Interest rates play a crucial role in determining the cost of borrowing and the return on savings, directly influencing personal finances and the broader economy. Understanding how interest rates fluctuate and their impact on loans, credit cards, and investments can help you make smarter financial decisions. Explore the rest of the article to learn how changing interest rates affect your financial future.

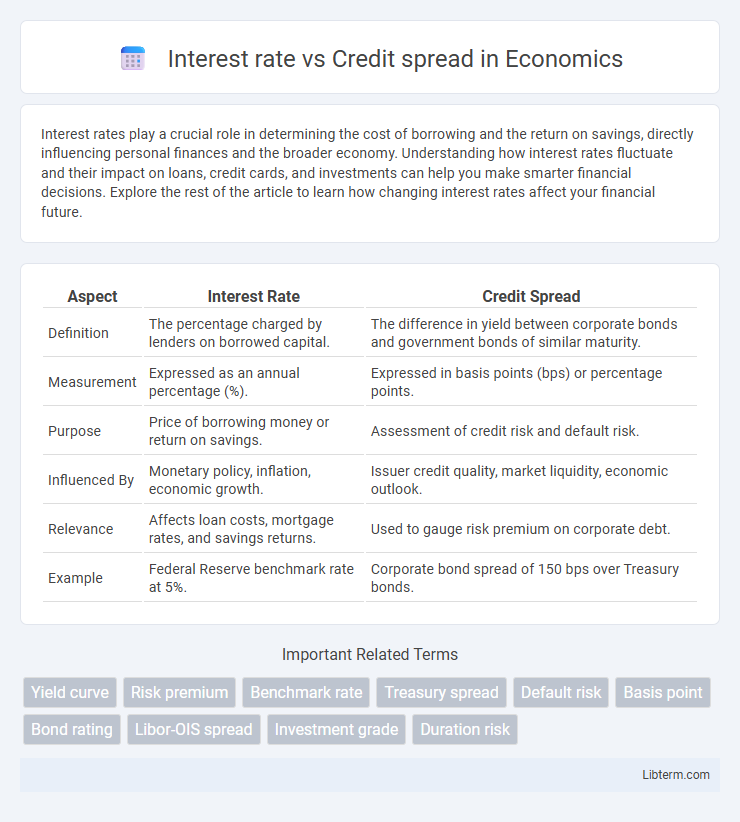

Table of Comparison

| Aspect | Interest Rate | Credit Spread |

|---|---|---|

| Definition | The percentage charged by lenders on borrowed capital. | The difference in yield between corporate bonds and government bonds of similar maturity. |

| Measurement | Expressed as an annual percentage (%). | Expressed in basis points (bps) or percentage points. |

| Purpose | Price of borrowing money or return on savings. | Assessment of credit risk and default risk. |

| Influenced By | Monetary policy, inflation, economic growth. | Issuer credit quality, market liquidity, economic outlook. |

| Relevance | Affects loan costs, mortgage rates, and savings returns. | Used to gauge risk premium on corporate debt. |

| Example | Federal Reserve benchmark rate at 5%. | Corporate bond spread of 150 bps over Treasury bonds. |

Introduction to Interest Rates and Credit Spreads

Interest rates represent the cost of borrowing money, typically expressed as a percentage of the principal loan amount, and are influenced by central bank policies and macroeconomic factors. Credit spreads measure the difference in yield between corporate bonds and risk-free government bonds of similar maturity, reflecting the relative risk of default associated with a specific issuer. Understanding the dynamics between interest rates and credit spreads is crucial for assessing credit risk and making informed investment decisions in fixed income markets.

Defining Interest Rates: Types and Determinants

Interest rates represent the cost of borrowing money, influenced by factors such as central bank policies, inflation expectations, and economic growth. Different types include nominal rates, real rates (adjusted for inflation), fixed rates, and variable rates, each impacting loan agreements and investments differently. Determinants of interest rates encompass monetary policy decisions, credit risk, liquidity preferences, and market demand and supply for funds.

What Are Credit Spreads? An Overview

Credit spreads represent the difference in yield between two bonds of similar maturity but different credit quality, commonly measured as the gap between corporate bonds and risk-free government securities. They reflect the market's perception of credit risk, serving as a key indicator of the borrower's default risk and overall economic conditions. Unlike interest rates set by central banks, credit spreads fluctuate based on issuer creditworthiness and investor demand for risk premium compensation.

Key Differences Between Interest Rates and Credit Spreads

Interest rates represent the cost of borrowing money expressed as a percentage of the principal, influenced primarily by central bank policies and overall economic conditions. Credit spreads measure the difference in yield between a corporate bond and a comparable maturity government bond, reflecting the credit risk and default probability of the issuer. While interest rates indicate general borrowing costs, credit spreads specifically quantify the additional risk premium investors demand for credit risk exposure.

Factors Influencing Interest Rates

Interest rates are influenced by factors such as central bank policies, inflation expectations, and economic growth, which directly impact borrowing costs and monetary supply. Credit spreads, representing the risk premium over risk-free rates, reflect the creditworthiness of borrowers and market risk perception. Understanding the interplay of monetary policy, inflation trends, and economic conditions helps explain fluctuations in interest rates and corresponding changes in credit spreads.

Drivers of Credit Spreads in Financial Markets

Credit spreads in financial markets are primarily driven by factors such as default risk, liquidity risk, and macroeconomic conditions affecting issuers' creditworthiness, which distinguish them from mere interest rate fluctuations influenced by central bank policies. Credit spreads widen when investors demand higher compensation for increased perceived risk, including deteriorating corporate fundamentals or adverse economic outlooks. Market sentiment and sector-specific events also significantly impact credit spreads, reflecting the premium over benchmark interest rates required to offset potential credit losses.

Interest Rate Movements and Their Impact on Credit Spreads

Interest rate movements directly influence credit spreads as rising interest rates often lead to wider credit spreads due to increased borrowing costs and higher default risk premiums. When interest rates fall, credit spreads tend to tighten because lower rates improve corporate profitability and creditworthiness, reducing perceived risk. Investors closely monitor central bank policies and macroeconomic indicators, as these factors drive interest rate fluctuations and consequently affect the pricing of credit risk in bond markets.

The Role of Credit Risk in Spread Variation

Credit risk plays a crucial role in credit spread variation by reflecting the borrower's default probability, which causes spreads to widen when perceived risk increases. Interest rates measure the cost of borrowing based on central bank policies, while credit spreads represent the additional yield investors demand for bearing default risk. The dynamic interaction between benchmark interest rates and credit risk premiums drives the fluctuations in credit spreads across different issuers and market conditions.

Practical Implications for Investors and Borrowers

Interest rates directly impact borrowing costs and investment returns, influencing decisions on loans and fixed-income securities, while credit spreads measure the risk premium over benchmark rates, reflecting issuer creditworthiness. Investors use credit spreads to assess default risk and potential yield enhancement, guiding portfolio allocation between corporate bonds and safer government securities. Borrowers face varying costs based on credit spread fluctuations, affecting debt issuance pricing and refinancing strategies in different market conditions.

Conclusion: Navigating Interest Rates and Credit Spreads

Understanding the dynamic relationship between interest rates and credit spreads is crucial for effective financial decision-making. Interest rates directly influence borrowing costs, while credit spreads reflect the risk premium investors demand over risk-free rates. Successfully navigating these factors requires continuous monitoring of economic indicators and market sentiment to optimize investment strategies and manage risk exposure.

Interest rate Infographic

libterm.com

libterm.com