Stress testing evaluates the resilience and performance of systems or financial institutions under extreme conditions to identify vulnerabilities. This process helps ensure stability and prepares organizations for unexpected challenges. Discover how stress testing can safeguard your operations by reading the rest of the article.

Table of Comparison

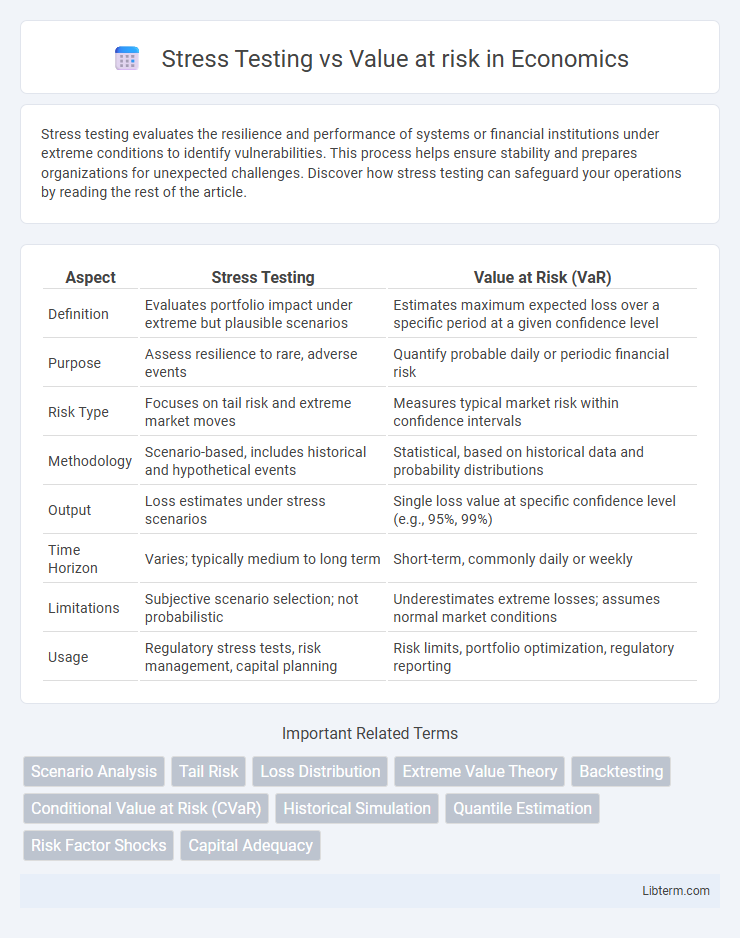

| Aspect | Stress Testing | Value at Risk (VaR) |

|---|---|---|

| Definition | Evaluates portfolio impact under extreme but plausible scenarios | Estimates maximum expected loss over a specific period at a given confidence level |

| Purpose | Assess resilience to rare, adverse events | Quantify probable daily or periodic financial risk |

| Risk Type | Focuses on tail risk and extreme market moves | Measures typical market risk within confidence intervals |

| Methodology | Scenario-based, includes historical and hypothetical events | Statistical, based on historical data and probability distributions |

| Output | Loss estimates under stress scenarios | Single loss value at specific confidence level (e.g., 95%, 99%) |

| Time Horizon | Varies; typically medium to long term | Short-term, commonly daily or weekly |

| Limitations | Subjective scenario selection; not probabilistic | Underestimates extreme losses; assumes normal market conditions |

| Usage | Regulatory stress tests, risk management, capital planning | Risk limits, portfolio optimization, regulatory reporting |

Introduction to Risk Management Techniques

Stress testing evaluates potential losses under extreme market conditions by simulating adverse scenarios, while Value at Risk (VaR) quantifies the maximum expected loss over a specific time frame at a given confidence level. Both techniques are essential components of risk management frameworks, offering complementary insights into portfolio vulnerabilities. Effective risk management integrates stress testing's scenario analysis with VaR's probabilistic loss estimation to enhance decision-making and capital allocation.

Understanding Stress Testing

Stress testing evaluates financial portfolios under extreme market conditions beyond normal expectations to gauge potential vulnerabilities. This method simulates scenarios like severe economic downturns, market crashes, or geopolitical events to measure the resilience of assets and risk exposure. Stress testing provides a broader perspective of risk by capturing tail events that traditional Value at Risk (VaR) models may underestimate or overlook.

What is Value at Risk (VaR)?

Value at Risk (VaR) quantifies the maximum potential loss in a portfolio over a specified period at a given confidence level, such as 95% or 99%. It uses historical market data and statistical models to estimate the probability of extreme losses under normal market conditions. VaR is widely employed in risk management to assess market risk exposure and inform capital allocation decisions.

Key Differences Between Stress Testing and VaR

Stress Testing evaluates the impact of extreme but plausible adverse scenarios on a portfolio's value, focusing on tail risks and potential financial shocks. Value at Risk (VaR) quantifies the maximum expected loss over a specific time horizon at a given confidence level under normal market conditions. Unlike VaR's probabilistic loss estimate, Stress Testing provides insights into vulnerabilities during rare, high-impact events, making it crucial for assessing risk beyond standard market fluctuations.

Objectives of Stress Testing in Finance

Stress testing in finance aims to evaluate the resilience of financial institutions and portfolios under extreme but plausible adverse conditions, identifying vulnerabilities that may not be captured by Value at Risk (VaR) models. Unlike VaR, which quantifies potential losses within normal market fluctuations, stress testing focuses on scenarios involving sharp market downturns, liquidity crises, or economic shocks to ensure effective risk management and regulatory compliance. Its objective is to enhance preparedness by assessing the impact of tail risks and extreme events on capital adequacy and overall financial stability.

The Role of Value at Risk in Portfolio Management

Value at Risk (VaR) serves as a crucial metric in portfolio management by quantifying the potential maximum loss within a specific confidence level and time horizon, enabling risk managers to allocate capital more effectively. Unlike stress testing, which examines portfolio performance under extreme hypothetical scenarios, VaR provides a statistically derived threshold for expected losses under normal market conditions. Integrating VaR into risk assessment frameworks helps identify risk exposure, optimize asset allocation, and ensure compliance with regulatory capital requirements.

Limitations of Stress Testing and VaR

Stress testing often suffers from limitations such as reliance on hypothetical scenarios that may not capture extreme market events accurately and the challenge of selecting appropriate stress conditions. Value at Risk (VaR) is limited by its assumption of normal market conditions and inability to predict losses beyond a certain confidence level, making it less effective during periods of high volatility or market crashes. Both methods can underestimate risk due to their dependence on historical data and model assumptions, potentially leading to inadequate risk management decisions.

Practical Applications: When to Use Each Method

Stress testing is ideal for evaluating the impact of extreme market events or economic shocks on portfolios, helping financial institutions prepare for rare but severe risks. Value at Risk (VaR) suits daily risk management by quantifying potential losses within a specified confidence level under normal market conditions. Practical application involves using VaR for routine monitoring and stress testing for scenario analysis during periods of heightened market uncertainty or regulatory requirements.

Regulatory Perspectives on Stress Testing vs VaR

Regulatory perspectives emphasize stress testing as a crucial tool for assessing risk under extreme but plausible scenarios, complementing the Value at Risk (VaR) framework that estimates potential losses within a normal market environment. Financial regulators, including the Basel Committee, mandate stress testing to identify vulnerabilities overlooked by VaR's reliance on historical data and assumptions of market normality. Stress testing enhances risk management by providing forward-looking insights that guide capital adequacy requirements beyond the VaR's quantitative loss thresholds.

Best Practices for Effective Risk Assessment

Effective risk assessment combines stress testing and Value at Risk (VaR) for comprehensive financial analysis. Stress testing evaluates portfolio resilience under extreme scenarios beyond historical market behaviors, while VaR estimates potential losses within a defined confidence level over a short time horizon. Implementing scenario-based stress tests alongside VaR models enhances risk management accuracy by capturing tail risks and systemic shocks often missed by VaR alone.

Stress Testing Infographic

libterm.com

libterm.com