Open market operations involve the buying and selling of government securities by a central bank to regulate the money supply and control interest rates. These transactions directly impact liquidity in the banking system, influencing inflation and economic growth. Explore the rest of the article to understand how open market operations affect Your financial environment.

Table of Comparison

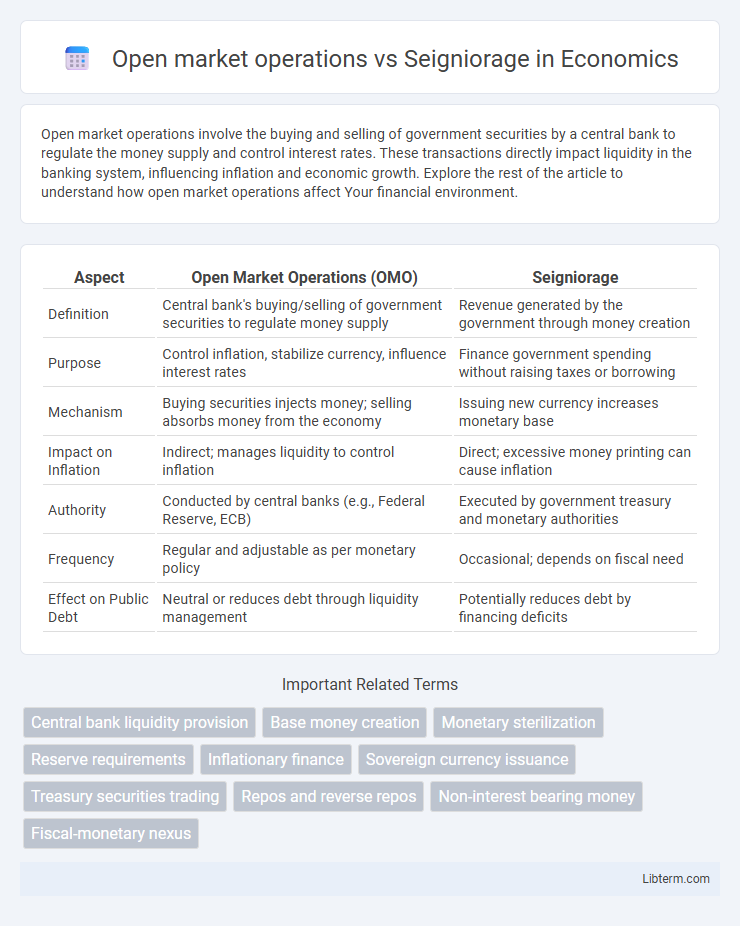

| Aspect | Open Market Operations (OMO) | Seigniorage |

|---|---|---|

| Definition | Central bank's buying/selling of government securities to regulate money supply | Revenue generated by the government through money creation |

| Purpose | Control inflation, stabilize currency, influence interest rates | Finance government spending without raising taxes or borrowing |

| Mechanism | Buying securities injects money; selling absorbs money from the economy | Issuing new currency increases monetary base |

| Impact on Inflation | Indirect; manages liquidity to control inflation | Direct; excessive money printing can cause inflation |

| Authority | Conducted by central banks (e.g., Federal Reserve, ECB) | Executed by government treasury and monetary authorities |

| Frequency | Regular and adjustable as per monetary policy | Occasional; depends on fiscal need |

| Effect on Public Debt | Neutral or reduces debt through liquidity management | Potentially reduces debt by financing deficits |

Introduction to Monetary Policy Tools

Open market operations involve the buying and selling of government securities by a central bank to regulate money supply and influence interest rates, serving as a primary tool in monetary policy implementation. Seigniorage refers to the profit a government earns from issuing currency, essentially the difference between the face value of money and its production cost, impacting inflation and public debt management. Both tools affect liquidity and economic stability, with open market operations offering short-term control over monetary conditions while seigniorage provides long-term fiscal resources.

Defining Open Market Operations

Open Market Operations (OMO) refer to the central bank's buying and selling of government securities in the open market to regulate money supply and control interest rates. This tool influences liquidity by either injecting cash into the banking system when purchasing securities or absorbing excess funds when selling. Unlike seigniorage, which involves the profit gained from issuing currency, OMOs directly target monetary policy implementation to stabilize the economy.

Understanding Seigniorage

Seigniorage is the profit a government earns by issuing currency, which occurs when the face value of money exceeds the production cost, effectively creating revenue from money creation. Unlike open market operations, which involve the central bank buying or selling government securities to regulate money supply and interest rates, seigniorage directly impacts inflation and monetary base expansion. Understanding seigniorage is crucial for assessing its role in fiscal policy and inflationary pressures within an economy.

Historical Context of Both Mechanisms

Open market operations emerged in the early 20th century as central banks sought more precise control over money supply and interest rates, evolving from simpler, less direct monetary tools used before the Federal Reserve's establishment in 1913. Seigniorage, rooted in medieval times, historically referred to rulers' profits from minting coins, serving as a primary state revenue source before modern taxation systems developed. While open market operations reflect sophisticated monetary policy techniques in modern economies, seigniorage captures the older economic practice of generating government funds through currency issuance.

How Open Market Operations Influence Liquidity

Open Market Operations (OMO) directly influence liquidity by controlling the money supply through the buying and selling of government securities in the open market, which adjusts the reserves of commercial banks. When central banks purchase securities, they inject liquidity into the banking system increasing available funds for lending, while selling securities withdraws liquidity, tightening credit conditions. Seigniorage, the revenue generated from money creation, does not actively manage liquidity but rather results from issuing currency, making OMO a more precise tool for short-term liquidity adjustments in the financial markets.

The Role of Seigniorage in Government Revenue

Seigniorage refers to the government's revenue generated by issuing currency, effectively the profit earned from the difference between the face value of money and its production cost. Unlike open market operations, which primarily aim to regulate liquidity and control inflation by buying or selling government securities, seigniorage provides a direct financial resource to the government. This revenue plays a crucial role in funding public expenditures without raising taxes, especially in economies facing fiscal deficits.

Inflationary Impacts: OMO vs Seigniorage

Open market operations (OMO) involve buying or selling government securities to regulate money supply, typically exerting controlled inflationary effects by adjusting liquidity without directly increasing the monetary base. Seigniorage, the revenue generated from money creation by the central bank, often leads to higher inflation since it directly increases the money supply, potentially devaluing currency and raising price levels. The inflationary impact of seigniorage is more pronounced in economies relying heavily on monetizing deficits compared to the calibrated influence of OMOs in stabilizing inflation expectations.

Central Bank Independence and Policy Choices

Open market operations enable central banks to adjust liquidity and influence interest rates without direct fiscal involvement, preserving monetary policy autonomy and reinforcing central bank independence. In contrast, seigniorage, the revenue from money creation, risks fiscal dominance as governments may pressure central banks to monetize debt, compromising their independence and long-term policy credibility. Central bank policy choices balance these tools to maintain price stability while avoiding inflationary bias and safeguarding institutional autonomy.

Effectiveness in Modern Economies

Open market operations provide central banks with precise control over short-term interest rates and liquidity, making them highly effective tools for managing inflation and stabilizing financial markets in modern economies. Seigniorage, relying on revenue from money creation, risks fueling inflation if overused and serves less as a monetary policy instrument and more as a fiscal resource. The effectiveness of open market operations surpasses seigniorage in maintaining price stability and fostering economic growth in dynamic financial systems.

Comparative Advantages and Disadvantages

Open market operations provide central banks with flexible tools to control money supply and interest rates, enabling precise short-term economic stabilization with minimal inflation risk. Seigniorage generates government revenue by printing money, which can finance deficits without immediate debt but risks high inflation and currency devaluation if overused. While open market operations prioritize market stability and gradual monetary adjustments, seigniorage offers quick fiscal relief at the expense of long-term price stability.

Open market operations Infographic

libterm.com

libterm.com