Loss aversion is a psychological phenomenon where individuals feel the pain of losses more intensely than the pleasure of equivalent gains, influencing decision-making and risk behavior. This bias often leads people to avoid risks, even when potential rewards outweigh possible losses, impacting financial choices, negotiations, and everyday decisions. Discover how understanding loss aversion can empower your decision-making by reading the rest of the article.

Table of Comparison

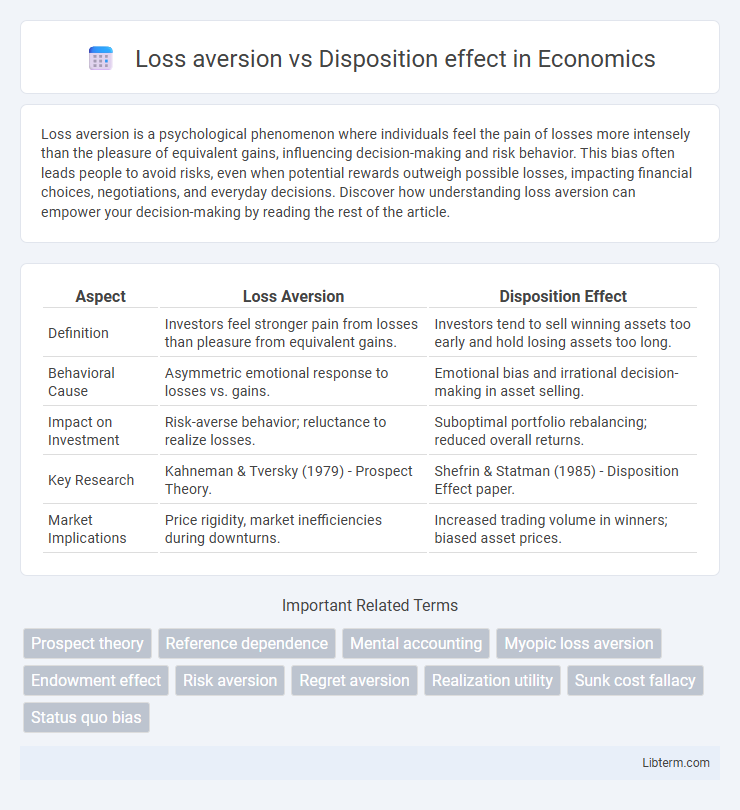

| Aspect | Loss Aversion | Disposition Effect |

|---|---|---|

| Definition | Investors feel stronger pain from losses than pleasure from equivalent gains. | Investors tend to sell winning assets too early and hold losing assets too long. |

| Behavioral Cause | Asymmetric emotional response to losses vs. gains. | Emotional bias and irrational decision-making in asset selling. |

| Impact on Investment | Risk-averse behavior; reluctance to realize losses. | Suboptimal portfolio rebalancing; reduced overall returns. |

| Key Research | Kahneman & Tversky (1979) - Prospect Theory. | Shefrin & Statman (1985) - Disposition Effect paper. |

| Market Implications | Price rigidity, market inefficiencies during downturns. | Increased trading volume in winners; biased asset prices. |

Understanding Loss Aversion

Loss aversion describes the psychological tendency for individuals to prefer avoiding losses rather than acquiring equivalent gains, often leading to risk-averse behavior when facing potential losses. This bias significantly impacts decision-making by causing people to overvalue potential losses relative to gains, thereby influencing financial choices and investment strategies. Understanding loss aversion is crucial for interpreting related behaviors such as the disposition effect, where investors prematurely sell winning assets while holding onto losing ones to avoid realizing losses.

Explaining the Disposition Effect

The disposition effect refers to investors' tendency to sell assets that have increased in value while holding onto those that have declined, driven by the desire to realize gains and avoid realizing losses. This behavior contrasts with loss aversion, which is the psychological preference to avoid losses rather than acquiring equivalent gains. The disposition effect can lead to suboptimal investment decisions by causing premature selling of winners and prolonged holding of losers.

Psychological Roots of Loss Aversion

Loss aversion stems primarily from the psychological impact of potential losses being perceived as more significant than equivalent gains, rooted in the brain's emotional response to risk and fear. This cognitive bias activates the amygdala and other neural pathways associated with negative stimuli, causing individuals to prefer avoiding losses rather than acquiring gains. Contrarily, the disposition effect reflects a behavioral tendency to sell winning investments too early and hold onto losing ones, influenced by loss aversion but also by mental accounting and regret-aversion mechanisms.

How the Disposition Effect Influences Investing

The disposition effect influences investing by causing investors to hold onto losing stocks too long while quickly selling winning stocks to realize gains. This behavior stems from the emotional impact of loss aversion, where the pain of losses weighs heavier than the pleasure of gains. As a result, portfolios may become skewed, underperforming due to the reluctance to realize losses and the premature realization of gains.

Key Differences Between Loss Aversion and Disposition Effect

Loss aversion refers to the psychological phenomenon where individuals experience stronger negative emotions from losses than the positive emotions from equivalent gains, influencing decision-making under risk. The disposition effect involves investors' tendency to sell winning assets too early while holding onto losing assets longer, driven by an emotional reluctance to realize losses. Key differences lie in loss aversion being a broader cognitive bias related to potential outcomes, whereas the disposition effect specifically describes a behavioral pattern in financial asset management.

Real-Life Examples in Financial Decision-Making

Loss aversion manifests in investors holding onto losing stocks longer than rational analysis suggests, fearing the pain of realizing losses, while the disposition effect leads them to sell winning stocks prematurely to secure gains. For instance, a trader may avoid selling a depreciated stock despite market signals to cut losses, exemplifying loss aversion, whereas selling a profitable stock quickly to lock in gains highlights the disposition effect. These behaviors distort portfolio management, often resulting in suboptimal financial outcomes influenced by emotional biases rather than objective market assessments.

Cognitive Biases Underlying Both Phenomena

Loss aversion and disposition effect both stem from cognitive biases influencing decision-making under uncertainty, particularly the tendency to weigh losses more heavily than gains, as described by Prospect Theory. While loss aversion reflects the fear of realizing losses, the disposition effect reveals a bias that leads investors to prematurely sell winning assets and hold onto losing ones to avoid acknowledging losses. These biases are rooted in emotional responses and heuristics that distort rational evaluation, causing behavioral anomalies in financial markets.

Impact on Portfolio Performance

Loss aversion causes investors to hold losing investments too long to avoid realizing losses, negatively affecting portfolio performance by increasing risk exposure and reducing diversification. The disposition effect leads to premature selling of winning assets and holding onto losers, which can result in suboptimal asset allocation and lower overall returns. Both behavioral biases distort rational investment decisions, ultimately diminishing long-term portfolio growth and increasing volatility.

Strategies to Overcome Behavioral Biases

Loss aversion and the disposition effect often lead investors to hold losing stocks too long while selling winners prematurely, undermining portfolio performance. Employing strategies such as setting predefined exit rules, using automated trading systems, and practicing mental accounting can help mitigate these biases by promoting disciplined decision-making. Cognitive behavioral training and regular portfolio reviews also enhance investor awareness, reducing emotional responses and encouraging data-driven choices.

Practical Implications for Investors

Loss aversion causes investors to hold losing investments too long to avoid realizing losses, often leading to greater financial damage. The disposition effect biases investors to sell winning assets prematurely while retaining losers, impairing portfolio performance. Understanding these behaviors helps investors implement disciplined strategies like setting stop-loss orders and establishing clear profit-taking rules to optimize returns.

Loss aversion Infographic

libterm.com

libterm.com