represents the average rate at which an individual or corporation is taxed on total income, calculated by dividing total tax paid by total income. Understanding the distinction between marginal and effective tax rates is essential for accurate tax planning and financial analysis.

Defining Marginal Tax Rate

The marginal tax rate defines the percentage of tax applied to the next dollar of taxable income, reflecting the rate at which additional earnings are taxed. It is essential for understanding how income increases impact tax liabilities within progressive tax systems, where different income brackets are taxed at varying rates. This rate contrasts with the effective tax rate, which represents the average percentage of total income paid in taxes.

Explaining Effective Tax Rate

The effective tax rate represents the average rate at which an individual or corporation is taxed on their total income, calculated by dividing total tax paid by total taxable income. Unlike the marginal tax rate, which applies only to the last dollar earned within a specific tax bracket, the effective tax rate provides a comprehensive view of the overall tax burden. This metric helps taxpayers and analysts understand the real percentage of income paid in taxes across all sources and brackets.

Key Differences Between Marginal and Effective Tax Rates

Marginal tax rate refers to the percentage of tax applied to the last dollar of income earned, highlighting the tax bracket an individual or business falls into. Effective tax rate represents the average rate at which income is taxed, calculated by dividing total tax paid by total taxable income. The key difference lies in that the marginal rate affects future earnings and decisions, while the effective rate provides a clearer view of the actual tax burden.

How Marginal Tax Rate Impacts Taxpayers

The marginal tax rate affects taxpayers by determining the percentage of tax they pay on their next dollar of income, influencing decisions on working extra hours or seeking additional income. Higher marginal rates can discourage additional earning or investment due to increased tax liability on incremental income. Understanding marginal tax rates helps taxpayers optimize income strategies to minimize the overall tax burden, contrasting with the effective tax rate, which reflects the average rate on total income.

Calculating Your Marginal Tax Rate

Calculating your marginal tax rate involves identifying the tax bracket your last dollar of income falls into, which determines the percentage of tax applied to any additional income earned. This rate is crucial for understanding how extra income will be taxed, as it reflects the highest tax rate applied to your earnings. Unlike the effective tax rate, which averages all taxes paid across total income, the marginal tax rate specifically guides decisions on earning increments and tax planning.

Calculating Your Effective Tax Rate

Calculating your effective tax rate involves dividing the total tax paid by your total taxable income, providing a clear percentage of your income that goes toward taxes. While the marginal tax rate reflects the tax rate on the last dollar of income earned, the effective tax rate offers a comprehensive view of your overall tax burden. This calculation helps in understanding the actual tax impact, considering deductions, credits, and various income brackets.

Common Misconceptions About Tax Rates

Many taxpayers confuse the marginal tax rate with the effective tax rate, mistakenly believing both reflect the same tax burden. The marginal tax rate applies to the last dollar of income earned, indicating the rate at which additional income is taxed, whereas the effective tax rate represents the average rate paid on total income, accounting for deductions and varying tax brackets. Misunderstanding this distinction can lead to inaccurate expectations about tax liabilities and financial planning strategies.

Importance of Understanding Both Tax Rates

Understanding both marginal tax rate and effective tax rate is crucial for accurate financial planning and tax compliance. The marginal tax rate indicates the percentage of tax applied to the last dollar of income earned, affecting decisions on additional income or investments, while the effective tax rate represents the average tax paid across total income, providing a clearer picture of overall tax burden. Awareness of both rates enables taxpayers to optimize deductions, credits, and income strategies to minimize liabilities and maximize after-tax wealth.

Marginal vs Effective Tax Rate: Which Matters More?

Marginal tax rate represents the percentage of tax applied to the last dollar of income earned, directly influencing decisions on additional earnings and investments. Effective tax rate calculates the average rate of taxation on total income, providing a clearer picture of overall tax burden. Understanding the difference is crucial for financial planning, but the effective tax rate matters more for assessing total tax liability, while the marginal rate guides incremental income decisions.

Marginal tax rate Infographic

libterm.com

libterm.com