The AD-AS model explains the relationship between aggregate demand and aggregate supply in an economy, illustrating how price levels and real output interact. It helps analyze economic fluctuations, inflation, and unemployment by showing shifts in these curves. Discover how understanding the AD-AS model can enhance your insight into economic dynamics by reading the rest of the article.

Table of Comparison

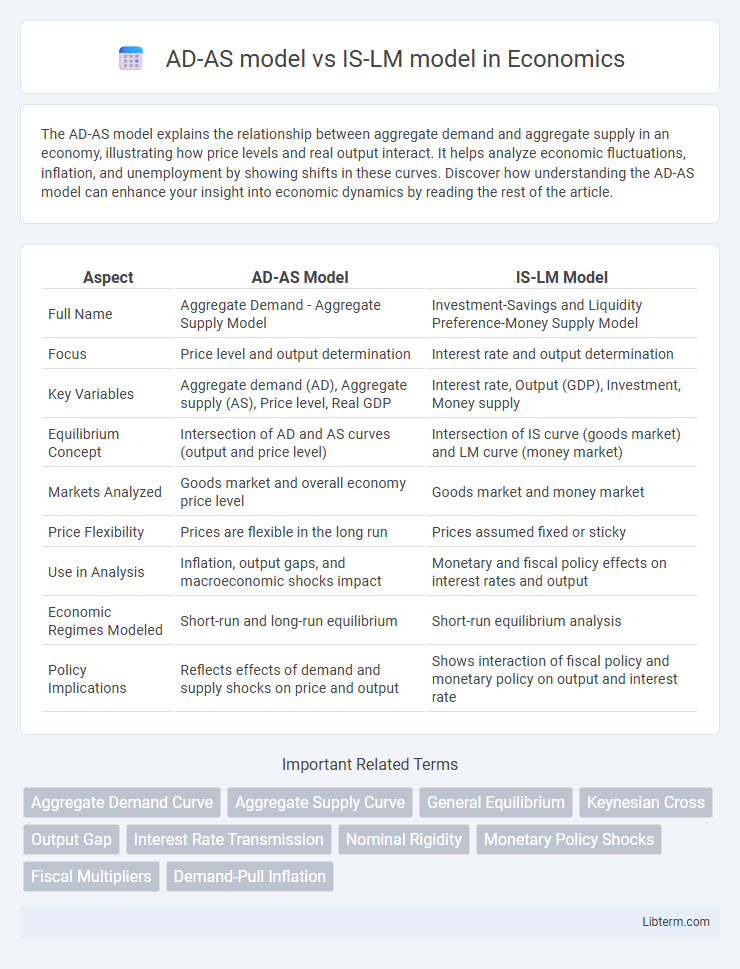

| Aspect | AD-AS Model | IS-LM Model |

|---|---|---|

| Full Name | Aggregate Demand - Aggregate Supply Model | Investment-Savings and Liquidity Preference-Money Supply Model |

| Focus | Price level and output determination | Interest rate and output determination |

| Key Variables | Aggregate demand (AD), Aggregate supply (AS), Price level, Real GDP | Interest rate, Output (GDP), Investment, Money supply |

| Equilibrium Concept | Intersection of AD and AS curves (output and price level) | Intersection of IS curve (goods market) and LM curve (money market) |

| Markets Analyzed | Goods market and overall economy price level | Goods market and money market |

| Price Flexibility | Prices are flexible in the long run | Prices assumed fixed or sticky |

| Use in Analysis | Inflation, output gaps, and macroeconomic shocks impact | Monetary and fiscal policy effects on interest rates and output |

| Economic Regimes Modeled | Short-run and long-run equilibrium | Short-run equilibrium analysis |

| Policy Implications | Reflects effects of demand and supply shocks on price and output | Shows interaction of fiscal policy and monetary policy on output and interest rate |

Introduction to Macroeconomic Models

The AD-AS model illustrates the relationship between aggregate demand and aggregate supply, capturing price level adjustments and economic output in the short run and long run. The IS-LM model represents equilibrium in the goods and money markets, emphasizing interest rates and output under different fiscal and monetary policies. Both frameworks are fundamental in macroeconomic analysis, providing complementary insights into economic fluctuations and policy impacts.

Overview of the AD-AS Model

The AD-AS model represents the relationship between aggregate demand and aggregate supply, illustrating overall price levels and output in the economy. It captures short-run economic fluctuations through shifts in aggregate demand and supply curves influenced by factors like investment, consumption, government spending, and input prices. Unlike the IS-LM model, which focuses on interest rates and real output in the goods and money markets, the AD-AS framework emphasizes price level adjustments and macroeconomic equilibrium.

Key Components of the IS-LM Model

The IS-LM model centers on the interaction between the real economy and financial markets, with the IS curve representing equilibrium in the goods market where investment equals savings, and the LM curve depicting equilibrium in the money market where money demand equals money supply. Key components include interest rates, income levels, and money supply, which jointly determine equilibrium output and interest rates. This model is essential for analyzing how fiscal and monetary policies impact national income and interest rates in the short run.

Core Assumptions: AD-AS vs IS-LM

The AD-AS model assumes price flexibility and analyzes the relationship between aggregate demand, aggregate supply, and price levels in the overall economy, emphasizing output and inflation fluctuations. In contrast, the IS-LM model assumes fixed prices in the short run and focuses on equilibrium in the goods market (Investment-Savings) and money market (Liquidity preference-Money supply) to determine output and interest rates. These foundational differences highlight the AD-AS model's dynamic price adjustment mechanism, whereas the IS-LM framework centers on interest rate determination under rigid price conditions.

Depiction of Aggregate Demand and Supply

The AD-AS model depicts aggregate demand and aggregate supply curves to explain overall price level and output in the economy, illustrating how shifts in demand or supply affect inflation and real GDP. In contrast, the IS-LM model focuses on equilibrium in goods and money markets, representing the interaction between interest rates and output without directly showing price level changes or supply constraints. While AD-AS captures price adjustment dynamics in aggregate markets, IS-LM primarily analyzes demand-side fluctuations under fixed prices.

Interest Rates and Output in IS-LM

The IS-LM model emphasizes the relationship between interest rates and output by illustrating equilibrium where investment equals savings (IS curve) and money supply equals money demand (LM curve). Changes in fiscal policy shift the IS curve, affecting both output and interest rates, while monetary policy shifts the LM curve, primarily influencing interest rates and output levels. Compared to the AD-AS model, which focuses on aggregate demand and supply affecting price levels and output, the IS-LM model provides a more detailed analysis of how interest rates mediate the interaction between real output and money markets.

Policy Implications in Each Model

The AD-AS model highlights the effects of fiscal and monetary policies on aggregate demand and price levels, emphasizing inflation and output stabilization through shifts in aggregate demand or supply curves. The IS-LM model focuses on the interaction between interest rates and output in goods and money markets, guiding policymakers on managing fiscal spending and monetary supply to influence equilibrium income and interest rates. Both models offer complementary insights for macroeconomic stabilization, with AD-AS stressing price level adjustments and IS-LM centering on liquidity preference and investment dynamics.

Strengths and Limitations: AD-AS vs IS-LM

The AD-AS model effectively captures the relationship between inflation, output, and aggregate demand-supply dynamics, making it useful for analyzing price level changes and long-run economic equilibrium. Its limitation lies in less detailed treatment of interest rates and financial markets compared to the IS-LM model, which focuses on the interaction between interest rates and output in goods and money markets. The IS-LM model excels in short-run macroeconomic policy analysis involving monetary and fiscal policy but assumes fixed price levels, limiting its applicability for long-term inflation dynamics.

Real-World Applications and Examples

The AD-AS model is extensively used to analyze aggregate output, inflation, and unemployment dynamics by illustrating how shifts in aggregate demand and aggregate supply influence price levels and real GDP, evident in scenarios like stagflation during the 1970s. The IS-LM model primarily serves to explore equilibrium in the goods and money markets by showing the interaction between interest rates and output, which is useful for understanding monetary and fiscal policy effects during economic fluctuations, such as the Great Depression. Real-world applications of these models include central banks employing the IS-LM framework to guide interest rate decisions and policymakers using the AD-AS model to predict inflationary pressures or recession risks.

Conclusion: Choosing the Right Model

The AD-AS model effectively captures the relationship between aggregate demand, aggregate supply, price levels, and real output, making it ideal for analyzing inflation and economic growth trends. The IS-LM model focuses on equilibrium in goods and money markets, providing detailed insights into interest rates and fiscal-monetary policy interactions. Selecting the right model depends on whether the analysis prioritizes price level dynamics and supply constraints (AD-AS) or monetary-fiscal policy effects and interest rate determination (IS-LM).

AD-AS model Infographic

libterm.com

libterm.com