Beta-delta discounting is a behavioral economics model that explains how people value immediate rewards more heavily than future ones, capturing time-inconsistent preferences. This approach modifies the standard exponential discounting by introducing a present-bias factor (beta) alongside the traditional discount rate (delta), providing a more accurate representation of real-world decision-making. Explore the rest of the article to understand how beta-delta discounting impacts your financial choices and long-term planning.

Table of Comparison

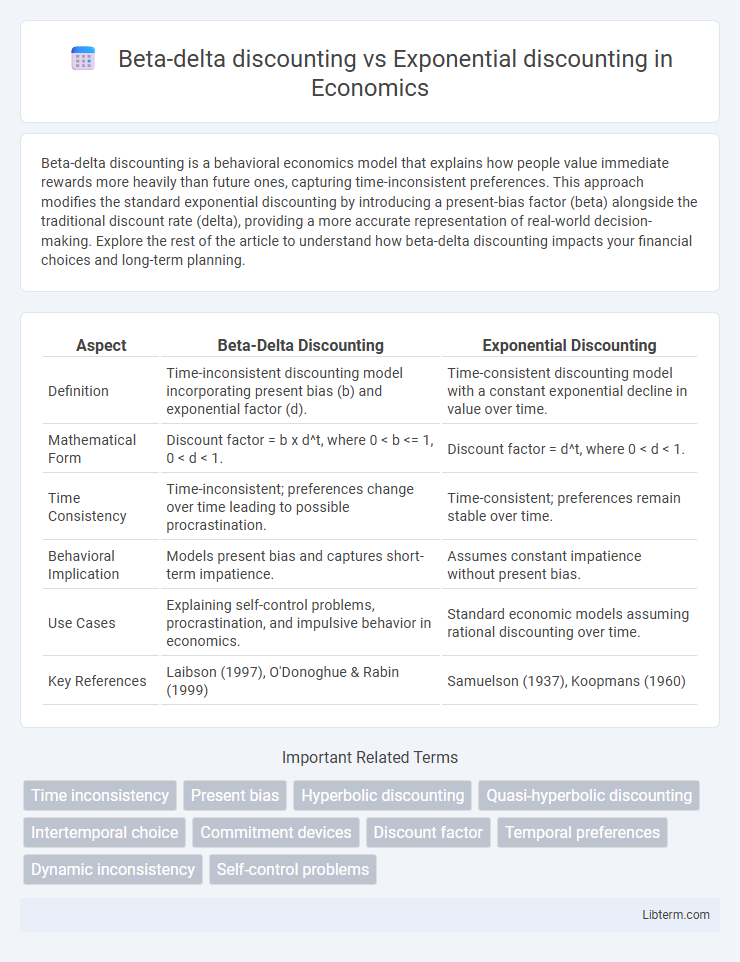

| Aspect | Beta-Delta Discounting | Exponential Discounting |

|---|---|---|

| Definition | Time-inconsistent discounting model incorporating present bias (b) and exponential factor (d). | Time-consistent discounting model with a constant exponential decline in value over time. |

| Mathematical Form | Discount factor = b x d^t, where 0 < b <= 1, 0 < d < 1. | Discount factor = d^t, where 0 < d < 1. |

| Time Consistency | Time-inconsistent; preferences change over time leading to possible procrastination. | Time-consistent; preferences remain stable over time. |

| Behavioral Implication | Models present bias and captures short-term impatience. | Assumes constant impatience without present bias. |

| Use Cases | Explaining self-control problems, procrastination, and impulsive behavior in economics. | Standard economic models assuming rational discounting over time. |

| Key References | Laibson (1997), O'Donoghue & Rabin (1999) | Samuelson (1937), Koopmans (1960) |

Introduction to Time Discounting Models

Time discounting models describe how individuals value rewards over time, with exponential discounting assuming a constant discount rate leading to time-consistent preferences. Beta-delta discounting introduces a present-bias factor, capturing the tendency to disproportionately prefer immediate rewards over future ones, resulting in time-inconsistent choices. These models are fundamental in behavioral economics for explaining decision-making behaviors related to savings, consumption, and self-control.

Understanding Exponential Discounting

Exponential discounting refers to the process of valuing future rewards or costs by applying a constant discount rate over time, resulting in a consistent and time-consistent preference pattern. This approach assumes rational decision-making where individuals evaluate the present value of future outcomes using an exponential decay function, typically expressed as V = A * e^(-rt), where V is the discounted value, A is the future amount, r is the discount rate, and t is time. Understanding exponential discounting is crucial for economic models of intertemporal choice, as it contrasts with beta-delta discounting by maintaining stable preferences and avoiding preference reversals over time.

The Beta-Delta Discounting Framework

The Beta-Delta discounting framework models time preferences by incorporating a present-bias parameter (beta) alongside a standard exponential discount factor (delta), capturing both immediate gratification and future valuation. Unlike exponential discounting, which assumes consistent time preferences, the beta-delta model accounts for preference reversals and short-term impatience by weighting immediate rewards more heavily. Empirical studies demonstrate that beta-delta discounting provides a more accurate representation of human intertemporal choice behavior, especially in contexts involving procrastination or self-control problems.

Key Differences Between Beta-Delta and Exponential Discounting

Beta-delta discounting incorporates a present-bias factor (beta) alongside the standard exponential discounting model, capturing individuals' tendency to disproportionately value immediate rewards over future ones. Exponential discounting applies a constant discount rate, reflecting time-consistent preferences and resulting in time-consistent decision-making. The key difference lies in beta-delta discounting's ability to model time-inconsistent behaviors and preference reversals, whereas exponential discounting assumes stable, time-consistent preferences.

Mathematical Formulations of Both Models

Beta-delta discounting models future utility as \( U_t = u_t + \beta \sum_{k=1}^\infty \delta^k u_{t+k} \), where \( \beta \in (0,1) \) captures present bias and \( \delta \in (0,1) \) is the standard exponential discount factor, reflecting consistent time preferences. Exponential discounting is expressed as \( U_t = \sum_{k=0}^\infty \delta^k u_{t+k} \), with a single constant \( \delta \) representing time-consistent discounting, implying no present bias. Beta-delta formulas introduce time-inconsistency by separating immediate vs. delayed utility valuations, while exponential discounting assumes stationary, geometric decay of future reward values.

Behavioral Insights From Beta-Delta Discounting

Beta-delta discounting captures present bias by combining a present-focused beta parameter with an exponential delta factor, reflecting how individuals disproportionately value immediate rewards over future gains. Behavioral insights reveal that this model better predicts time-inconsistent preferences and procrastination compared to pure exponential discounting, which assumes consistent temporal valuation. Studies show that beta-delta discounting aligns with observed human impulsivity, highlighting the gap between long-term planning and short-term decision-making in intertemporal choices.

Real-World Applications and Implications

Beta-delta discounting captures time-inconsistent preferences commonly seen in real-world decision-making, such as procrastination and preference reversals, making it more applicable for modeling consumer behavior and retirement savings than exponential discounting's constant rate assumption. Exponential discounting assumes consistent time preferences across periods, which often fails to predict actual human choices involving impatience and short-term bias observed in health interventions and environmental policy. Beta-delta models better inform policy design that accounts for present-biased preferences, improving outcomes in saving schemes, addiction treatment, and climate change mitigation strategies.

Limitations and Criticisms of Each Model

Beta-delta discounting often faces criticism for its assumption of a fixed present-bias parameter, which may oversimplify human decision-making and ignore context-dependent variations. Exponential discounting is limited by its constant discount rate, leading to time-consistent preferences that fail to capture observed behaviors like hyperbolic discounting and preference reversals. Both models struggle to accurately predict intertemporal choices in real-world scenarios, highlighting the need for more flexible frameworks that incorporate cognitive and psychological factors.

Empirical Evidence and Case Studies

Empirical evidence highlights that beta-delta discounting better captures observed human preferences for present bias, as demonstrated in studies on intertemporal choice tasks where participants disproportionately favor immediate rewards over delayed ones compared to exponential discounting models. Case studies in behavioral economics reveal that beta-delta discounting accurately models decision-making in retirement savings and health behavior, showing time-inconsistent preferences not accounted for by exponential discounting's constant discount rate. Neuroeconomic research and field experiments further support beta-delta discounting, identifying distinct neural correlates linked to immediate versus delayed reward valuation absent in exponential discounting frameworks.

Conclusion: Choosing the Right Discounting Model

Choosing the right discounting model depends on the context of decision-making and time preferences. Beta-delta discounting captures present bias and is suitable for modeling short-term impatience followed by long-term consistency, making it ideal for behavioral economics and policy design. Exponential discounting, with its constant discount rate, suits situations requiring time-consistent valuation, such as financial modeling and traditional economic analysis.

Beta-delta discounting Infographic

libterm.com

libterm.com