Sovereign default occurs when a government fails to meet its debt repayment obligations, causing significant economic disruption and loss of investor confidence. These defaults can lead to severe consequences such as borrowing difficulties, currency devaluation, and recession. Discover the causes, impacts, and potential solutions for sovereign default in the rest of this article.

Table of Comparison

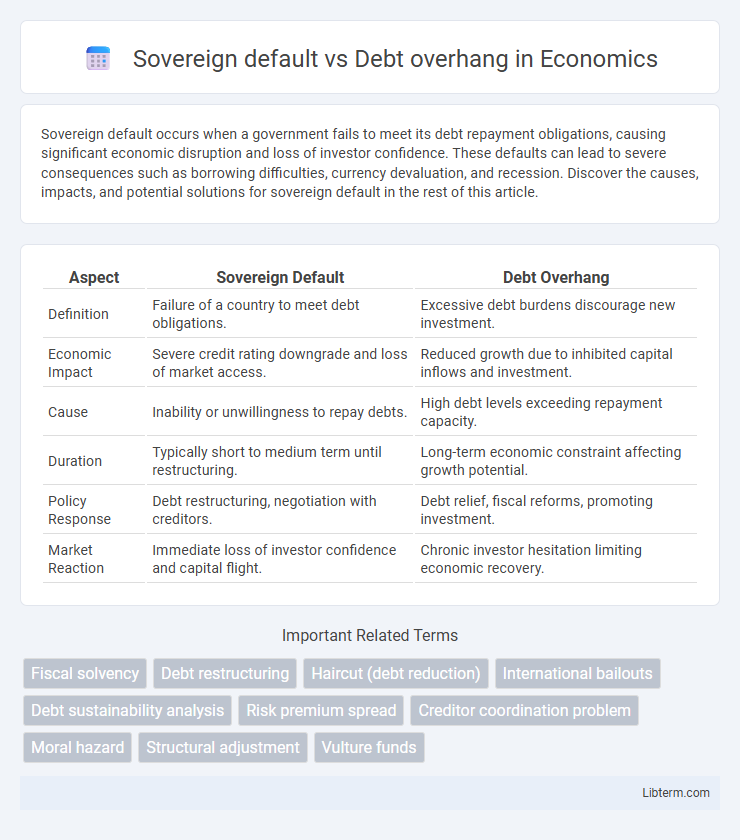

| Aspect | Sovereign Default | Debt Overhang |

|---|---|---|

| Definition | Failure of a country to meet debt obligations. | Excessive debt burdens discourage new investment. |

| Economic Impact | Severe credit rating downgrade and loss of market access. | Reduced growth due to inhibited capital inflows and investment. |

| Cause | Inability or unwillingness to repay debts. | High debt levels exceeding repayment capacity. |

| Duration | Typically short to medium term until restructuring. | Long-term economic constraint affecting growth potential. |

| Policy Response | Debt restructuring, negotiation with creditors. | Debt relief, fiscal reforms, promoting investment. |

| Market Reaction | Immediate loss of investor confidence and capital flight. | Chronic investor hesitation limiting economic recovery. |

Understanding Sovereign Default

Sovereign default occurs when a country fails to meet its debt obligations, leading to a loss of creditor trust and limited access to international capital markets. Understanding sovereign default involves analyzing factors such as fiscal imbalances, political instability, and external shocks that weaken debt sustainability. Differentiating sovereign default from debt overhang is crucial, as debt overhang describes a situation where excessive debt discourages new investment, but the country has not necessarily missed payments.

Defining Debt Overhang

Debt overhang occurs when a country's existing debt is so large that it discourages new investment due to expected future tax burdens or reduced returns on capital. Unlike sovereign default, where a country outright fails to meet debt obligations, debt overhang represents a situation where heavy debt inhibits economic growth and the ability to finance new projects. The phenomenon leads to underinvestment despite potential positive returns, as future earnings would primarily go toward servicing past debts.

Causes of Sovereign Defaults

Sovereign defaults often result from a combination of economic mismanagement, political instability, and external shocks such as commodity price collapses or sudden stops in capital flows. Debt overhang aggravates the risk by burdening a country with unsustainable debt levels, which discourages new investment and weakens fiscal capacity. Structural factors like weak institutions and poor governance also play critical roles in triggering sovereign default episodes.

Key Drivers of Debt Overhang

Debt overhang arises when a country's existing debt burden discourages new investment due to uncertainty about debt restructuring or repayment capacity. Key drivers include high debt-to-GDP ratios that limit fiscal space, weak economic growth reducing government revenues, and investor concerns about sovereign credit risk leading to increased borrowing costs. Sovereign default differs as it represents an outright failure to meet debt obligations, often triggered by unsustainable debt levels and fiscal imbalances.

Economic Impacts of Sovereign Default

Sovereign default triggers severe economic impacts including loss of investor confidence, capital flight, and reduced access to international credit markets, often resulting in deep recessions and prolonged periods of low growth. Debt overhang exacerbates these issues by discouraging new investment due to the anticipation that future earnings will primarily service existing debt rather than foster economic expansion. The combination of sovereign default and debt overhang undermines fiscal stability, increases borrowing costs, and hampers long-term development prospects for affected countries.

Consequences of Debt Overhang on Growth

Debt overhang occurs when a country's existing debt is so large that it discourages new investment, as potential returns primarily go to existing creditors, thereby stalling economic growth. This prolonged underinvestment reduces capital accumulation, lowers productivity, and hampers innovation, ultimately constraining the country's GDP expansion. In contrast to a sovereign default, which may reset debt burdens through restructuring, debt overhang perpetuates financial distress and slows recovery by undermining investor confidence and growth prospects.

Policy Responses to Sovereign Default

Policy responses to sovereign default typically involve debt restructuring, fiscal consolidation, and enhancing debt sustainability through multilateral negotiations and support from institutions like the IMF. Debt overhang complicates these responses by discouraging new investment and growth, requiring targeted measures such as easing debt burdens to restore creditworthiness and economic stability. Effective policy frameworks combine transparent communication, credibility restoration, and strategic economic reforms to break the debt spiral and promote recovery.

Strategies to Mitigate Debt Overhang

Strategies to mitigate debt overhang in sovereign defaults include restructuring existing debt to reduce burdensome repayment schedules and offering debt relief to restore fiscal sustainability. Implementing transparent fiscal policies and improving debt management frameworks attract investor confidence and prevent future over-indebtedness. Enhancing economic growth through targeted investments supports revenue generation needed to service residual debt effectively.

Comparative Analysis: Sovereign Default vs Debt Overhang

Sovereign default occurs when a country fails to meet its debt obligations, leading to loss of creditor confidence and restricted access to international capital markets. Debt overhang refers to a situation where excessive debt discourages new investment because the anticipated returns are largely claimed by existing creditors, stalling economic growth without immediate default. Comparing both, sovereign default represents a binary outcome with legal and financial consequences, while debt overhang is a prolonged condition causing chronic underinvestment and delayed economic recovery.

Lessons Learned and Future Outlook

Sovereign default often stems from an unsustainable debt overhang, where excessive debt burdens hinder economic growth and repayment capacity. Lessons learned emphasize the importance of transparent fiscal policies, early intervention, and restructuring frameworks to mitigate spillover effects and restore investor confidence. Future outlook suggests enhanced multilateral cooperation and innovative debt instruments to prevent defaults and promote sustainable debt management.

Sovereign default Infographic

libterm.com

libterm.com