Debt restructuring involves reorganizing existing obligations to improve financial stability and reduce repayment burdens. This process can include negotiating lower interest rates, extending payment deadlines, or converting debt into equity, helping individuals or companies avoid insolvency. Discover how strategic debt restructuring can safeguard your financial future by reading the full article.

Table of Comparison

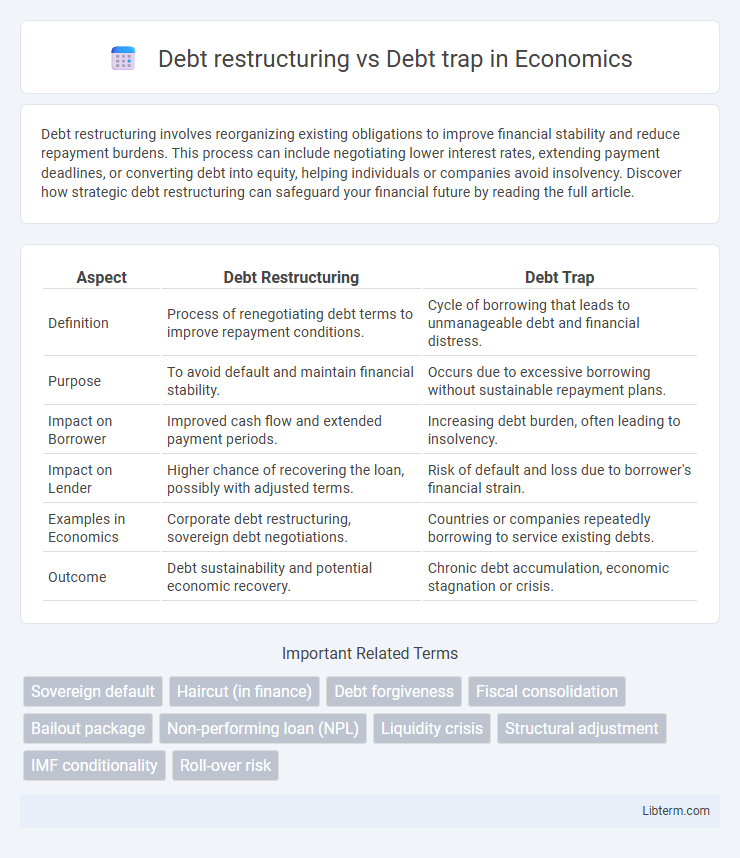

| Aspect | Debt Restructuring | Debt Trap |

|---|---|---|

| Definition | Process of renegotiating debt terms to improve repayment conditions. | Cycle of borrowing that leads to unmanageable debt and financial distress. |

| Purpose | To avoid default and maintain financial stability. | Occurs due to excessive borrowing without sustainable repayment plans. |

| Impact on Borrower | Improved cash flow and extended payment periods. | Increasing debt burden, often leading to insolvency. |

| Impact on Lender | Higher chance of recovering the loan, possibly with adjusted terms. | Risk of default and loss due to borrower's financial strain. |

| Examples in Economics | Corporate debt restructuring, sovereign debt negotiations. | Countries or companies repeatedly borrowing to service existing debts. |

| Outcome | Debt sustainability and potential economic recovery. | Chronic debt accumulation, economic stagnation or crisis. |

Understanding Debt Restructuring

Debt restructuring involves reorganizing existing debt agreements to improve repayment terms, such as extending deadlines, reducing interest rates, or altering payment schedules, thereby enhancing a borrower's financial stability. It acts as a strategic solution to avoid falling into a debt trap, which occurs when a borrower cannot manage repayments and continuously borrows more, leading to escalating liabilities and financial distress. Understanding debt restructuring helps businesses and individuals regain control over their finances by negotiating manageable obligations and preventing the cycle of unmanageable debt accumulation.

What is a Debt Trap?

A debt trap occurs when a borrower continuously borrows more money to repay existing debts, leading to a cycle of increasing interest and financial burden. Debt restructuring involves modifying loan terms to reduce payments and interest rates, helping borrowers avoid falling into or escaping a debt trap. Understanding the difference is crucial for managing financial health and preventing long-term insolvency.

Key Differences: Debt Restructuring vs Debt Trap

Debt restructuring involves renegotiating loan terms to reduce financial stress, extend repayment periods, or lower interest rates, providing borrowers with a sustainable debt management solution. A debt trap occurs when high-interest debts or unfavorable loan conditions lead to a cycle of borrowing that increases financial burden, making it difficult to repay the principal amount. The key difference lies in debt restructuring offering a strategic approach to manage liabilities, whereas a debt trap signifies a detrimental debt cycle that limits financial freedom.

Signs You Might Need Debt Restructuring

Persistent difficulty in meeting monthly debt payments and rising interest rates indicate a potential need for debt restructuring. Frequent borrowing to cover existing loans and increasing reliance on credit cards signal a debt trap that restructuring can address. Evaluating cash flow patterns and debt-to-income ratios helps identify when restructuring is necessary to avoid long-term financial distress.

Warning Indicators of a Debt Trap

Warning indicators of a debt trap include high-interest rates that outpace income growth, frequent borrowing to cover existing debt payments, and a rising debt-to-income ratio that signals unsustainable repayment capacity. Persistent late payments and reliance on payday or short-term loans exacerbate financial strain, leading to a cycle of debt accumulation. Identifying these signs early enables effective debt restructuring strategies to replace costly debt with manageable repayment terms, avoiding long-term financial distress.

Pros and Cons of Debt Restructuring

Debt restructuring offers borrowers the advantage of reduced interest rates, extended repayment terms, and improved cash flow, which can prevent default and protect credit ratings. However, it may lead to longer debt durations and potential penalties that increase overall costs, while creditors might impose strict conditions limiting financial flexibility. Unlike a debt trap, which involves escalating debt and worsening financial distress, debt restructuring aims to provide a manageable repayment plan that stabilizes finances and prevents insolvency.

Consequences of Falling into a Debt Trap

Falling into a debt trap results in escalating interest payments that outpace income growth, leading to chronic financial instability and reduced creditworthiness. Debt restructuring offers a strategic remedy by reorganizing repayment terms to lower interest rates and extend maturity, preventing default and preserving financial health. Persistent debt traps cause asset liquidation and psychological stress, emphasizing the importance of proactive debt management to avoid long-term economic damage.

How to Navigate Out of a Debt Trap

Navigating out of a debt trap requires a strategic debt restructuring plan that prioritizes renegotiating loan terms to reduce interest rates, extend repayment periods, or consolidate multiple debts. Engaging with creditors to achieve manageable payment schedules and seeking professional financial counseling can prevent the cycle of escalating debt. Implementing a strict budget and increasing income streams further supports regaining financial stability and avoiding future debt traps.

Best Practices for Successful Debt Restructuring

Successful debt restructuring requires clear communication with creditors, realistic repayment plans, and thorough financial analysis to avoid falling into a debt trap. Implementing best practices such as transparent negotiations, prioritizing high-interest debts, and seeking professional financial advice significantly improves the chances of sustainable debt relief. Monitoring cash flow and regularly reviewing restructuring terms help maintain fiscal discipline and prevent future insolvency risks.

Preventing Debt Traps: Strategies for Financial Stability

Debt restructuring involves renegotiating loan terms to ease repayment burdens, promoting sustainable financial management and preventing escalating debt risks. Strategies for financial stability emphasize proactive budgeting, improving credit literacy, and maintaining diversified income streams to avoid the pitfalls of debt traps. Implementing timely debt restructuring alongside robust financial planning safeguards against chronic indebtedness and ensures long-term economic resilience.

Debt restructuring Infographic

libterm.com

libterm.com