The permanent income hypothesis suggests that individuals base their consumption decisions on their expected long-term average income rather than current income fluctuations, promoting more stable spending patterns. This theory explains why temporary changes in income have a limited effect on consumption and highlights the importance of income expectations in financial planning. Discover how understanding this hypothesis can improve your approach to personal finance and economic behavior throughout the rest of the article.

Table of Comparison

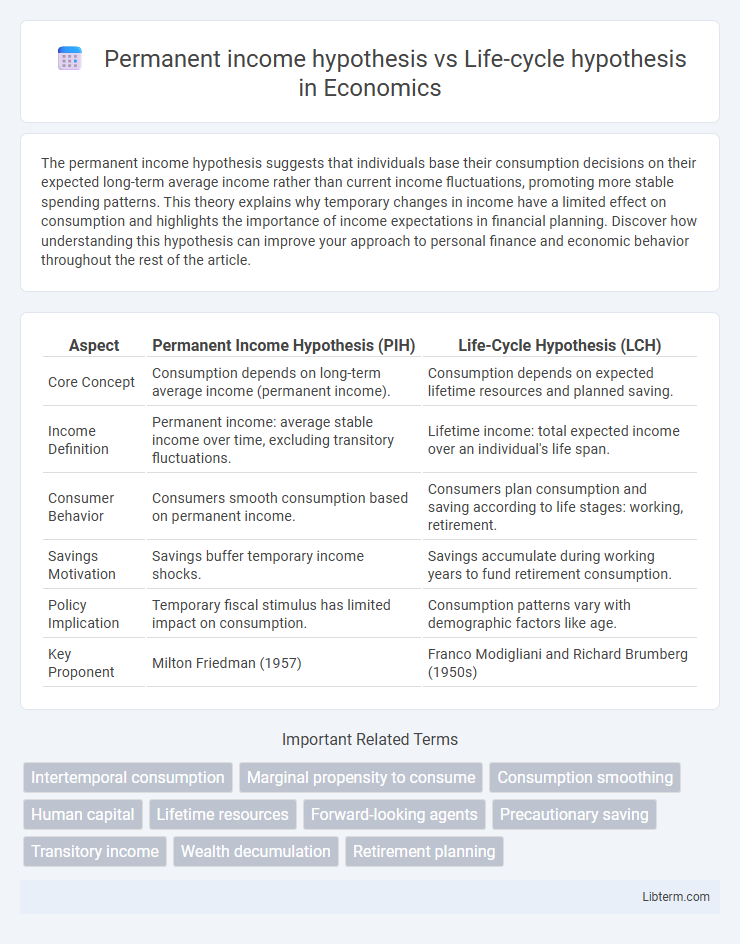

| Aspect | Permanent Income Hypothesis (PIH) | Life-Cycle Hypothesis (LCH) |

|---|---|---|

| Core Concept | Consumption depends on long-term average income (permanent income). | Consumption depends on expected lifetime resources and planned saving. |

| Income Definition | Permanent income: average stable income over time, excluding transitory fluctuations. | Lifetime income: total expected income over an individual's life span. |

| Consumer Behavior | Consumers smooth consumption based on permanent income. | Consumers plan consumption and saving according to life stages: working, retirement. |

| Savings Motivation | Savings buffer temporary income shocks. | Savings accumulate during working years to fund retirement consumption. |

| Policy Implication | Temporary fiscal stimulus has limited impact on consumption. | Consumption patterns vary with demographic factors like age. |

| Key Proponent | Milton Friedman (1957) | Franco Modigliani and Richard Brumberg (1950s) |

Introduction to Consumption Theories

The Permanent Income Hypothesis, developed by Milton Friedman, asserts that consumers base their spending on an estimate of their long-term average income rather than current income fluctuations, promoting consumption smoothing over time. The Life-Cycle Hypothesis, formulated by Franco Modigliani, suggests individuals plan their consumption and savings behavior over their lifetime to optimize utility, balancing income during working years with retirement needs. Both theories are foundational in understanding consumption patterns and savings decisions, influencing economic policy and forecasting models.

Overview of the Permanent Income Hypothesis

The Permanent Income Hypothesis (PIH), developed by Milton Friedman, posits that individuals base their consumption decisions on an estimate of their long-term average income rather than current income fluctuations. This theory suggests that temporary changes in income have minimal impact on consumption patterns, as people smooth consumption over time to maintain stability. PIH contrasts with the Life-Cycle Hypothesis by emphasizing the role of expected permanent income rather than the accumulation and decumulation of assets over a lifetime.

Key Concepts of the Life-Cycle Hypothesis

The Life-Cycle Hypothesis posits that individuals plan their consumption and savings behavior over their lifetime to smooth consumption in anticipation of varying income phases, such as working years and retirement. Key concepts include the intention to accumulate savings during high-earning periods and dissave during retirement to maintain stable consumption. This hypothesis emphasizes the role of predictable changes in income and wealth over an individual's lifetime in shaping spending patterns, contrasting with the Permanent Income Hypothesis which focuses on income expectations affecting consumption.

Historical Background and Development

The Permanent Income Hypothesis, formulated by Milton Friedman in the 1950s, posits that individuals base consumption on expected long-term average income rather than current income fluctuations, emphasizing income smoothing over time. The Life-cycle Hypothesis, developed by Franco Modigliani and Richard Brumberg in the early 1960s, suggests that people plan consumption and savings behavior over their lifetime to maintain a stable standard of living, factoring in varying income at different life stages. Both theories significantly advanced the understanding of consumption patterns and intertemporal choices in macroeconomics by incorporating expectations and planning horizons into consumer behavior models.

Core Assumptions and Mechanisms

The Permanent Income Hypothesis (PIH) assumes consumers base spending on expected long-term average income, smoothing consumption despite short-term income fluctuations through saving or borrowing. The Life-Cycle Hypothesis (LCH) posits individuals plan consumption and savings over their lifetime, aiming to maintain stable consumption by accumulating wealth during working years and decumulating during retirement. Both theories emphasize intertemporal consumption choices, but PIH focuses on income expectations while LCH highlights wealth accumulation aligned with aging profiles.

Similarities Between PIH and LCH

Both the Permanent Income Hypothesis (PIH) and the Life-Cycle Hypothesis (LCH) emphasize consumption smoothing over time, highlighting how individuals plan their spending based on expected lifetime resources rather than current income alone. Both theories incorporate the idea that consumers optimize utility by balancing consumption and saving to maintain stable consumption patterns despite income fluctuations. Furthermore, PIH and LCH rely on intertemporal budget constraints and rational expectations to explain consumer behavior across different stages of life.

Main Differences: PIH vs LCH

The Permanent Income Hypothesis (PIH) emphasizes consumption based on an individual's expected long-term average income, suggesting that people smooth consumption by responding primarily to permanent income changes rather than transitory fluctuations. The Life-Cycle Hypothesis (LCH) models consumption patterns over an individual's lifetime, highlighting how people plan savings and spending to optimize utility by balancing income during working years and retirement. Unlike PIH, which focuses on income expectations, LCH incorporates age-related dynamics and life stages to explain variations in consumption and saving behavior.

Empirical Evidence and Real-World Applications

Empirical evidence on the Permanent Income Hypothesis (PIH) shows that consumption closely aligns with anticipated long-term income, as demonstrated by studies such as Hall (1978) confirming the random walk model of consumption, while the Life-Cycle Hypothesis (LCH) is supported by data revealing age-related patterns in saving and spending, exemplified by Modigliani and Brumberg's analysis of intertemporal consumption smoothing. In real-world applications, the PIH influences monetary policy design by emphasizing expectations and forward-looking behavior in consumption responses, whereas the LCH informs social security and pension planning through its focus on lifetime resource allocation and retirement saving. Both hypotheses guide financial advisors and economists in modeling consumer behavior, though empirical research often integrates elements of each to address observed deviations like liquidity constraints and uncertainty.

Policy Implications of Consumption Theories

Permanent income hypothesis suggests fiscal policy should target long-term income stability to influence consumption, as temporary income changes have limited effects on spending behavior. Life-cycle hypothesis emphasizes the need for policies supporting saving and borrowing across different life stages to smooth consumption over a lifetime. Effective economic policies must consider these theories to balance short-term stimulus and long-term financial security for individuals.

Conclusion: Relevance in Modern Economics

The Permanent Income Hypothesis (PIH) and Life-Cycle Hypothesis (LCH) both fundamentally shape understanding of consumer behavior and savings patterns in modern economics. PIH emphasizes income stability and anticipatory spending, influencing monetary policy effectiveness in managing consumption, while LCH highlights age-based consumption smoothing, guiding retirement planning and social security frameworks. Together, these models underpin contemporary economic theories on consumer demand and inform policy design addressing long-term fiscal sustainability and economic growth.

Permanent income hypothesis Infographic

libterm.com

libterm.com