Market pricing reflects the equilibrium value where supply meets demand, influencing the cost consumers pay for goods and services. Understanding market pricing helps you make informed decisions about purchases and investments by recognizing price trends and factors driving fluctuations. Explore the rest of the article to discover how market pricing impacts your financial choices and strategies.

Table of Comparison

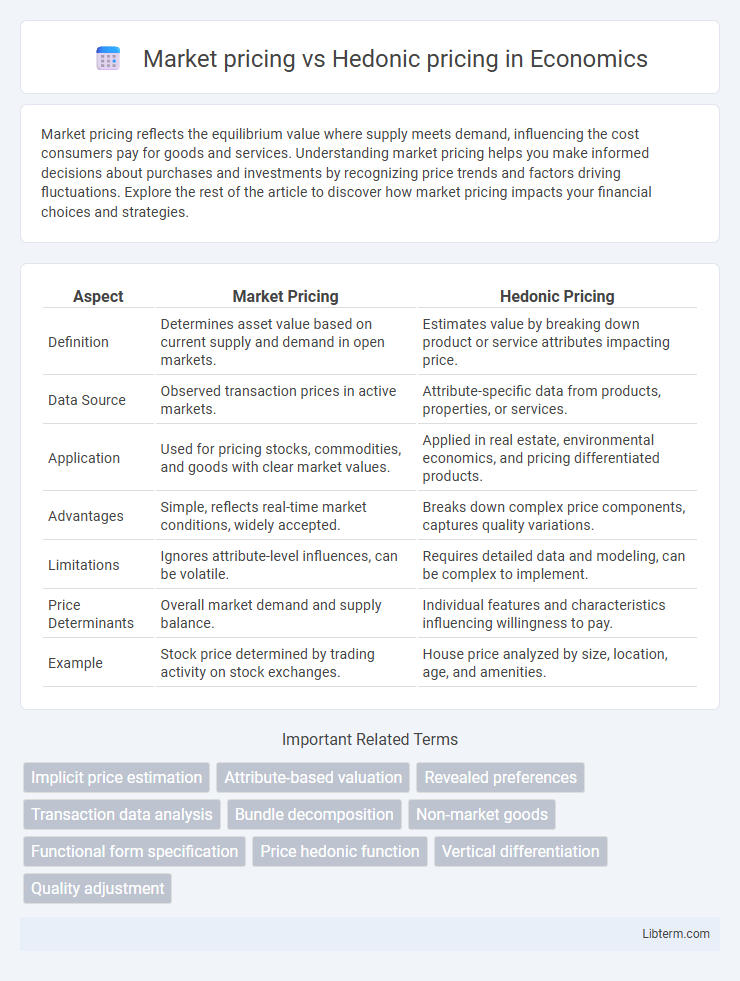

| Aspect | Market Pricing | Hedonic Pricing |

|---|---|---|

| Definition | Determines asset value based on current supply and demand in open markets. | Estimates value by breaking down product or service attributes impacting price. |

| Data Source | Observed transaction prices in active markets. | Attribute-specific data from products, properties, or services. |

| Application | Used for pricing stocks, commodities, and goods with clear market values. | Applied in real estate, environmental economics, and pricing differentiated products. |

| Advantages | Simple, reflects real-time market conditions, widely accepted. | Breaks down complex price components, captures quality variations. |

| Limitations | Ignores attribute-level influences, can be volatile. | Requires detailed data and modeling, can be complex to implement. |

| Price Determinants | Overall market demand and supply balance. | Individual features and characteristics influencing willingness to pay. |

| Example | Stock price determined by trading activity on stock exchanges. | House price analyzed by size, location, age, and amenities. |

Introduction to Market and Hedonic Pricing

Market pricing reflects the actual transaction prices of goods and services in competitive markets, capturing supply and demand dynamics. Hedonic pricing decomposes the market price into attribute-specific values, estimating how different features contribute to the overall price based on regression analysis. This method is widely used in real estate, automotive, and environmental economics to evaluate the implicit value of individual characteristics within heterogeneous products.

Defining Market Pricing: Overview and Principles

Market pricing refers to the determination of asset or product prices based on real-time supply and demand dynamics within competitive markets. This method relies on observable market transactions to establish equilibrium prices that reflect collective buyer and seller preferences. Principles of market pricing include price discovery, transparency, and efficiency, ensuring that prices adjust promptly to new information and market conditions.

Understanding Hedonic Pricing: Concept and Application

Hedonic pricing is a method used to estimate the value of a good or service by analyzing the underlying characteristics that contribute to its price, often applied in real estate and environmental economics. Unlike market pricing, which reflects straightforward supply and demand dynamics, hedonic pricing decomposes a product into its individual attributes, such as location, size, or quality, to determine how each feature affects overall market value. This method enables more precise valuation by capturing consumer preferences and the implicit prices of various features within heterogeneous products.

Key Differences Between Market and Hedonic Pricing

Market pricing reflects the overall price at which goods or services are bought and sold in the marketplace, capturing aggregate supply and demand dynamics. Hedonic pricing, in contrast, decomposes the market price into value components based on specific product attributes such as size, quality, and features. The key difference lies in market pricing providing a direct transaction price, while hedonic pricing analyzes how individual characteristics influence that price, enabling a detailed understanding of value drivers.

Advantages of Market Pricing Strategies

Market pricing strategies offer the advantage of reflecting real-time supply and demand dynamics, ensuring prices are competitive and aligned with consumer willingness to pay. This approach facilitates quick adjustments to market fluctuations, enhancing profit maximization and inventory management. Furthermore, market pricing supports clear benchmarking against competitors, aiding in strategic positioning and market share growth.

Benefits and Limitations of Hedonic Pricing

Hedonic pricing provides a nuanced approach by estimating the value of individual attributes within a product or service, enabling more precise market segmentation and informed pricing strategies. This method captures consumer preferences and quality differentials, which traditional market pricing often overlooks, but it requires extensive data and sophisticated modeling, limiting its applicability in markets with sparse or unreliable information. Although hedonic pricing enhances understanding of complex product characteristics, its reliance on assumptions about attribute independence can reduce accuracy when attributes interact or market conditions change rapidly.

Real-World Examples: Market Pricing in Action

Market pricing in real estate reflects the actual transaction prices of comparable properties, such as the sale of homes in a neighborhood where prices fluctuate based on demand, location, and property features. For instance, urban housing markets show clear market pricing signals, where recent sales of similar apartments set benchmarks for listing prices. This approach contrasts with hedonic pricing, which decomposes a property's value into constituent attributes like size, age, and proximity to amenities, but market pricing directly captures real-world buyer behavior and current market conditions.

Case Studies: Hedonic Pricing Applications

Case studies on hedonic pricing reveal its effectiveness in valuing real estate by isolating property attributes like location, size, and amenities, which traditional market pricing often overlooks. Research in urban housing markets demonstrates how hedonic models capture nuanced preferences, informing pricing strategies and policy decisions more accurately than aggregate market prices. Applications in environmental economics highlight the method's ability to quantify the impact of factors such as air quality and noise pollution on property values, providing critical insights for urban planning and regulatory frameworks.

Choosing the Right Pricing Model: Factors to Consider

Choosing the right pricing model involves evaluating product characteristics, market conditions, and consumer behavior. Market pricing suits competitive and standardized products by reflecting current market rates, while hedonic pricing captures the value of product attributes and quality differences, ideal for differentiated goods. Consider data availability, accuracy needs, and the complexity of attributes when deciding between market pricing and hedonic pricing models.

Future Trends in Market and Hedonic Pricing

Future trends in market pricing emphasize increased reliance on big data analytics and AI to enhance real-time price optimization, driven by consumer behavior and competitive dynamics. Hedonic pricing methods are evolving with advanced machine learning algorithms enabling more precise valuation of product attributes, especially in sectors like real estate and e-commerce. Integration of IoT and enhanced data granularity will further refine hedonic models, allowing businesses to capture nuanced consumer preferences and improve predictive accuracy.

Market pricing Infographic

libterm.com

libterm.com