A well-designed landing page is essential for capturing your audience's attention and driving conversions. It strategically presents key information and a clear call-to-action that encourages visitors to take the desired step. Explore the rest of this article to discover effective landing page techniques that can boost your online success.

Table of Comparison

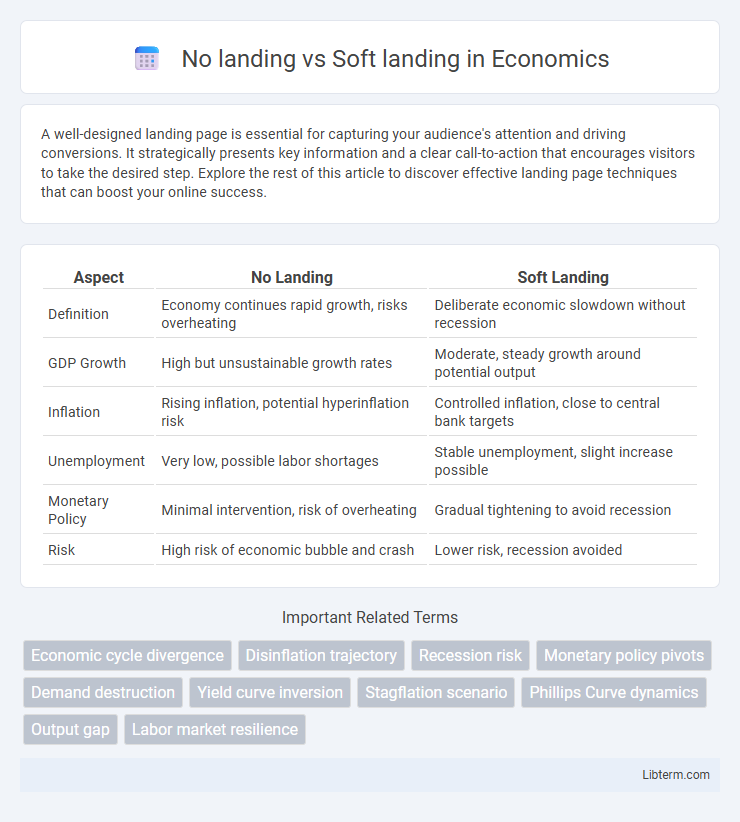

| Aspect | No Landing | Soft Landing |

|---|---|---|

| Definition | Economy continues rapid growth, risks overheating | Deliberate economic slowdown without recession |

| GDP Growth | High but unsustainable growth rates | Moderate, steady growth around potential output |

| Inflation | Rising inflation, potential hyperinflation risk | Controlled inflation, close to central bank targets |

| Unemployment | Very low, possible labor shortages | Stable unemployment, slight increase possible |

| Monetary Policy | Minimal intervention, risk of overheating | Gradual tightening to avoid recession |

| Risk | High risk of economic bubble and crash | Lower risk, recession avoided |

Understanding Economic Landings: No Landing vs. Soft Landing

No landing in economic terms refers to a scenario where the economy avoids a recession entirely and maintains steady growth without overheating, while a soft landing signifies a controlled slowdown aimed at curbing inflation without triggering significant unemployment or a downturn. Central banks often strive for a soft landing by adjusting monetary policies to balance economic expansion and price stability. Understanding these concepts is crucial for policymakers aiming to navigate the complexities of economic cycles and minimize financial disruptions.

Defining No Landing: What Does It Mean for the Economy?

No landing refers to an economic scenario where growth slows significantly without tipping into a recession, maintaining stability despite reduced momentum. This outcome contrasts with a soft landing, where the economy deliberately slows to a sustainable pace, avoiding a downturn through controlled measures like monetary policy adjustments. Understanding no landing is critical for investors and policymakers aiming to navigate periods of low growth without triggering negative economic spiral effects.

Breaking Down the Soft Landing Scenario

Soft landing in economic terms refers to a scenario where a country's economy slows down just enough to curb inflation without triggering a recession. It involves careful balancing of monetary policies, such as interest rate adjustments, to reduce overheating while maintaining growth and employment levels. Unlike a no landing scenario where the economy continues expanding without slowdown, a soft landing requires precise intervention to prevent an economic downturn while stabilizing markets.

Key Differences Between No Landing and Soft Landing

No landing refers to a spacecraft or vehicle not touching down on a surface, often remaining in orbit or floating in a controlled environment, whereas soft landing involves a controlled descent with minimal impact, ensuring the vehicle or payload remains intact. Key differences include impact velocity, where no landing has zero surface contact velocity and soft landing features a significantly reduced velocity to prevent damage. Soft landing typically requires advanced propulsion or cushioning technology, while no landing emphasizes sustained flight or orbit without surface interaction.

Historical Examples of No Landing and Soft Landing

Historical examples of no landing include the Great Depression in the 1930s, where economic downturns led to prolonged recessions without timely recovery efforts. In contrast, soft landings are exemplified by the 1994-1995 U.S. Federal Reserve actions, where gradual interest rate hikes helped slow inflation without triggering a recession. These cases highlight how policy responses and economic conditions determine whether an economy experiences a no landing or a soft landing scenario.

Economic Indicators Signaling Each Scenario

No landing scenarios are characterized by persistently strong economic indicators such as robust GDP growth, low unemployment rates, and rising inflation signaling an overheated economy. Soft landing scenarios emerge when key metrics like slowing inflation, steady job growth, and moderate consumer spending indicate a gradual economic deceleration without triggering a recession. Monitoring central bank interest rate adjustments, yield curve patterns, and consumer confidence indexes provides critical insights to distinguish between no landing and soft landing outcomes.

Impacts on Financial Markets and Investors

No landing scenarios cause financial markets to experience heightened volatility as investors grapple with uncertainty about economic growth, often leading to sharp sell-offs in equities and bonds. Soft landing outcomes tend to stabilize markets by indicating controlled economic slowdown with manageable inflation, which supports steady investor confidence and moderate asset price adjustments. Investors typically favor soft landings because they signal a reduced risk of recession, encouraging continued investment and lower risk premiums across asset classes.

Central Bank Policies and Their Role in Economic Landings

Central bank policies play a crucial role in determining whether an economy experiences a no landing or a soft landing during economic cycles. In a soft landing, central banks implement gradual interest rate hikes and maintain liquidity to carefully slow inflation without triggering a recession, balancing growth and price stability. Conversely, a no landing scenario often results from overly aggressive tightening or premature easing, causing inflation to persist or economic overheating, thereby preventing a stable transition to controlled growth.

Potential Risks and Opportunities in Each Scenario

No landing scenarios pose significant risks such as abrupt economic downturns, heightened unemployment rates, and financial market instability driven by uncontrolled inflation or external shocks. Soft landing strategies create opportunities for stable growth by gradually cooling inflation and avoiding recession, yet they require precise policy calibration to prevent overheating or stagnation. Each scenario demands vigilant monitoring of economic indicators like GDP growth, inflation rates, and labor market data to mitigate risks and capitalize on sustainable recovery paths.

Future Outlook: Which Scenario Is More Likely?

The future outlook for economic recovery strongly favors a soft landing scenario due to ongoing central bank efforts to balance inflation control with growth support. Various economic indicators, such as moderated inflation rates, resilient labor markets, and steady consumer spending, suggest avoiding a no landing crash is more probable. However, geopolitical tensions and unexpected supply chain disruptions remain key risks that could shift this trajectory.

No landing Infographic

libterm.com

libterm.com