The Permanent Income Hypothesis explains consumer behavior by suggesting that individuals base their spending on expected long-term average income rather than current earnings. This theory highlights the importance of income stability in influencing consumption patterns over time. Discover how this concept can reshape your understanding of financial decision-making in the rest of the article.

Table of Comparison

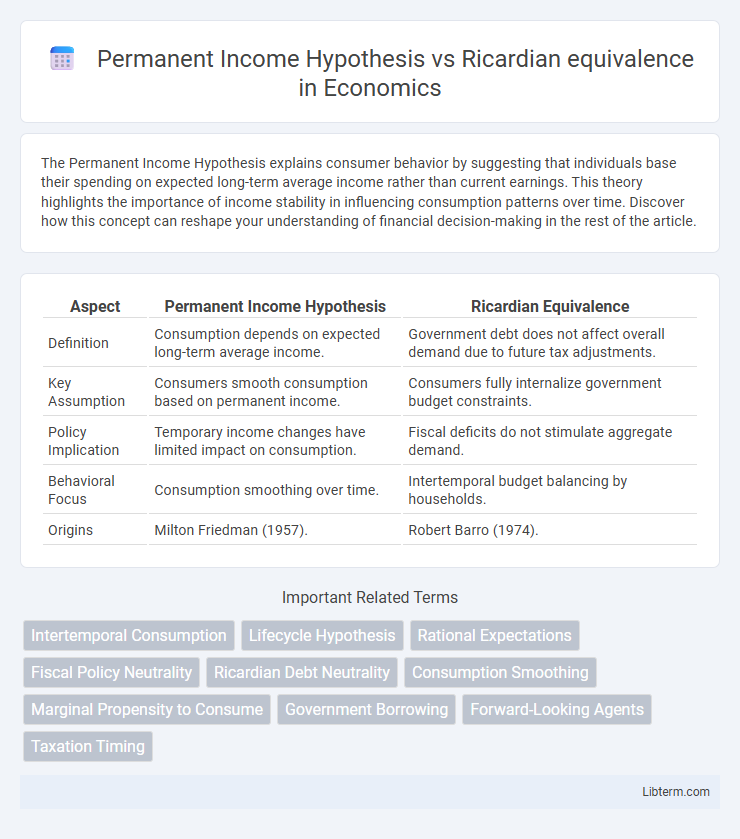

| Aspect | Permanent Income Hypothesis | Ricardian Equivalence |

|---|---|---|

| Definition | Consumption depends on expected long-term average income. | Government debt does not affect overall demand due to future tax adjustments. |

| Key Assumption | Consumers smooth consumption based on permanent income. | Consumers fully internalize government budget constraints. |

| Policy Implication | Temporary income changes have limited impact on consumption. | Fiscal deficits do not stimulate aggregate demand. |

| Behavioral Focus | Consumption smoothing over time. | Intertemporal budget balancing by households. |

| Origins | Milton Friedman (1957). | Robert Barro (1974). |

Introduction to Consumption Theories

The Permanent Income Hypothesis posits that consumers base their consumption decisions on expected long-term average income rather than current income fluctuations, smoothing consumption over time to maintain stable living standards. Ricardian Equivalence asserts that government deficits do not affect overall demand since households anticipate future tax liabilities and adjust their savings accordingly, neutralizing fiscal stimulus effects. Both theories emphasize forward-looking behavior in consumption choices but differ in their assumptions about government influence and intergenerational transfer effects.

Overview of the Permanent Income Hypothesis

The Permanent Income Hypothesis (PIH) posits that individuals base consumption decisions on expected long-term average income rather than current income fluctuations, smoothing consumption over time to maintain stability. Developed by Milton Friedman, PIH emphasizes that transitory income changes have minimal impact on consumption patterns, as consumers save or borrow to offset short-term variations. This model contrasts with Ricardian equivalence by focusing on income expectations instead of government debt neutrality in influencing consumption behavior.

Fundamentals of Ricardian Equivalence

Ricardian Equivalence posits that consumers internalize government budget constraints, anticipating that government borrowing today implies higher future taxes, which leads them to save rather than spend current fiscal stimulus, aligning their consumption with lifetime income rather than current income. This hypothesis contrasts with the Permanent Income Hypothesis, which emphasizes consumption smoothing based on expected average lifetime income without necessarily accounting for government debt implications. The fundamental assumption of Ricardian Equivalence relies on perfect capital markets, intergenerational altruism, and rational expectations, ensuring that fiscal deficits do not affect aggregate demand.

Key Assumptions and Mechanisms

The Permanent Income Hypothesis (PIH) assumes consumers smooth consumption based on expected lifetime income, relying on forward-looking behavior and perfect capital markets to separate permanent from transitory income shocks. Ricardian Equivalence posits that consumers anticipate future taxation due to government debt, leading to full internalization of government budget constraints and unchanged consumption despite fiscal deficits. Both models hinge on rational expectations and intertemporal optimization but differ fundamentally in assumptions about liquidity constraints and the equivalence of government debt and future taxes.

Differences in Theoretical Foundations

The Permanent Income Hypothesis (PIH), developed by Milton Friedman, is based on the idea that consumers plan their consumption according to expected long-term average income rather than current income, emphasizing smoothing consumption over time. In contrast, Ricardian equivalence, rooted in Ricardian fiscal theory, posits that consumers anticipate future taxes resulting from government debt, leading to unchanged consumption despite government borrowing. The key theoretical difference lies in PIH focusing on income expectations for consumption decisions, while Ricardian equivalence centers on intergenerational budget constraints and the neutrality of government fiscal policy on aggregate demand.

Impacts on Fiscal Policy and Government Debt

The Permanent Income Hypothesis suggests that consumers adjust their spending based on expected lifetime income rather than current fiscal policy changes, which may reduce the effectiveness of temporary government debt-financed stimulus. In contrast, Ricardian equivalence argues that rational consumers anticipate future tax liabilities from government borrowing, leading them to save rather than spend fiscal transfers, neutralizing fiscal policy impacts. Both theories imply limited short-term demand stimulation from increased government debt, challenging policymakers to design fiscal interventions that directly alter perceived permanent income or transfer burdens.

Empirical Evidence and Real-World Applications

Empirical evidence on the Permanent Income Hypothesis (PIH) generally supports the idea that consumers smooth consumption based on expected long-term income rather than current income fluctuations, as seen in studies using panel data from developed economies. In contrast, Ricardian equivalence, which posits that government borrowing does not affect aggregate demand because consumers anticipate future taxes, finds mixed empirical support due to liquidity constraints and imperfect information in real-world applications. Policymakers often rely on PIH insights for designing fiscal stimulus programs, while Ricardian equivalence informs debates on debt sustainability and the effectiveness of deficit spending.

Criticisms and Limitations of Both Theories

The Permanent Income Hypothesis faces criticism for its assumption of rational expectations and perfect capital markets, often ignoring liquidity constraints and behavioral factors affecting consumption. Ricardian equivalence is limited by its strong assumptions that consumers internalize government budget constraints fully and have infinite horizons, which empirical studies have frequently contradicted. Both theories struggle to account for short-term consumption fluctuations and heterogeneous agent behavior in real-world economies.

Policy Implications for Modern Economies

The Permanent Income Hypothesis emphasizes that consumers base spending on expected long-term income rather than current income, suggesting that temporary fiscal stimulus may have limited effects on aggregate demand. Ricardian equivalence asserts that government borrowing does not affect overall consumption because individuals anticipate future taxes to repay debt and thus save accordingly. Policymakers in modern economies must consider these theories when designing fiscal policy, as temporary deficits may not boost spending if consumers follow these forward-looking behaviors, potentially reducing the effectiveness of stimulative measures.

Conclusion: Comparing Economic Insights

The Permanent Income Hypothesis emphasizes that consumers base spending on expected lifetime income, smoothing consumption despite short-term income fluctuations, while Ricardian equivalence suggests that government debt does not affect aggregate demand since individuals anticipate future taxes and adjust their savings accordingly. Comparing these theories highlights differing views on fiscal policy effectiveness: Permanent Income Hypothesis implies fiscal stimulus can influence consumption, whereas Ricardian equivalence predicts neutral effects due to forward-looking households. Both frameworks provide crucial insights into understanding consumption patterns and the limitations of government intervention in stabilizing the economy.

Permanent Income Hypothesis Infographic

libterm.com

libterm.com