The formal market encompasses businesses and consumers engaged in legally recognized and regulated economic activities, ensuring transparency and compliance with established standards. It plays a crucial role in fostering economic growth, attracting investments, and providing structured employment opportunities. Explore the article to understand how the formal market influences your financial decisions and broader economic trends.

Table of Comparison

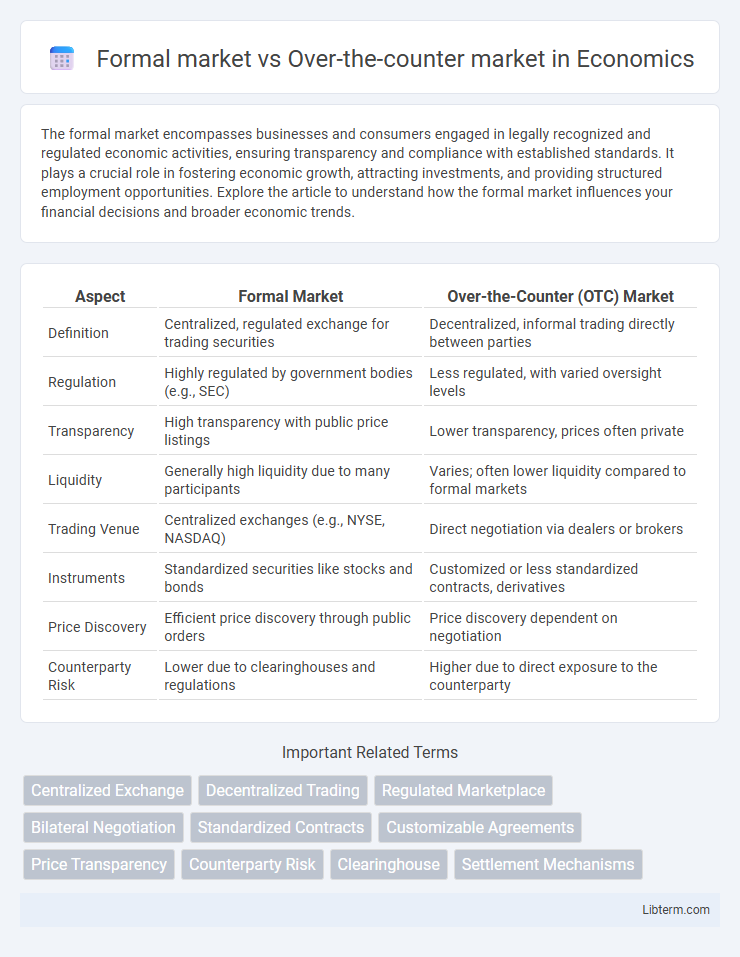

| Aspect | Formal Market | Over-the-Counter (OTC) Market |

|---|---|---|

| Definition | Centralized, regulated exchange for trading securities | Decentralized, informal trading directly between parties |

| Regulation | Highly regulated by government bodies (e.g., SEC) | Less regulated, with varied oversight levels |

| Transparency | High transparency with public price listings | Lower transparency, prices often private |

| Liquidity | Generally high liquidity due to many participants | Varies; often lower liquidity compared to formal markets |

| Trading Venue | Centralized exchanges (e.g., NYSE, NASDAQ) | Direct negotiation via dealers or brokers |

| Instruments | Standardized securities like stocks and bonds | Customized or less standardized contracts, derivatives |

| Price Discovery | Efficient price discovery through public orders | Price discovery dependent on negotiation |

| Counterparty Risk | Lower due to clearinghouses and regulations | Higher due to direct exposure to the counterparty |

Understanding Formal Markets: Definition and Key Features

Formal markets are regulated trading venues characterized by centralized exchanges, standardized contracts, and strict compliance with financial regulations. Key features include transparent price discovery mechanisms, high liquidity, and strong investor protection measures enforced by regulatory authorities such as the SEC or FCA. These markets facilitate efficient capital allocation by providing reliable platforms for trading securities, commodities, and derivatives.

Over-the-Counter Markets: An Overview

Over-the-counter (OTC) markets facilitate trading of securities directly between parties without centralized exchanges, enabling access to a broader range of assets, including derivatives, bonds, and smaller company stocks. OTC markets offer greater flexibility in terms, customized contracts, and trading hours but carry higher risks due to lower transparency and reduced regulatory oversight compared to formal exchanges such as the NYSE or NASDAQ. Key players in OTC markets include market makers and dealers who provide liquidity, and the markets are predominantly electronic, with platforms like OTCQX and Pink Sheets providing price information and trade execution.

Structural Differences Between Formal and OTC Markets

Formal markets operate through centralized exchanges with standardized contracts and regulated trading environments, ensuring transparency and liquidity. Over-the-counter (OTC) markets involve decentralized trading directly between parties, allowing customized contracts but with less transparency and increased counterparty risk. The structural distinction lies mainly in the regulatory oversight and trading mechanisms, where formal markets rely on strict rules and OTC markets on private negotiation.

Key Participants in Formal and OTC Trading

Key participants in the formal market include regulated exchanges, institutional investors, brokers, and clearinghouses that ensure transparency and standardized trading processes. In contrast, the over-the-counter (OTC) market primarily involves dealers, market makers, and institutional investors engaging in direct bilateral transactions without centralized exchange oversight. The presence of regulatory bodies in formal markets offers greater investor protection, while OTC participants benefit from customized contracts and greater flexibility.

Regulatory Framework: Formal Market vs OTC Market

The formal market operates under strict regulatory frameworks enforced by government agencies such as the Securities and Exchange Commission (SEC), ensuring transparency, standardized procedures, and investor protection. In contrast, the over-the-counter (OTC) market is less regulated, with trades occurring directly between parties, often leading to less transparency and higher counterparty risk. This regulatory difference impacts liquidity, pricing efficiency, and the level of oversight investors can expect in both markets.

Transparency and Price Discovery in Both Markets

The formal market offers higher transparency with regulated exchanges where prices and trades are publicly available, facilitating efficient price discovery through centralized order books. In contrast, the over-the-counter (OTC) market operates through direct negotiations between parties, resulting in less transparency and more variable price discovery due to limited public information. This difference impacts liquidity, with formal markets providing more reliable price signals and OTC markets allowing greater flexibility but increased information asymmetry.

Trading Process: Comparing Execution and Settlement

In the formal market, trading processes are centralized with standardized execution protocols and regulated settlement systems ensuring transparency and reduced counterparty risk. Over-the-counter (OTC) markets feature decentralized trading directly between parties, allowing flexible negotiation but introducing higher counterparty risk and less standardized settlement procedures. Settlement in formal markets typically occurs through clearinghouses, whereas OTC transactions often rely on bilateral agreements and private clearing mechanisms.

Advantages of Formal Markets

Formal markets offer enhanced transparency through standardized regulations and centralized trading platforms, promoting fair price discovery and investor confidence. Access to a broad range of financial instruments with stringent oversight reduces counterparty risk and improves liquidity. Regulatory compliance and market supervision protect investors from fraud and ensure efficient capital allocation.

Benefits and Risks of Over-the-Counter Markets

Over-the-counter (OTC) markets offer increased flexibility and accessibility, allowing trading of securities not listed on formal exchanges, which benefits smaller companies and investors seeking customized contracts. However, OTC markets carry higher risks due to lower transparency, less stringent regulatory oversight, and increased counterparty risk compared to formal markets like the NYSE or NASDAQ. These factors can lead to increased price volatility and potential difficulties in evaluating true market value and liquidity.

Choosing the Right Market: Factors to Consider

Choosing between the formal market and the over-the-counter (OTC) market depends on factors such as regulatory oversight, transparency, and liquidity. The formal market offers greater regulatory protections, standardized contracts, and higher liquidity, making it suitable for risk-averse investors and those requiring price transparency. In contrast, the OTC market provides flexibility with customized contracts and access to a broader range of assets but comes with increased counterparty risk and less price visibility.

Formal market Infographic

libterm.com

libterm.com