A fixed exchange rate system stabilizes your country's currency by pegging it to another major currency or a basket of currencies, reducing fluctuations and providing economic predictability. This system supports international trade and investment by minimizing exchange rate risk, but can limit monetary policy flexibility. Dive into the rest of the article to explore how fixed exchange rates impact your economy and global markets.

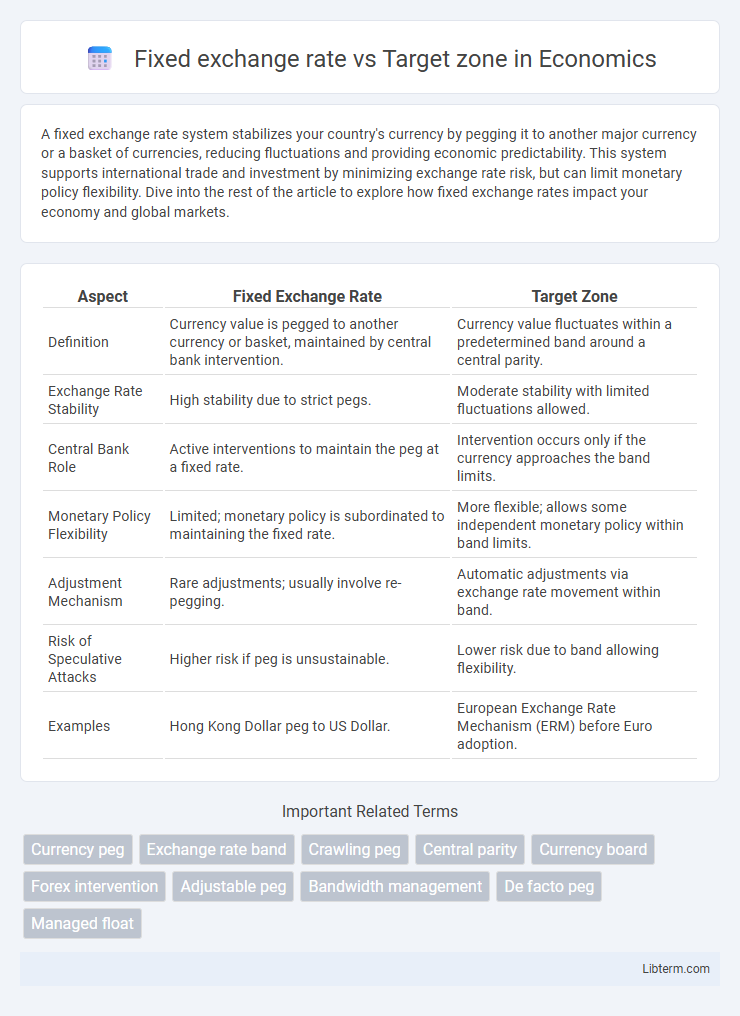

Table of Comparison

| Aspect | Fixed Exchange Rate | Target Zone |

|---|---|---|

| Definition | Currency value is pegged to another currency or basket, maintained by central bank intervention. | Currency value fluctuates within a predetermined band around a central parity. |

| Exchange Rate Stability | High stability due to strict pegs. | Moderate stability with limited fluctuations allowed. |

| Central Bank Role | Active interventions to maintain the peg at a fixed rate. | Intervention occurs only if the currency approaches the band limits. |

| Monetary Policy Flexibility | Limited; monetary policy is subordinated to maintaining the fixed rate. | More flexible; allows some independent monetary policy within band limits. |

| Adjustment Mechanism | Rare adjustments; usually involve re-pegging. | Automatic adjustments via exchange rate movement within band. |

| Risk of Speculative Attacks | Higher risk if peg is unsustainable. | Lower risk due to band allowing flexibility. |

| Examples | Hong Kong Dollar peg to US Dollar. | European Exchange Rate Mechanism (ERM) before Euro adoption. |

Introduction to Exchange Rate Regimes

Fixed exchange rate regimes maintain a constant currency value by pegging it to another currency or a basket of currencies, ensuring stability and predictability in international trade. Target zone arrangements allow exchange rates to fluctuate within a predefined band, offering more flexibility while still preventing excessive volatility. Both systems aim to balance monetary stability with economic adaptability in global financial markets.

Defining Fixed Exchange Rate Systems

Fixed exchange rate systems maintain a constant value of a country's currency relative to another currency or a basket of currencies, established through government or central bank intervention. Central banks actively buy or sell their own currency to stabilize the exchange rate within a narrow margin. This system contrasts with target zones, which allow for limited fluctuation within predefined upper and lower bounds around a central rate.

Understanding Target Zone Arrangements

Target zone arrangements involve maintaining a currency's exchange rate within a specified band or interval around a central parity, allowing limited fluctuations to enhance stability while providing some flexibility. Unlike fixed exchange rate systems, target zones rely on intervention and market expectations to keep the exchange rate within the bounds, reducing uncertainty without fully fixing the rate. This approach helps manage external shocks and speculative pressures by signaling commitment to monetary stability within predefined limits.

Key Differences Between Fixed and Target Zone

Fixed exchange rate systems maintain a constant currency value by pegging it directly to another currency or basket of currencies, ensuring stability and predictability in international trade. Target zone regimes allow exchange rates to fluctuate within a predefined band, offering more flexibility while still providing a controlled range to limit excessive volatility. This difference means fixed rates require substantial central bank intervention to maintain the peg, whereas target zones rely on adjustments only when exchange rates approach the boundaries.

Advantages of Fixed Exchange Rate Systems

Fixed exchange rate systems provide currency stability by pegging a nation's currency to a major currency or basket of currencies, reducing exchange rate volatility and fostering investor confidence. This stability encourages international trade and investment by minimizing currency risk and promoting predictable pricing for exporters and importers. Moreover, fixed exchange rates help control inflation by anchoring domestic prices to the stability of the pegged currency, supporting economic discipline and monetary policy credibility.

Benefits of Target Zone Approaches

Target zone exchange rate regimes provide greater flexibility than fixed exchange rates by allowing limited currency fluctuations within predetermined boundaries, which helps stabilize exchange rates while accommodating market dynamics. These zones reduce speculative attacks and currency volatility, supporting economic stability and investor confidence. Target zones also facilitate smoother adjustment processes for economies facing external shocks, balancing fixed exchange rate stability with market responsiveness.

Economic Impacts: Stability and Flexibility

Fixed exchange rate regimes provide currency stability by eliminating exchange rate volatility, which promotes predictable trade and investment conditions but limits monetary policy flexibility. Target zones allow for controlled exchange rate fluctuations within predefined bands, balancing stability with some degree of adaptability to economic shocks. This hybrid approach supports external competitiveness while preserving room for domestic policy adjustments, enhancing overall economic resilience.

Historical Examples and Case Studies

Fixed exchange rate systems, exemplified by the Bretton Woods system (1944-1971), provided currency stability by pegging national currencies to the U.S. dollar, which was convertible to gold. Target zones, demonstrated by the European Exchange Rate Mechanism (ERM) from 1979 to 1999, allowed currencies to fluctuate within predefined bands, balancing stability with flexibility before the adoption of the euro. Historical case studies reveal that fixed rates often faced sustainability challenges under speculative attacks, while target zones offered adaptive policy mechanisms to mitigate exchange rate volatility.

Challenges and Risks of Each System

Fixed exchange rate systems face challenges such as limited monetary policy flexibility and vulnerability to speculative attacks that can deplete foreign reserves. Target zone regimes risk frequent realignments if market expectations diverge, leading to increased volatility and uncertainty for investors. Both systems require substantial central bank intervention, which can strain reserves and complicate economic adjustments during external shocks.

Choosing the Right Exchange Rate Policy

Selecting the right exchange rate policy requires evaluating economic stability and market flexibility; fixed exchange rates provide predictable currency values that reduce exchange rate risk for international trade, while target zones allow limited currency fluctuation within predetermined bands, offering a balance between stability and adaptability. Fixed exchange rates are ideal for countries seeking to anchor inflation expectations and foster investor confidence, but they demand substantial foreign reserves to maintain the peg. Target zones suit economies aiming to combine monetary policy autonomy with exchange rate discipline, as they help smooth out short-term volatility without rigid commitments.

Fixed exchange rate Infographic

libterm.com

libterm.com