Government disaster relief programs provide critical support by offering financial aid, emergency shelter, and medical assistance to communities affected by natural or man-made disasters. These initiatives aim to restore infrastructure, ensure public safety, and facilitate recovery to minimize long-term impacts on livelihoods. Discover how these efforts can assist your community and what steps you can take to access available resources in the full article.

Table of Comparison

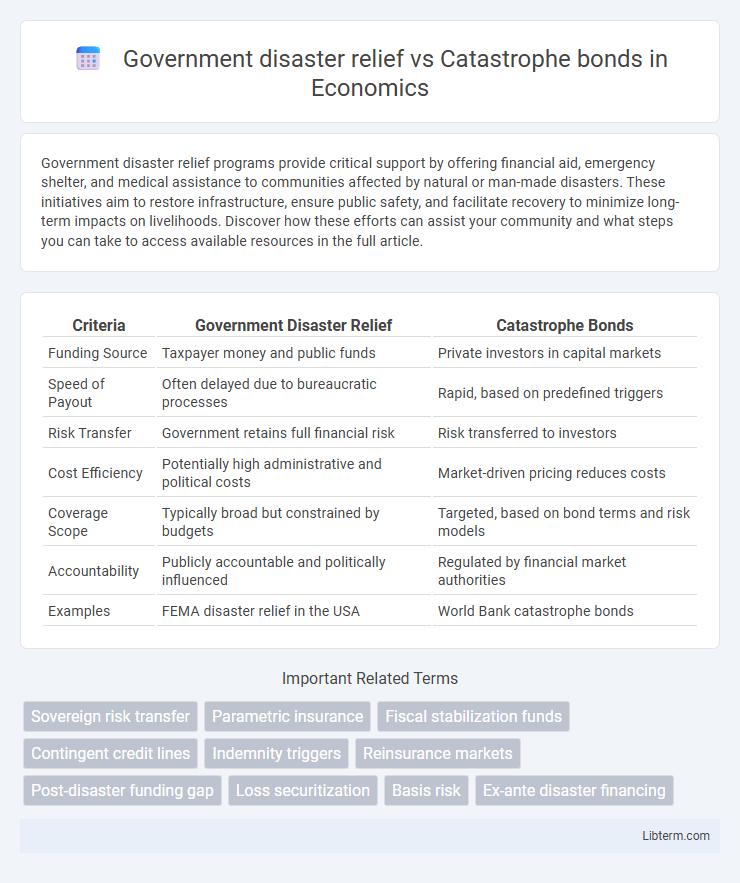

| Criteria | Government Disaster Relief | Catastrophe Bonds |

|---|---|---|

| Funding Source | Taxpayer money and public funds | Private investors in capital markets |

| Speed of Payout | Often delayed due to bureaucratic processes | Rapid, based on predefined triggers |

| Risk Transfer | Government retains full financial risk | Risk transferred to investors |

| Cost Efficiency | Potentially high administrative and political costs | Market-driven pricing reduces costs |

| Coverage Scope | Typically broad but constrained by budgets | Targeted, based on bond terms and risk models |

| Accountability | Publicly accountable and politically influenced | Regulated by financial market authorities |

| Examples | FEMA disaster relief in the USA | World Bank catastrophe bonds |

Introduction to Disaster Relief Mechanisms

Government disaster relief involves state-funded programs and emergency response teams that provide immediate aid and recovery assistance after natural or man-made disasters, ensuring public safety and infrastructure restoration. Catastrophe bonds are financial instruments issued by insurers or governments to transfer disaster risks to investors, offering upfront capital for large-scale emergencies while mitigating fiscal impact on public budgets. Both mechanisms play crucial roles in disaster management, combining direct aid deployment with innovative risk financing to enhance resilience and recovery capacity.

Defining Government Disaster Relief

Government disaster relief refers to the public sector's organized response to natural or man-made emergencies, providing financial aid, resources, and logistical support to affected communities. This relief system typically involves federal, state, and local agencies collaborating to ensure rapid deployment of emergency services, infrastructure repair, and humanitarian assistance. In contrast, catastrophe bonds are financial instruments used by governments and insurers to transfer risk to capital markets, offering a pre-funded mechanism for disaster recovery based on specific triggering events.

What Are Catastrophe Bonds?

Catastrophe bonds are risk-linked securities that transfer the financial risk of natural disasters from governments or insurers to investors, providing immediate capital relief when specified catastrophic events occur. These bonds pay high yields to investors but only lose principal if triggering events, such as hurricanes or earthquakes exceeding predefined parameters, happen. Unlike traditional government disaster relief funds, catastrophe bonds offer a market-based mechanism to quickly mobilize substantial funds, reducing fiscal strain and enhancing disaster resilience.

Funding Sources and Financial Structures

Government disaster relief relies primarily on public funding through tax revenues and emergency reserves, enabling immediate allocation for disaster response and recovery without the need for repayment. Catastrophe bonds, issued by insurers or governments, attract capital market investors by transferring disaster risk, with bondholders receiving high yields but potentially losing principal if specific disaster triggers occur. Financial structures differ as government relief is budget-centric and flexible, whereas catastrophe bonds involve predefined contractual payouts tied to event parameters, creating a market-driven risk-sharing mechanism.

Speed and Efficiency of Response

Government disaster relief often faces delays due to bureaucratic processes and budget approvals, impacting the speed of response to emergencies. Catastrophe bonds provide faster access to funds by automatically releasing capital when predefined triggers are met, enabling immediate financial support for disaster recovery. This mechanism enhances efficiency by reducing administrative bottlenecks and ensuring timely resource allocation to affected areas.

Risk Transfer and Financial Protection

Government disaster relief provides immediate funding and resources for recovery but often entails significant fiscal strain and delayed disbursement, limiting effective risk transfer. Catastrophe bonds enable governments to transfer specific disaster risks to capital markets, offering pre-arranged financial protection and prompt liquidity upon event triggers. This risk transfer mechanism diversifies exposure, reduces budget volatility, and enhances resilience against catastrophic losses.

Flexibility in Disaster Recovery

Government disaster relief programs often face rigid budget allocations and bureaucratic delays, limiting their flexibility in rapidly adjusting resources to meet evolving disaster recovery needs. Catastrophe bonds offer greater financial agility by providing pre-secured capital that can be quickly deployed based on defined triggers, enabling faster response and adaptive funding during disaster recovery phases. This flexibility allows for more efficient allocation of funds, improving resilience and reducing downtime in affected communities.

Accountability and Oversight

Government disaster relief programs operate under strict accountability frameworks with oversight from legislative bodies, ensuring transparency in fund allocation and usage. Catastrophe bonds, issued by insurers or governments, incorporate third-party monitoring by rating agencies and trustees to oversee trigger events and payout processes. Both mechanisms emphasize robust oversight, but government relief is directly subject to public sector audits, whereas catastrophe bonds rely on private market accountability and contractual transparency.

Case Studies: Real-World Applications

Government disaster relief programs, such as FEMA in the United States, have been pivotal in response efforts for hurricanes like Katrina (2005) and Harvey (2017), providing immediate funding and resources for recovery. Catastrophe bonds have gained prominence in financing large-scale disasters, exemplified by Mexico's pioneering use in 2006 following earthquakes, enabling rapid liquidity without burdening public budgets. This combination of traditional relief and innovative financial instruments demonstrates a multifaceted approach to disaster resilience and resource mobilization.

Future Trends in Disaster Risk Management

Government disaster relief efforts are increasingly complemented by catastrophe bonds as innovative financial instruments allowing rapid mobilization of funds when predefined disaster triggers occur. Future trends in disaster risk management emphasize integrating catastrophe bonds with public-private partnerships, leveraging data analytics, and enhancing real-time risk modeling to optimize fund allocation and resilience strategies. Advances in parametric insurance and blockchain technology further enable transparent, efficient, and scalable disaster financing solutions beyond traditional government aid.

Government disaster relief Infographic

libterm.com

libterm.com