A monopsony occurs when there is a single buyer dominating the market, giving them significant control over prices and purchasing terms. This market structure often leads to reduced competition and can negatively impact suppliers' bargaining power. Discover how monopsony affects your industry and what it means for market dynamics by reading the full article.

Table of Comparison

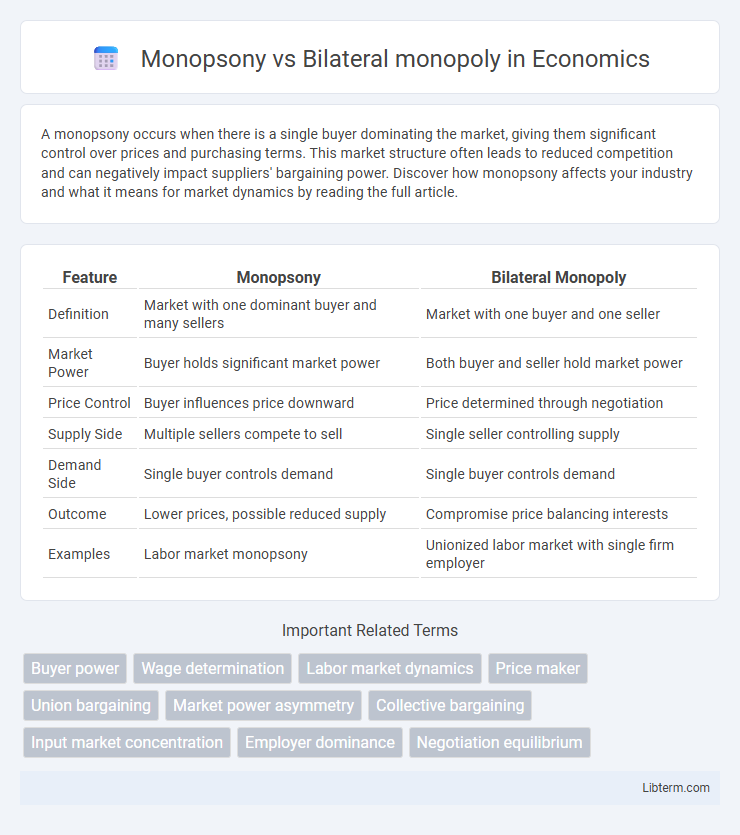

| Feature | Monopsony | Bilateral Monopoly |

|---|---|---|

| Definition | Market with one dominant buyer and many sellers | Market with one buyer and one seller |

| Market Power | Buyer holds significant market power | Both buyer and seller hold market power |

| Price Control | Buyer influences price downward | Price determined through negotiation |

| Supply Side | Multiple sellers compete to sell | Single seller controlling supply |

| Demand Side | Single buyer controls demand | Single buyer controls demand |

| Outcome | Lower prices, possible reduced supply | Compromise price balancing interests |

| Examples | Labor market monopsony | Unionized labor market with single firm employer |

Introduction to Monopsony and Bilateral Monopoly

Monopsony occurs when a single buyer dominates the market, exerting significant control over the price of goods or labor due to limited seller options. Bilateral monopoly arises when a sole buyer and a sole seller interact, creating a unique market dynamic where both parties have substantial market power. Understanding these market structures is crucial for analyzing wage determination and pricing strategies in imperfect competition scenarios.

Defining Monopsony: Key Characteristics

A monopsony is a market structure characterized by a single buyer with significant control over the price and quantity of goods or labor it purchases, creating an imbalance of power favoring the buyer. Key characteristics include a lack of competition among buyers, the ability to set prices lower than in competitive markets, and high barriers for sellers seeking alternative buyers. This results in reduced market efficiency and potential welfare losses for sellers, contrasting sharply with the dynamics seen in bilateral monopolies where both a single buyer and single seller interact.

Understanding Bilateral Monopoly: Core Concepts

A bilateral monopoly occurs when a single buyer (monopsony) faces a single seller (monopoly), creating a unique market structure characterized by mutual interdependence in price and quantity determination. The outcome depends on bargaining power and negotiation dynamics, as neither side can unilaterally impose terms without risking market collapse. Understanding bilateral monopoly requires analyzing the strategic interaction between both parties, often modeled through game theory to predict equilibrium outcomes in wage or price settings.

Market Power Dynamics in Monopsony

Monopsony market power centers on a single buyer's significant control over price and wage determination, often suppressing supplier leverage due to the lack of alternative purchasers. This concentrated buying power leads to reduced input costs and wage suppression, impacting supplier revenues and labor markets. In contrast to bilateral monopoly, where buyer and seller market powers counterbalance each other, a monopsony distinctly favors the buyer's dominant position in the transaction.

Negotiation Processes in Bilateral Monopoly

Negotiation processes in a bilateral monopoly involve strategic bargaining between the single buyer and single seller to determine price and quantity since neither has a competitive alternative. Both parties leverage their market power, often resulting in prolonged negotiations to reach a mutually beneficial agreement, influenced by factors like bargaining strength, cost structures, and demand elasticity. This dynamic contrasts with monopsony, where the buyer alone dictates terms, highlighting the unique interdependence in bilateral monopoly negotiations.

Price and Wage Determination Mechanisms

Monopsony features a single buyer controlling wage determination by leveraging employer power to set lower wages due to limited worker alternatives, resulting in price-setting mechanisms favoring buyers. In contrast, bilateral monopoly involves a sole buyer and a sole seller, where wage and price outcomes emerge from negotiation and bargaining between employer and labor union, balancing market power on both sides. Wage determination in bilateral monopoly is dynamic, reflecting strategic interactions rather than unilateral decisions typical in monopsonistic markets.

Real-World Examples of Monopsony

Monopsony occurs when a single buyer controls the market, such as major retailers like Walmart dominating suppliers, leading to significant price-setting power. In the labor market, a defense contractor acting as the sole employer in a specific region exemplifies monopsony, restricting workers' bargaining leverage. Bilateral monopoly arises when a single buyer faces a single seller, creating a unique negotiation dynamic often seen in exclusive supplier agreements or specialized labor unions negotiating with sole employers.

Case Studies of Bilateral Monopoly Scenarios

Bilateral monopoly occurs when a single seller and a single buyer dominate a market, as seen in labor markets where one labor union negotiates with a sole employer, such as the case of General Motors and the United Auto Workers in mid-20th century America. Another example includes specialized defense contractors and government agencies engaged in exclusive procurement contracts, creating a unique bargaining environment. These case studies illustrate power dynamics, negotiation strategies, and price setting under mutual interdependence in bilateral monopolies distinct from monopsony conditions.

Economic Implications and Efficiency Outcomes

Monopsony, characterized by a single buyer in the labor or product market, often leads to lower prices and reduced wages due to buyer market power, causing allocative inefficiency and potential output underproduction. Bilateral monopoly, where a single buyer and single seller interact, results in negotiated prices that can vary widely, frequently causing market inefficiencies due to bargaining power imbalances and uncertainty. Both market structures typically produce less efficient outcomes compared to competitive markets, with monopsonies suppressing supplier surplus and bilateral monopolies creating indeterminate price and output levels that hinder optimal resource allocation.

Policy Responses and Regulation Strategies

Policy responses to monopsony often involve enforcing antitrust laws and promoting market entry to increase competition among buyers, thereby improving supplier bargaining power and prices. In bilateral monopolies, regulation strategies focus on negotiated agreements or arbitration to balance the sole buyer's and seller's interests, preventing exploitation and ensuring fair market outcomes. Governments may also implement price controls or facilitate collective bargaining to mitigate market power concentration on both sides.

Monopsony Infographic

libterm.com

libterm.com