The Phillips curve illustrates the inverse relationship between inflation and unemployment, suggesting that lower unemployment rates often coincide with higher inflation. Understanding this economic concept is essential for predicting how changes in labor markets might influence price stability and wage growth. Explore the rest of the article to see how the Phillips curve impacts your economic decisions and policy-making.

Table of Comparison

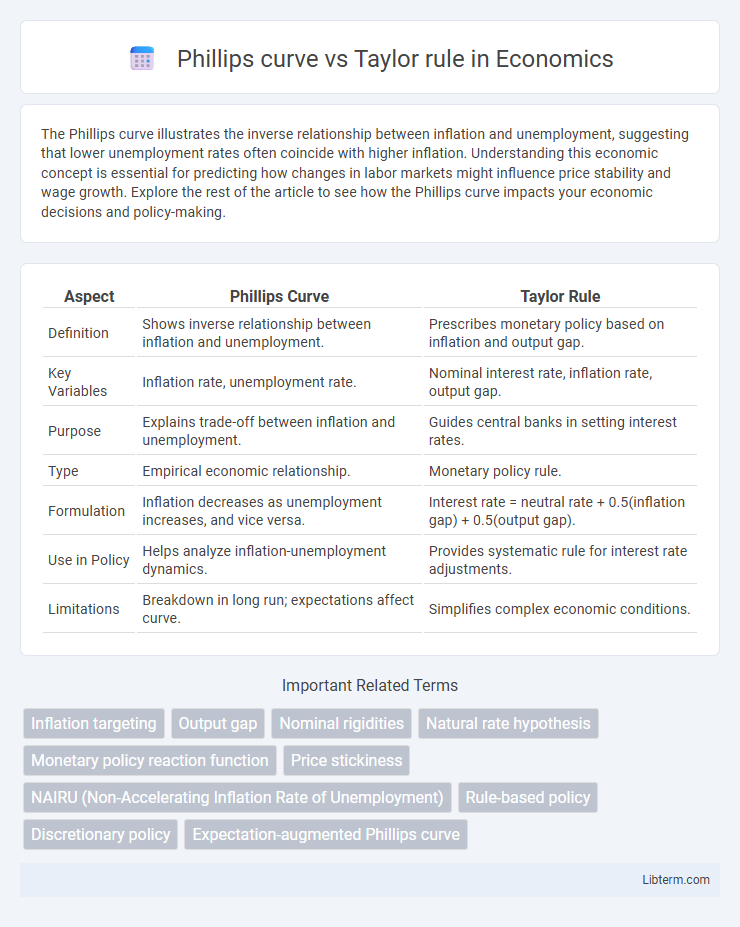

| Aspect | Phillips Curve | Taylor Rule |

|---|---|---|

| Definition | Shows inverse relationship between inflation and unemployment. | Prescribes monetary policy based on inflation and output gap. |

| Key Variables | Inflation rate, unemployment rate. | Nominal interest rate, inflation rate, output gap. |

| Purpose | Explains trade-off between inflation and unemployment. | Guides central banks in setting interest rates. |

| Type | Empirical economic relationship. | Monetary policy rule. |

| Formulation | Inflation decreases as unemployment increases, and vice versa. | Interest rate = neutral rate + 0.5(inflation gap) + 0.5(output gap). |

| Use in Policy | Helps analyze inflation-unemployment dynamics. | Provides systematic rule for interest rate adjustments. |

| Limitations | Breakdown in long run; expectations affect curve. | Simplifies complex economic conditions. |

Introduction to the Phillips Curve and Taylor Rule

The Phillips Curve illustrates the inverse relationship between inflation and unemployment, suggesting that lower unemployment rates lead to higher inflation. The Taylor Rule provides a guideline for setting interest rates based on deviations of actual inflation from target inflation and actual GDP from potential GDP. Both concepts are fundamental in macroeconomic policy, linking monetary policy decisions to inflation dynamics and economic output.

Historical Background of the Phillips Curve

The Phillips Curve, developed by economist A.W. Phillips in 1958, initially depicted an inverse relationship between unemployment and wage inflation based on UK labor market data. This empirical observation was later extended to price inflation, influencing Keynesian economic policy throughout the 1960s and 1970s. The Phillips Curve's historical significance lies in its challenge to the classical view, shaping inflation-unemployment trade-off debates before being contrasted with policy rules like the Taylor Rule in modern macroeconomics.

Origins and Development of the Taylor Rule

The Taylor Rule originated from economist John B. Taylor's 1993 research to provide a systematic approach for central banks in setting interest rates based on inflation and economic output gaps. It was developed as a response to the limitations of discretionary monetary policy and aimed to stabilize inflation and unemployment by linking interest rate decisions to deviations from target inflation and output levels. This rule contrasts with the Phillips Curve, which primarily illustrates the inverse relationship between inflation and unemployment without specifying explicit policy guidelines.

Core Concepts: Inflation, Unemployment, and Interest Rates

The Phillips curve illustrates an inverse relationship between inflation and unemployment, suggesting that lower unemployment often leads to higher inflation. The Taylor rule provides a formula to set interest rates based on deviations of actual inflation from target inflation and actual unemployment from its natural rate. Central banks use the Phillips curve to understand inflation-unemployment trade-offs, while the Taylor rule guides systematic adjustments of interest rates to stabilize both inflation and employment.

Mathematical Formulations: Comparing the Two Models

The Phillips curve mathematically expresses inflation \( \pi_t \) as a function of expected inflation \( \pi_t^e \) and the unemployment gap \( u_t - u^* \), typically formulated as \( \pi_t = \pi_t^e - \alpha (u_t - u^*) \), where \( \alpha \) measures the sensitivity of inflation to unemployment deviations. The Taylor rule prescribes the nominal interest rate \( i_t \) based on the inflation gap \( \pi_t - \pi^* \) and output gap \( y_t - y^* \), often given by \( i_t = r^* + \pi_t + \beta_{\pi}(\pi_t - \pi^*) + \beta_y(y_t - y^*) \), where \( r^* \) is the real equilibrium interest rate and \( \beta_{\pi}, \beta_y \) are policy response coefficients. While the Phillips curve captures the trade-off between inflation and unemployment in the short run, the Taylor rule guides monetary policy decisions via interest rate adjustments in response to deviations in inflation and output from target levels.

Policy Implications: How Central Banks Use Each Tool

Central banks utilize the Phillips curve to gauge inflation-unemployment trade-offs, guiding interest rate adjustments to stabilize prices without causing excessive job losses. The Taylor rule provides a formula-based approach, setting interest rates based on deviations of inflation and output from their targets, ensuring systematic and transparent monetary policy. Both tools influence policy decisions to achieve balanced economic growth and price stability.

Criticisms and Limitations of the Phillips Curve

The Phillips Curve faces criticism for its failure to consistently predict inflation-unemployment trade-offs, especially during periods of stagflation in the 1970s when both inflation and unemployment rose simultaneously. Critics argue it oversimplifies inflation dynamics by ignoring expectations and supply shocks, limiting its reliability in guiding monetary policy. In contrast, the Taylor Rule incorporates inflation expectations and output gaps, providing a more systematic and adaptive approach to setting interest rates.

Strengths and Weaknesses of the Taylor Rule

The Taylor Rule offers a systematic framework for adjusting interest rates based on inflation and output gaps, promoting policy transparency and predictability. Its strength lies in providing a clear guideline for central banks to stabilize the economy and reduce uncertainty. However, the rule's reliance on accurate estimates of potential output and natural interest rates can lead to misapplication during economic shocks or structural changes, limiting its flexibility and effectiveness.

Empirical Evidence: Real-World Applications and Outcomes

Empirical evidence comparing the Phillips curve and Taylor rule demonstrates that the Phillips curve's inflation-unemployment trade-off is less stable in modern economies, influenced by expectations and supply shocks. The Taylor rule, prescribing systematic adjustments to interest rates based on inflation deviations and output gaps, shows consistent effectiveness in guiding monetary policy and stabilizing inflation and output in various countries. Real-world applications highlight that central banks often integrate insights from both frameworks to accommodate changing economic dynamics and improve policy outcomes.

Conclusion: Choosing Between the Phillips Curve and Taylor Rule

Choosing between the Phillips Curve and Taylor Rule depends on the specific economic context and policy objectives. The Phillips Curve offers insights into the trade-off between inflation and unemployment, making it valuable during supply shocks or labor market adjustments. The Taylor Rule, grounded in monetary policy reaction functions, provides systematic guidance for interest rate settings to stabilize inflation and output gaps, often preferred in central bank policy frameworks.

Phillips curve Infographic

libterm.com

libterm.com