Equity financing involves raising capital by selling shares of your company to investors, allowing you to access funds without incurring debt. This method can provide long-term financial stability and enable you to share the risks and rewards of your business growth. Explore the rest of the article to understand how equity financing can impact your company's future and which options might suit you best.

Table of Comparison

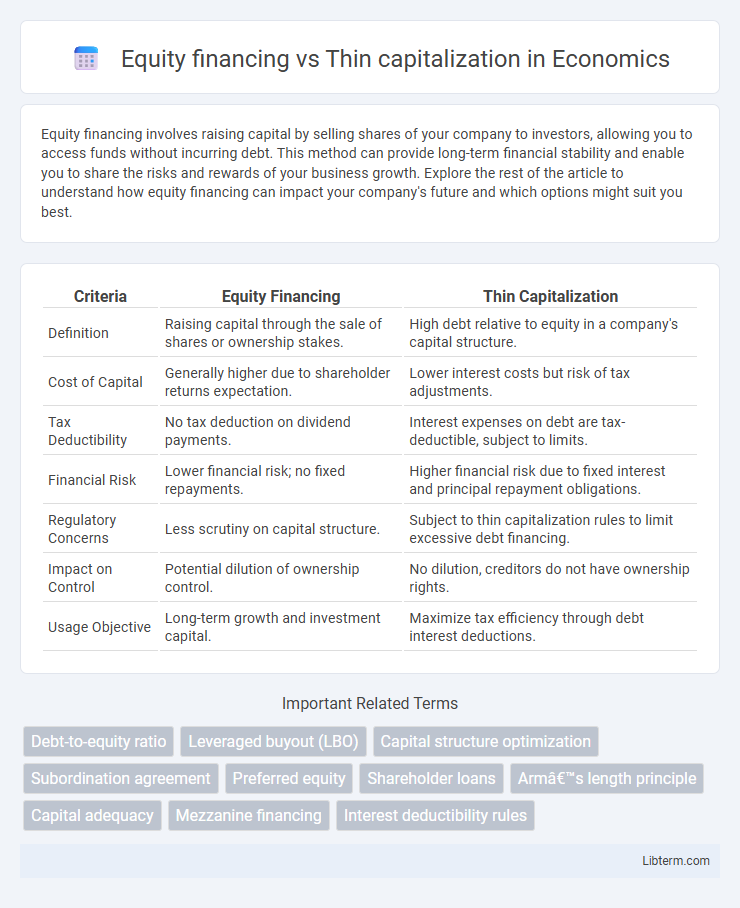

| Criteria | Equity Financing | Thin Capitalization |

|---|---|---|

| Definition | Raising capital through the sale of shares or ownership stakes. | High debt relative to equity in a company's capital structure. |

| Cost of Capital | Generally higher due to shareholder returns expectation. | Lower interest costs but risk of tax adjustments. |

| Tax Deductibility | No tax deduction on dividend payments. | Interest expenses on debt are tax-deductible, subject to limits. |

| Financial Risk | Lower financial risk; no fixed repayments. | Higher financial risk due to fixed interest and principal repayment obligations. |

| Regulatory Concerns | Less scrutiny on capital structure. | Subject to thin capitalization rules to limit excessive debt financing. |

| Impact on Control | Potential dilution of ownership control. | No dilution, creditors do not have ownership rights. |

| Usage Objective | Long-term growth and investment capital. | Maximize tax efficiency through debt interest deductions. |

Introduction to Equity Financing and Thin Capitalization

Equity financing involves raising capital by selling shares of ownership in a company, providing long-term funding without incurring debt and avoiding interest obligations. Thin capitalization occurs when a company is financed through a high level of debt compared to equity, potentially triggering tax regulations that limit interest deductibility to prevent excessive tax avoidance. Understanding the balance between equity financing and thin capitalization is crucial for optimizing capital structure and ensuring compliance with tax authorities.

Definitions and Key Concepts

Equity financing involves raising capital through the sale of shares, providing investors with ownership stakes and potential dividends, which strengthens the company's balance sheet without incurring debt. Thin capitalization occurs when a company is financed through a high level of debt relative to equity, potentially leading to tax challenges due to interest deduction limitations. Understanding these concepts is critical for optimizing capital structure and ensuring compliance with tax regulations on debt and equity ratios.

How Equity Financing Works

Equity financing involves raising capital by selling shares of ownership in a company to investors, which increases the company's equity base without incurring debt. This method improves the company's balance sheet by enhancing net assets and reducing leverage, thereby potentially lowering financial risk related to thin capitalization rules that limit excessive debt usage. Investors receive ownership stakes and possible dividends, aligning their interests with the company's long-term growth and profitability.

Understanding Thin Capitalization

Thin capitalization occurs when a company is financed through a high level of debt compared to equity, raising concerns about excessive interest deductions that can erode taxable income. Understanding thin capitalization rules is crucial for businesses to comply with tax regulations that limit the deductibility of interest expenses on related-party loans. Equity financing, in contrast, involves raising capital through the issuance of shares, providing a more balanced capital structure and reducing the risk of thin capitalization penalties.

Benefits of Equity Financing

Equity financing provides companies with capital without increasing debt levels, reducing financial risk and avoiding interest obligations that thin capitalization might impose. It enhances the company's creditworthiness and balance sheet strength, attracting further investment and facilitating long-term growth. Unlike excessive debt, equity financing offers greater financial flexibility and resilience during economic downturns.

Risks Associated with Thin Capitalization

Thin capitalization occurs when a company is financed through a high level of debt compared to equity, increasing financial risk and vulnerability to economic downturns. Risks associated with thin capitalization include limited access to additional financing, increased interest payment obligations, and potential tax implications such as disallowed interest deductions by tax authorities. Excessive leverage can also trigger creditor concerns and may lead to financial distress or insolvency if the company cannot meet its debt obligations.

Tax Implications: Equity vs. Thin Capitalization

Equity financing typically offers tax advantages by avoiding interest deductions limitations, whereas thin capitalization rules restrict excessive debt financing to prevent eroding the taxable base through interest expense deductions. Tax authorities impose thin capitalization limits by capping deductible interest expenses relative to equity or earnings, which can increase taxable income and resulting tax liabilities for highly leveraged companies. Companies benefit from maintaining a balanced capital structure to optimize tax efficiency by maximizing allowable interest deductions while complying with thin capitalization rules.

Regulatory Framework and Compliance

Equity financing involves raising capital through the sale of shares, subject to strict regulatory frameworks like securities laws and stock exchange regulations designed to protect investors and ensure transparency. Thin capitalization rules limit the amount of debt a company can use relative to its equity to prevent excessive interest deductions and tax base erosion, requiring compliance with specific debt-to-equity ratio thresholds established by tax authorities. Companies must navigate both equity issuance regulations and thin capitalization compliance to optimize capital structure while adhering to legal and tax guidelines.

Impact on Financial Structure and Investment

Equity financing strengthens a company's financial structure by increasing net worth and reducing debt reliance, which improves creditworthiness and supports long-term investment capacity. Thin capitalization, characterized by excessive debt relative to equity, raises financial risk and limits investment potential due to higher interest obligations and potential restrictions from tax authorities. Balancing equity and debt optimizes capital structure, enhances financial stability, and maximizes investment opportunities by minimizing cost of capital and financial distress.

Choosing the Right Approach for Your Business

Equity financing involves raising capital through the sale of shares, providing businesses with long-term funds without incurring debt, which strengthens the balance sheet and reduces financial risk. Thin capitalization occurs when a company is funded through a high level of debt compared to equity, often leading to increased interest expenses and potential tax implications due to limits on interest deductibility. Choosing the right approach requires assessing factors such as the company's growth stage, cash flow stability, cost of capital, and regulatory environment to balance financial leverage with sustainable growth.

Equity financing Infographic

libterm.com

libterm.com