Yield to Maturity (YTM) represents the total return an investor can expect to earn if a bond is held until it matures, accounting for all coupon payments and the difference between the purchase price and face value. Understanding YTM helps you evaluate the true earning potential of bonds compared to other investments. Explore the full article to discover how YTM impacts your fixed-income investment strategies.

Table of Comparison

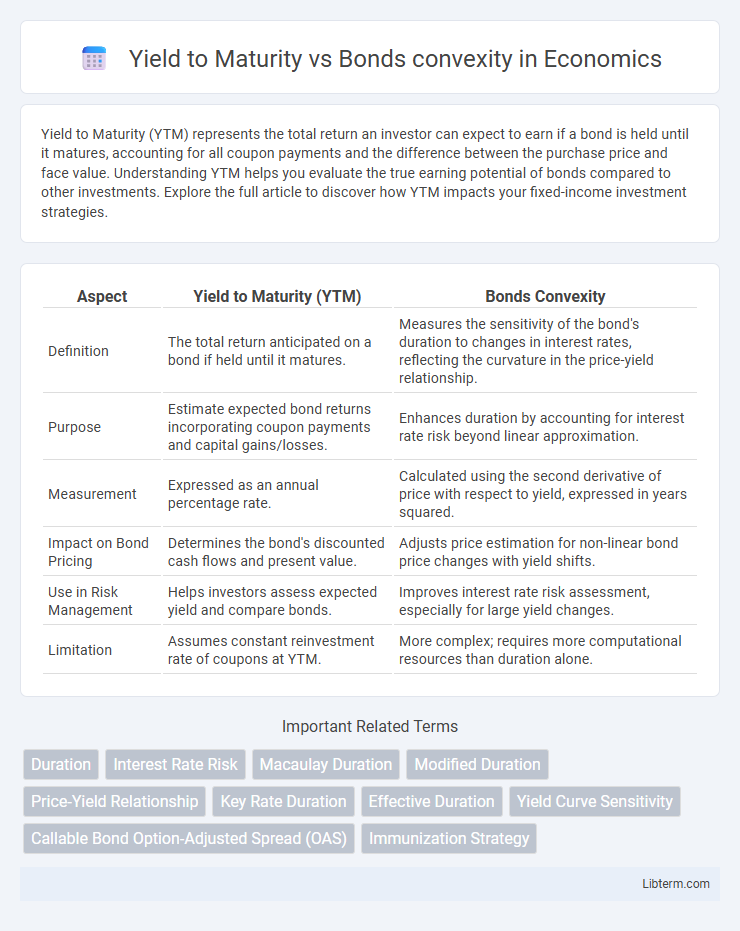

| Aspect | Yield to Maturity (YTM) | Bonds Convexity |

|---|---|---|

| Definition | The total return anticipated on a bond if held until it matures. | Measures the sensitivity of the bond's duration to changes in interest rates, reflecting the curvature in the price-yield relationship. |

| Purpose | Estimate expected bond returns incorporating coupon payments and capital gains/losses. | Enhances duration by accounting for interest rate risk beyond linear approximation. |

| Measurement | Expressed as an annual percentage rate. | Calculated using the second derivative of price with respect to yield, expressed in years squared. |

| Impact on Bond Pricing | Determines the bond's discounted cash flows and present value. | Adjusts price estimation for non-linear bond price changes with yield shifts. |

| Use in Risk Management | Helps investors assess expected yield and compare bonds. | Improves interest rate risk assessment, especially for large yield changes. |

| Limitation | Assumes constant reinvestment rate of coupons at YTM. | More complex; requires more computational resources than duration alone. |

Understanding Yield to Maturity (YTM)

Yield to Maturity (YTM) is the total return anticipated on a bond if held until it matures, reflecting the discount rate that equates the bond's current price with the present value of its future cash flows. YTM provides a comprehensive measure incorporating coupon payments, capital gains or losses, and the time value of money, making it crucial for comparing bonds with different maturities and coupon rates. Understanding YTM is essential for assessing bond investment performance, as it connects directly to bond price sensitivity and convexity, which measures the curvature of the price-yield relationship and the bond's risk exposure to interest rate changes.

What Is Bond Convexity?

Bond convexity measures the curvature in the relationship between bond prices and yields, capturing how the duration of a bond changes as interest rates fluctuate. It provides a more accurate estimate of bond price sensitivity compared to yield to maturity, especially for large interest rate movements. Investors use convexity to assess interest rate risk and to enhance portfolio immunization strategies beyond simple duration metrics.

Key Differences Between YTM and Convexity

Yield to Maturity (YTM) measures the average annual return an investor can expect if a bond is held until maturity, reflecting its current price, coupon payments, and time to maturity. Convexity quantifies the curvature in the bond price-yield relationship, capturing how the bond's duration changes as yields fluctuate, thus providing a more accurate measure of interest rate risk. Key differences include YTM being a linear estimate of return, while convexity accounts for the nonlinear price sensitivity to yield changes, making it essential for assessing price volatility beyond duration.

How YTM Affects Bond Pricing

Yield to Maturity (YTM) directly influences bond pricing by discounting future cash flows, including coupon payments and the principal, at the YTM rate to determine the present value. When YTM rises, bond prices fall due to an increased discount rate, while a decrease in YTM results in higher bond prices since future payments are discounted less. Bonds convexity measures the curvature in the price-yield relationship, providing a more accurate estimate of price changes for large shifts in YTM, beyond the linear approximation given by duration.

The Role of Convexity in Bond Valuation

Convexity plays a critical role in bond valuation by measuring the curvature in the relationship between bond prices and yields, enhancing accuracy beyond the linear approximation provided by yield to maturity (YTM). While YTM assumes a constant rate of change, convexity accounts for the rate at which duration changes as yields fluctuate, helping investors more precisely estimate bond price sensitivity to interest rate movements. Incorporating convexity alongside YTM enables more effective risk management and valuation of bonds, especially in volatile or changing interest rate environments.

Yield to Maturity vs Convexity: Risk Implications

Yield to Maturity (YTM) measures the annualized return of a bond if held to maturity, while convexity assesses the curvature in the price-yield relationship, indicating sensitivity to interest rate changes. High YTM bonds typically carry greater credit and reinvestment risks, whereas higher convexity bonds exhibit less price volatility when yields fluctuate, reducing interest rate risk. Investors use convexity to manage risk exposure beyond duration, especially in volatile rate environments, making it a crucial factor alongside YTM in fixed income portfolio management.

Practical Applications of YTM and Convexity

Yield to Maturity (YTM) serves as a critical measure for investors to estimate the total return of a bond if held until maturity, making it essential for pricing and comparing fixed-income securities. Bonds convexity captures the curvature in the price-yield relationship, allowing investors and portfolio managers to assess interest rate risk more accurately and enhance bond portfolio immunization strategies. Utilizing YTM in combination with convexity enables more precise risk management and pricing models in volatile interest rate environments.

Limitations of Using YTM Alone

Yield to Maturity (YTM) provides a single discount rate that equates a bond's current price with the present value of its cash flows but fails to capture price sensitivity to interest rate changes, which bond convexity measures. Relying solely on YTM ignores the curvature of the bond's price-yield relationship, leading to inaccurate estimations of price risk and potential mispricing in volatile interest rate environments. Incorporating bond convexity alongside YTM enhances risk assessment by accounting for the nonlinear relationship between bond prices and yield fluctuations.

Why Convexity Matters for Investors

Yield to maturity (YTM) measures a bond's total expected return if held until maturity, while convexity evaluates how the bond's duration changes with interest rate fluctuations, capturing curvature in price-yield relationship. Investors prioritize convexity because it provides a more accurate assessment of interest rate risk, improving portfolio immunization against rate volatility and enhancing price prediction beyond duration alone. High convexity benefits investors by offering greater price appreciation for rate declines and smaller price declines for rate increases, thus reducing potential losses in volatile markets.

Making Informed Bond Investment Decisions

Yield to Maturity (YTM) measures the total return an investor can expect if a bond is held until maturity, while bond convexity assesses the sensitivity of a bond's duration to interest rate changes, providing a more accurate estimate of price volatility. Understanding both YTM and bond convexity is critical for making informed bond investment decisions, as it helps investors evaluate potential risks and returns more precisely. Incorporating convexity into investment analysis improves portfolio management by mitigating interest rate risk and optimizing bond selection strategies.

Yield to Maturity Infographic

libterm.com

libterm.com