Consumer surplus measures the financial benefit you receive when paying less for a product than what you are willing to pay. It represents the difference between your maximum willingness to pay and the actual market price, reflecting greater value and satisfaction. Discover how understanding consumer surplus can improve your economic decisions by reading the rest of the article.

Table of Comparison

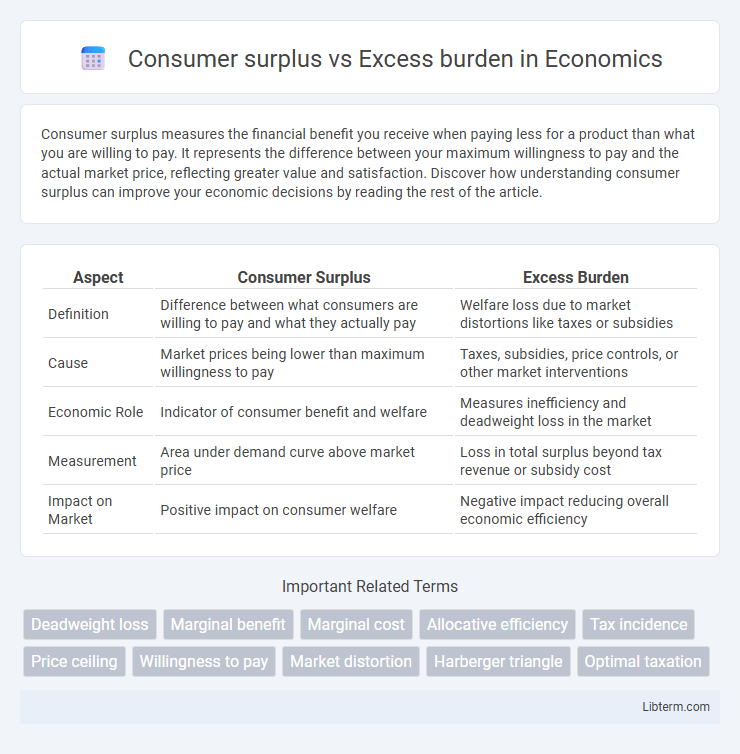

| Aspect | Consumer Surplus | Excess Burden |

|---|---|---|

| Definition | Difference between what consumers are willing to pay and what they actually pay | Welfare loss due to market distortions like taxes or subsidies |

| Cause | Market prices being lower than maximum willingness to pay | Taxes, subsidies, price controls, or other market interventions |

| Economic Role | Indicator of consumer benefit and welfare | Measures inefficiency and deadweight loss in the market |

| Measurement | Area under demand curve above market price | Loss in total surplus beyond tax revenue or subsidy cost |

| Impact on Market | Positive impact on consumer welfare | Negative impact reducing overall economic efficiency |

Introduction to Consumer Surplus and Excess Burden

Consumer surplus represents the difference between what consumers are willing to pay for a good and what they actually pay, reflecting the net benefit gained from market transactions. Excess burden, also known as deadweight loss, quantifies the economic inefficiency caused by market distortions such as taxes or subsidies that reduce total welfare. Understanding the relationship between consumer surplus and excess burden is crucial for evaluating the impact of policy interventions on market efficiency and consumer welfare.

Defining Consumer Surplus

Consumer surplus represents the difference between the maximum price consumers are willing to pay and the actual price they pay, reflecting the total benefit gained from purchasing goods at market prices. It quantifies consumer welfare and measures the net gain in utility from transactions in a competitive market. Excess burden, or deadweight loss, differs by capturing the economic inefficiency caused when market equilibrium is distorted, such as through taxes or subsidies, reducing total surplus.

Understanding Excess Burden (Deadweight Loss)

Excess burden, also known as deadweight loss, represents the loss of economic efficiency when market equilibrium is disrupted by taxation or other distortions, reducing both consumer and producer surplus. Unlike consumer surplus, which measures the difference between what consumers are willing to pay and what they actually pay, excess burden captures the total welfare loss that exceeds government revenue from the tax. Understanding excess burden is crucial for analyzing the impact of taxes, as it quantifies the inefficiencies that reduce overall social welfare beyond the direct financial cost to consumers.

Key Differences Between Consumer Surplus and Excess Burden

Consumer surplus measures the difference between what consumers are willing to pay and what they actually pay, reflecting the net benefit to consumers from market transactions. Excess burden, also known as deadweight loss, represents the loss of economic efficiency when market equilibrium is disrupted by taxes or subsidies, reducing total welfare beyond the tax revenue collected. The key difference lies in consumer surplus capturing individual gain from consumption, while excess burden reflects social loss due to market distortions.

Economic Significance in Market Analysis

Consumer surplus measures the net benefit consumers receive when they pay less than their maximum willingness to pay, reflecting true market efficiency and consumer welfare. Excess burden, or deadweight loss, quantifies the economic inefficiency caused by market distortions like taxes or subsidies, leading to lost potential gains from trade. Understanding these concepts is critical in market analysis for evaluating policy impacts, optimizing tax structures, and enhancing overall economic welfare.

Graphical Representation and Visualization

Consumer surplus is graphically represented as the area between the demand curve and the market price line, illustrating the net benefit consumers receive from purchasing a product at a price lower than their maximum willingness to pay. Excess burden, or deadweight loss, is depicted as the triangular area between the supply and demand curves that arises due to market distortions like taxes or subsidies, reflecting the loss of economic efficiency. Visualization of these concepts on a supply and demand graph highlights how consumer surplus changes with price shifts, while excess burden quantifies the welfare loss from price interventions.

Real-World Examples and Case Studies

Consumer surplus represents the difference between what consumers are willing to pay and what they actually pay, seen in cases like price drops in technology products leading to increased consumer welfare. Excess burden, or deadweight loss, arises from market distortions such as taxes or subsidies, evidenced by the welfare losses after imposing tariffs on imported goods reducing trade efficiency. Case studies on cigarette taxation in various countries reveal decreased consumer surplus balanced against excess burden from black markets and enforcement costs.

Impact on Policy and Taxation

Consumer surplus measures the benefit buyers receive when paying less than their maximum willingness to pay, while excess burden, or deadweight loss, reflects the efficiency loss from taxation or policy distortion. Policymakers aim to minimize excess burden to avoid reducing overall economic welfare, often balancing tax rates to preserve consumer surplus without discouraging consumption. Effective taxation strategies focus on sectors with inelastic demand, where excess burden is lower, thereby limiting negative impacts on consumer surplus and economic efficiency.

Measuring and Calculating: Consumer Surplus vs Excess Burden

Measuring consumer surplus involves calculating the difference between what consumers are willing to pay for a good and what they actually pay, typically represented by the area under the demand curve above the market price. Excess burden, or deadweight loss, is measured by estimating the loss in total welfare due to market distortions like taxes or subsidies, often illustrated as the triangle between supply and demand curves that reflects lost trades. Quantitative methods for calculating both concepts use graphical analysis and integral calculus to precisely capture the economic impact on consumer welfare and overall efficiency.

Implications for Consumers and Producers

Consumer surplus measures the net benefit consumers receive when they pay less than their maximum willingness to pay, directly reflecting increased consumer welfare. Excess burden, or deadweight loss, represents the inefficiency created by market distortions like taxes, leading to a reduction in total economic surplus impacting both consumers and producers. For producers, excess burden reduces producer surplus by decreasing demand and disrupting optimal production levels, while consumers face higher prices or reduced consumption, diminishing overall welfare.

Consumer surplus Infographic

libterm.com

libterm.com