Keynesian economics emphasizes the role of government intervention in stabilizing the economy through fiscal and monetary policies, particularly during periods of recession or low demand. It advocates for increased public spending and lower taxes to stimulate economic growth and reduce unemployment. Explore the rest of the article to understand how Keynesian principles can impact your financial decisions and economic outlook.

Table of Comparison

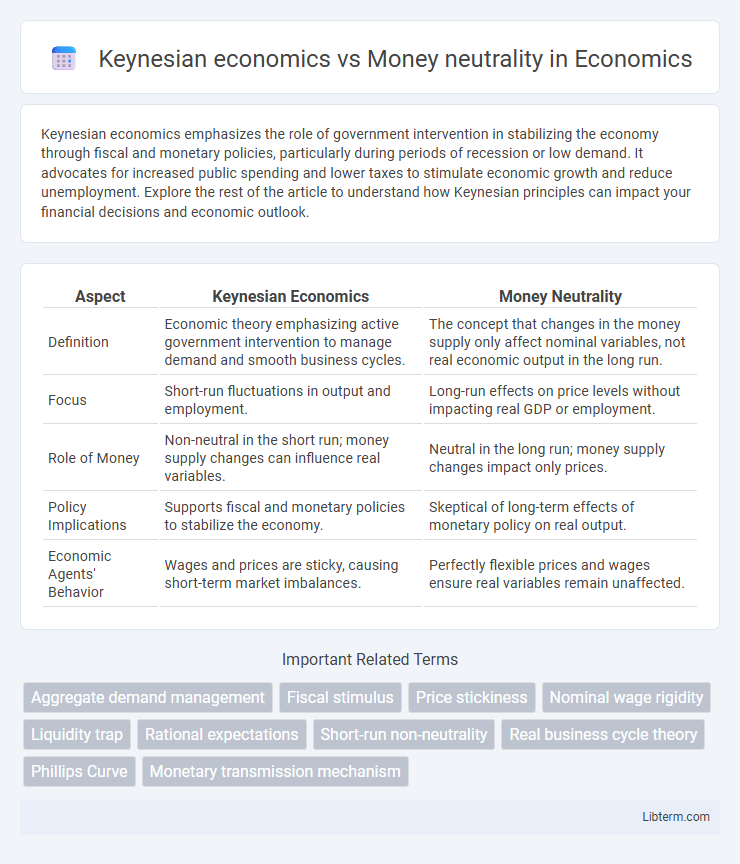

| Aspect | Keynesian Economics | Money Neutrality |

|---|---|---|

| Definition | Economic theory emphasizing active government intervention to manage demand and smooth business cycles. | The concept that changes in the money supply only affect nominal variables, not real economic output in the long run. |

| Focus | Short-run fluctuations in output and employment. | Long-run effects on price levels without impacting real GDP or employment. |

| Role of Money | Non-neutral in the short run; money supply changes can influence real variables. | Neutral in the long run; money supply changes impact only prices. |

| Policy Implications | Supports fiscal and monetary policies to stabilize the economy. | Skeptical of long-term effects of monetary policy on real output. |

| Economic Agents' Behavior | Wages and prices are sticky, causing short-term market imbalances. | Perfectly flexible prices and wages ensure real variables remain unaffected. |

Introduction to Keynesian Economics and Money Neutrality

Keynesian economics emphasizes the role of aggregate demand in influencing economic output and employment, challenging the classical notion that markets always clear. It argues that changes in the money supply can have real effects on output and employment, especially in the short run. In contrast, the concept of money neutrality asserts that variations in the money supply only affect nominal variables, such as prices, without impacting real economic indicators like output or employment in the long run.

Historical Context of Keynesian Thought

Keynesian economics emerged during the Great Depression as a response to classical theories that assumed money neutrality, which posits that changes in the money supply affect only nominal variables without influencing real economic output. John Maynard Keynes challenged this by arguing that monetary policy and government intervention could impact employment and production, especially in the short run when markets fail to clear. This historical context highlights the shift from classical neutrality assumptions to recognizing money's active role in addressing economic downturns.

Defining the Principle of Money Neutrality

Money neutrality asserts that changes in the money supply only impact nominal variables such as prices and wages without affecting real economic output or employment levels. In contrast, Keynesian economics argues that money supply fluctuations can influence real variables in the short run due to price stickiness and demand-driven factors. The principle of money neutrality is central to classical economic theories but faces criticism from Keynesian models emphasizing monetary policy's role in managing economic cycles.

Core Assumptions of Keynesian Economics

Keynesian economics assumes prices and wages are sticky, preventing markets from clearing immediately and causing short-run economic fluctuations. It emphasizes aggregate demand as the primary driver of economic output and employment, challenging the notion of money neutrality in the short term. This framework also assumes that government intervention can stabilize the economy by influencing demand through fiscal and monetary policies.

Short-run vs. Long-run Perspectives

Keynesian economics emphasizes the short-run non-neutrality of money, arguing that changes in the money supply can influence real output and employment due to price and wage rigidities. In contrast, the concept of money neutrality holds primarily in the long run, where monetary changes affect only nominal variables, leaving real economic factors unchanged. The divergence highlights Keynesian focus on short-run demand management, while classical theory prioritizes long-run real equilibrium.

The Role of Aggregate Demand

Keynesian economics emphasizes aggregate demand as the primary driver of economic output and employment, arguing that changes in demand can have real effects on the economy, especially in the short run. In contrast, the concept of money neutrality, rooted in classical economics, posits that changes in the money supply only affect nominal variables and have no long-term impact on real aggregate demand or output. Empirical evidence supports Keynesian views during periods of economic slack, where boosting aggregate demand through fiscal or monetary policy can reduce unemployment and stimulate growth.

Policy Implications: Government Intervention vs. Market Adjustment

Keynesian economics advocates for active government intervention through fiscal policies to stabilize economic fluctuations and boost aggregate demand during recessions, emphasizing short-term stimulus measures. In contrast, the concept of money neutrality suggests that changes in the money supply only affect nominal variables without influencing real economic output, promoting reliance on market adjustments and minimal policy interference. Policymakers influenced by Keynesian theory prioritize government spending and monetary easing to counteract economic downturns, whereas proponents of money neutrality argue for limiting intervention to allow price and wage flexibility to restore equilibrium.

Critiques and Limitations of Money Neutrality

Keynesian economics critiques money neutrality by emphasizing that changes in the money supply can affect real output and employment, especially in the short run, due to price and wage rigidities and imperfect information. Money neutrality assumes that monetary policy only impacts nominal variables without real economic consequences, which Keynesians argue overlooks demand-driven fluctuations and market frictions. Empirical evidence highlighting prolonged periods of unemployment and output gaps challenges the neutrality assumption, suggesting monetary interventions can stabilize economies during recessions.

Empirical Evidence and Real-world Applications

Empirical evidence shows Keynesian economics effectively explains short-term economic fluctuations through fiscal stimulus and government intervention, particularly during recessions, as seen in post-2008 recovery policies promoting employment and demand. In contrast, money neutrality, which posits that changes in the money supply only affect nominal variables in the long run, aligns with observed long-term trends where inflation adjusts without altering real output or employment. Real-world applications favor Keynesian tools for stabilizing economies in crisis, while monetary policy guided by money neutrality informs inflation targeting and long-term price stability frameworks.

Conclusion: Synthesizing Keynesianism and Money Neutrality

Keynesian economics emphasizes active fiscal and monetary policies to manage demand and stabilize output, while the concept of money neutrality suggests that changes in the money supply only affect nominal variables in the long run without impacting real economic factors. Synthesizing these views reveals that money may influence real output and employment in the short run due to price and wage rigidities, aligning with Keynesian insights, but tends to be neutral in the long run as classical theories predict. Understanding the temporal distinction between short-term non-neutrality and long-term neutrality enables more effective economic policy design that balances stabilization efforts with long-run growth objectives.

Keynesian economics Infographic

libterm.com

libterm.com