The Consumption-Based Asset Pricing Model (CAPM) explains asset prices by linking them to investors' consumption patterns and preferences over time. It asserts that the value of an asset depends on how its returns correlate with changes in consumption, emphasizing risk aversion and intertemporal choices. Discover how this model can enhance your understanding of market dynamics by exploring the full article.

Table of Comparison

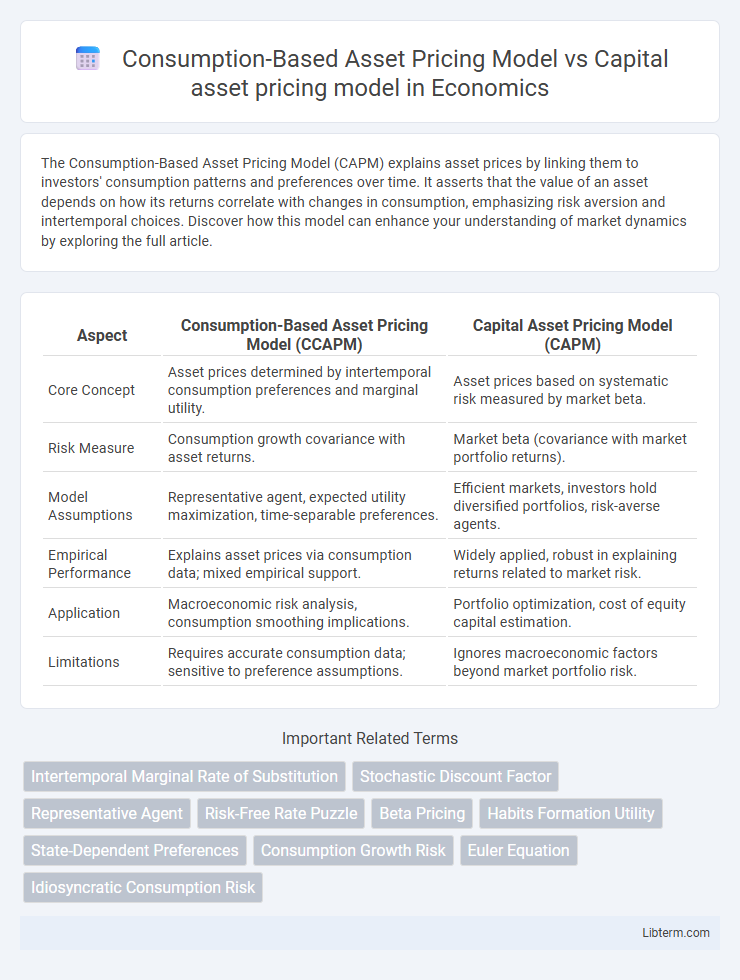

| Aspect | Consumption-Based Asset Pricing Model (CCAPM) | Capital Asset Pricing Model (CAPM) |

|---|---|---|

| Core Concept | Asset prices determined by intertemporal consumption preferences and marginal utility. | Asset prices based on systematic risk measured by market beta. |

| Risk Measure | Consumption growth covariance with asset returns. | Market beta (covariance with market portfolio returns). |

| Model Assumptions | Representative agent, expected utility maximization, time-separable preferences. | Efficient markets, investors hold diversified portfolios, risk-averse agents. |

| Empirical Performance | Explains asset prices via consumption data; mixed empirical support. | Widely applied, robust in explaining returns related to market risk. |

| Application | Macroeconomic risk analysis, consumption smoothing implications. | Portfolio optimization, cost of equity capital estimation. |

| Limitations | Requires accurate consumption data; sensitive to preference assumptions. | Ignores macroeconomic factors beyond market portfolio risk. |

Introduction to Asset Pricing Models

The Consumption-Based Asset Pricing Model (CCAPM) extends the Capital Asset Pricing Model (CAPM) by linking asset returns to consumption growth rather than relying solely on market portfolio risk. CAPM explains expected returns through a single factor--the market beta--while CCAPM incorporates intertemporal consumption decisions, providing a more comprehensive framework based on investor preferences and time-varying risk. Both models serve foundational roles in finance, but CCAPM offers deeper insights into risk premia by integrating macroeconomic variables and consumption data.

Overview of the Capital Asset Pricing Model (CAPM)

The Capital Asset Pricing Model (CAPM) explains the relationship between systematic risk and expected return for assets, particularly stocks. It posits that the expected return on an asset equals the risk-free rate plus the asset's beta multiplied by the market risk premium, which captures market-wide risk exposure. CAPM assumes investors hold diversified portfolios, making beta the key measure of asset-specific risk relative to overall market movements.

Fundamentals of the Consumption-Based Asset Pricing Model (CCAPM)

The Consumption-Based Asset Pricing Model (CCAPM) links asset prices directly to consumers' intertemporal consumption choices, emphasizing the marginal utility of consumption as a fundamental driver of expected returns. Unlike the Capital Asset Pricing Model (CAPM), which relies on market beta and assumes a single-period framework focused on variance and covariance of asset returns, CCAPM incorporates time-varying risk premia derived from the stochastic behavior of consumption growth. This model fundamentally asserts that the risk premium on assets compensates investors for exposure to fluctuations in consumption relative to overall economic wealth.

Key Assumptions Underlying CAPM

The Capital Asset Pricing Model (CAPM) assumes investors are rational and risk-averse, markets are perfectly competitive and frictionless, and all investors have homogeneous expectations regarding asset returns and risks. CAPM also presupposes a single-period investment horizon and the existence of a risk-free rate at which investors can borrow and lend unlimited amounts. These foundational assumptions distinguish CAPM from the Consumption-Based Asset Pricing Model, which incorporates intertemporal consumption preferences and varying risk aversion over time.

Core Assumptions of the CCAPM

The Consumption-Based Asset Pricing Model (CCAPM) fundamentally assumes that investors maximize expected utility derived from consumption over time, emphasizing the intertemporal substitution of consumption. Risk premiums are determined by the covariance of asset returns with the marginal utility of consumption, highlighting the role of consumption growth rather than market portfolio risk alone. This contrasts with the Capital Asset Pricing Model (CAPM), which presumes investors optimize portfolios based on mean-variance preferences and measures risk premiums solely by beta relative to the market portfolio.

Mathematical Formulations: CAPM vs. CCAPM

The Capital Asset Pricing Model (CAPM) defines the expected return \( E(R_i) \) as \( R_f + \beta_i (E(R_m) - R_f) \), where \( \beta_i = \frac{\text{Cov}(R_i, R_m)}{\text{Var}(R_m)} \) measures systematic risk relative to the market portfolio. The Consumption-Based Capital Asset Pricing Model (CCAPM) expresses expected returns through the intertemporal marginal rate of substitution, formulated as \( E(R_i) = R_f + \frac{\text{Cov}(R_i, \Delta C_{t+1}/C_t)}{\text{Var}(\Delta C_{t+1}/C_t)} \cdot \lambda \), linking asset returns to consumption growth risk. Unlike CAPM's reliance on market betas, CCAPM incorporates utility-based consumption preferences, providing a deeper economic foundation through stochastic discount factors derived from consumption data.

Risk Factors: Market vs. Consumption Risk

The Consumption-Based Asset Pricing Model (CCAPM) emphasizes consumption risk by linking asset returns to fluctuations in an investor's intertemporal consumption preferences, reflecting how changes in consumption growth affect risk premiums. In contrast, the Capital Asset Pricing Model (CAPM) centers on market risk, quantifying asset risk through beta relative to the overall market portfolio's returns. While CAPM assumes market risk as the sole systematic factor, CCAPM integrates consumption risk as a fundamental driver of expected returns, capturing broader economic conditions affecting investors' consumption patterns.

Empirical Evidence and Real-World Applications

Empirical evidence shows that the Consumption-Based Asset Pricing Model (CCAPM) often struggles to explain asset returns as effectively as the Capital Asset Pricing Model (CAPM), primarily due to difficulties in accurately capturing investors' consumption patterns and risk preferences. Real-world applications of CAPM dominate portfolio management and corporate finance because of its simplicity and ease of use, while CCAPM is more common in advanced academic research and macro-financial analysis that incorporate consumption data for long-term investment risk assessment. Studies indicate that CCAPM performs better in explaining cross-sectional variation in returns during economic downturns, whereas CAPM maintains stronger predictive power over short-term market dynamics.

Strengths and Limitations of Each Model

The Consumption-Based Asset Pricing Model (CCAPM) excels in linking asset prices to intertemporal consumption choices, capturing investor preferences over time and offering a theoretically grounded framework for explaining risk premiums. However, it faces limitations due to empirical challenges in accurately measuring consumption data and explaining observed asset returns under realistic market frictions. The Capital Asset Pricing Model (CAPM) provides a simpler and widely used approach by relating expected returns to systematic risk through beta, facilitating practical portfolio management but often fails to account for anomalies and cannot fully explain the cross-section of asset returns.

Choosing the Right Model for Portfolio Management

The Consumption-Based Asset Pricing Model (CCAPM) incorporates lifetime consumption patterns and intertemporal risk preferences, offering a dynamic framework for capturing investor behavior under changing economic conditions. In contrast, the Capital Asset Pricing Model (CAPM) relies on market beta to measure systematic risk and assumes investors optimize portfolios solely based on current market equilibrium. Portfolio managers selecting between these models should consider their investment horizon and sensitivity to consumption risks, as CCAPM better accommodates long-term consumption growth and preferences, whereas CAPM provides simplicity and ease of empirical implementation for market-based risk assessment.

Consumption-Based Asset Pricing Model Infographic

libterm.com

libterm.com