Crowding out occurs when increased government spending leads to reduced private sector investment by raising interest rates or absorbing financial resources. This economic phenomenon can impact Your business growth and investment opportunities by limiting available capital. Discover how crowding out influences financial markets and strategies to mitigate its effects in the rest of this article.

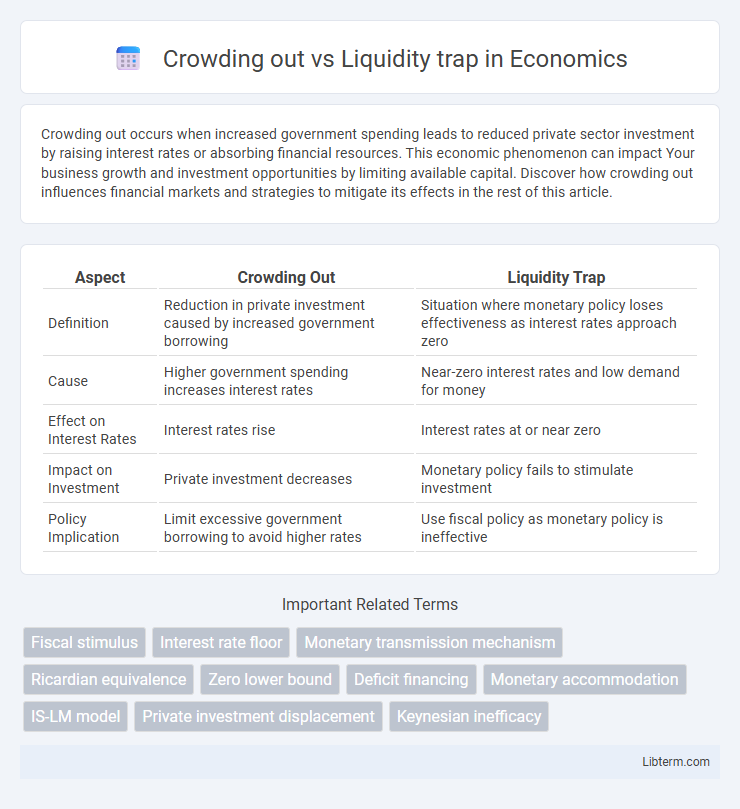

Table of Comparison

| Aspect | Crowding Out | Liquidity Trap |

|---|---|---|

| Definition | Reduction in private investment caused by increased government borrowing | Situation where monetary policy loses effectiveness as interest rates approach zero |

| Cause | Higher government spending increases interest rates | Near-zero interest rates and low demand for money |

| Effect on Interest Rates | Interest rates rise | Interest rates at or near zero |

| Impact on Investment | Private investment decreases | Monetary policy fails to stimulate investment |

| Policy Implication | Limit excessive government borrowing to avoid higher rates | Use fiscal policy as monetary policy is ineffective |

Introduction to Crowding Out and Liquidity Trap

Crowding out occurs when increased government borrowing leads to higher interest rates, reducing private investment and hindering economic growth. A liquidity trap arises when interest rates are near zero, rendering monetary policy ineffective as people hoard cash instead of spending or investing. Both phenomena illustrate challenges in stimulating demand but differ in their mechanisms and policy implications.

Defining Crowding Out: Causes and Mechanisms

Crowding out occurs when increased government borrowing raises interest rates, reducing private investment by making credit more expensive. This mechanism stems from limited available funds in the financial markets, causing the public sector's demand for loans to compete with and displace private sector borrowing. Key causes include fiscal deficits financed through bond issuance, leading to upward pressure on interest rates and constraining capital allocation to businesses.

Understanding Liquidity Trap: Key Features

A liquidity trap occurs when interest rates are near zero, rendering monetary policy ineffective because people prefer holding cash over investing. Key features include an abundance of liquidity, a flattening demand curve for bonds, and stagnant economic growth despite increased money supply. This contrasts with crowding out, where rising government borrowing drives up interest rates, reducing private investment.

Fiscal Policy Effects: Crowding Out Explained

Fiscal policy can lead to crowding out when government borrowing drives up interest rates, reducing private investment by making credit more expensive. This phenomenon occurs because increased demand for funds by the government competes with the private sector, limiting available capital for businesses. In contrast, during a liquidity trap, interest rates are near zero, and government spending does not raise rates, so crowding out effects are minimal or nonexistent.

Monetary Policy Challenges in a Liquidity Trap

Monetary policy faces significant challenges in a liquidity trap, where interest rates approach zero and conventional tools lose effectiveness in stimulating economic demand. Unlike crowding out, where increased government borrowing raises interest rates and reduces private investment, a liquidity trap renders monetary expansion ineffective as individuals hoard cash instead of spending or investing. Central banks must therefore explore unconventional measures like quantitative easing or negative interest rates to overcome the paralysis of traditional policy instruments.

Economic Conditions Favoring Crowding Out

Economic conditions favoring crowding out include a robust economy with full employment and rising interest rates, where government borrowing increases demand for loanable funds and drives up interest rates. This rise in interest rates makes private investment more expensive, leading to reduced private sector spending. Crowding out is less likely during periods of economic slack or low interest rates, where liquidity traps or stagnant demand dominate.

Situations Leading to a Liquidity Trap

A liquidity trap occurs when interest rates are near zero and savings rates are high, causing monetary policy to become ineffective as individuals prefer holding cash over bonds. Crowding out happens when increased government borrowing drives up interest rates, reducing private investment, whereas in a liquidity trap, low interest rates fail to stimulate additional demand. Situations leading to a liquidity trap include deflationary expectations, economic recessions, and a lack of confidence in future economic growth, which together halt the transmission of monetary policy to real economic activity.

Comparative Analysis: Crowding Out vs Liquidity Trap

Crowding out occurs when increased government borrowing leads to higher interest rates, reducing private investment and dampening economic growth, whereas a liquidity trap arises when interest rates are near zero, and monetary policy becomes ineffective as individuals hoard cash instead of spending or investing. In a crowding out scenario, fiscal expansion directly competes with private sector demand for funds, increasing borrowing costs, while in a liquidity trap, conventional monetary tools fail to stimulate the economy despite low borrowing costs. Understanding these distinctions is essential for policymakers to tailor fiscal and monetary interventions effectively during periods of constrained economic activity.

Policy Implications and Solutions

Crowding out occurs when increased government spending leads to higher interest rates, reducing private investment, necessitating policies that balance fiscal stimulus with monetary accommodation to avoid dampening economic growth. In contrast, a liquidity trap features near-zero interest rates where monetary policy loses effectiveness, requiring unconventional measures like quantitative easing and targeted fiscal interventions to stimulate demand. Policymakers must tailor solutions by assessing the economic context: tightening fiscal discipline to prevent crowding out or enhancing fiscal expansion to escape liquidity traps.

Conclusion: Navigating Economic Pitfalls

Understanding crowding out and liquidity traps is crucial for effective economic policy design. Crowding out reduces private investment when government borrowing drives up interest rates, while liquidity traps render monetary policy ineffective due to near-zero interest rates and high liquidity preference. Policymakers must balance fiscal stimulus with monetary tools to avoid exacerbating economic stagnation and ensure sustained growth.

Crowding out Infographic

libterm.com

libterm.com