A debit card provides convenient access to your bank account for everyday purchases and ATM withdrawals without borrowing money. It enhances financial control by allowing you to monitor spending in real time and avoid interest charges associated with credit cards. Discover how to maximize the benefits of your debit card throughout this article.

Table of Comparison

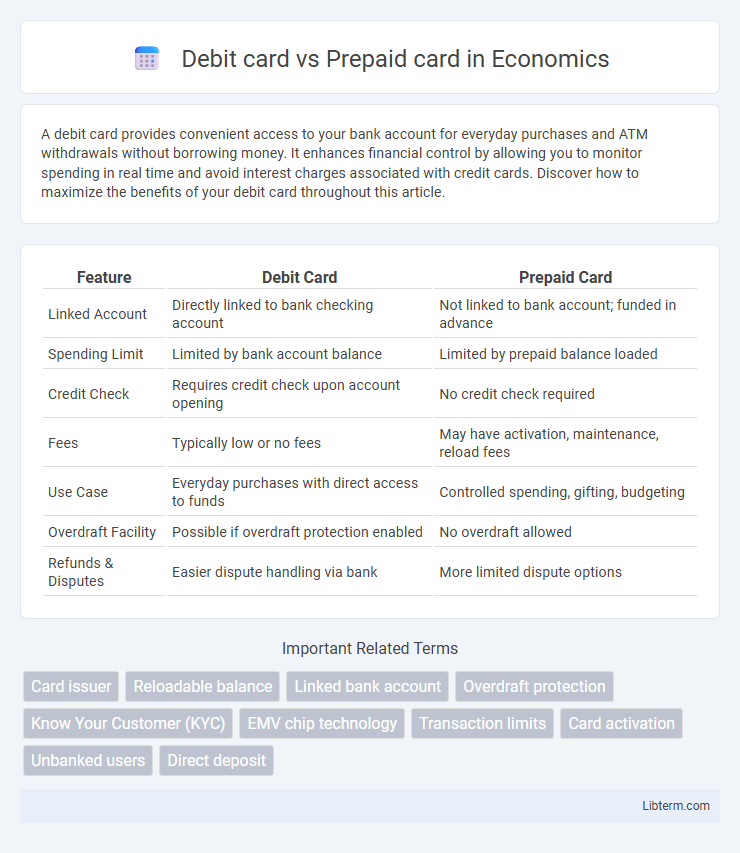

| Feature | Debit Card | Prepaid Card |

|---|---|---|

| Linked Account | Directly linked to bank checking account | Not linked to bank account; funded in advance |

| Spending Limit | Limited by bank account balance | Limited by prepaid balance loaded |

| Credit Check | Requires credit check upon account opening | No credit check required |

| Fees | Typically low or no fees | May have activation, maintenance, reload fees |

| Use Case | Everyday purchases with direct access to funds | Controlled spending, gifting, budgeting |

| Overdraft Facility | Possible if overdraft protection enabled | No overdraft allowed |

| Refunds & Disputes | Easier dispute handling via bank | More limited dispute options |

Introduction to Debit Cards and Prepaid Cards

Debit cards provide direct access to funds in a linked checking account, enabling users to make purchases or withdraw cash without incurring debt. Prepaid cards, loaded with a fixed amount of money beforehand, function independently of bank accounts and help users control spending by limiting the balance available. Both card types offer convenient payment methods but differ fundamentally in their funding sources and usage flexibility.

How Debit Cards Work

Debit cards connect directly to a user's checking account, allowing funds to be withdrawn or spent in real time without incurring debt. Each transaction is authorized by the cardholder's bank, which verifies sufficient balance before approving the purchase or cash withdrawal. These cards often include features such as PIN authentication and fraud protection to secure everyday financial activities.

How Prepaid Cards Work

Prepaid cards function by allowing users to load a specific amount of money onto the card before use, providing a controlled spending limit without the need for a bank account. Unlike debit cards linked to checking accounts, prepaid cards operate on a pay-as-you-go basis, typically requiring registration and activation. These cards offer features such as online purchases, ATM withdrawals, and direct deposits, making them a versatile option for budgeting and financial management.

Key Differences Between Debit and Prepaid Cards

Debit cards are linked directly to a checking account, allowing users to spend only available funds and often include access to ATM withdrawals and overdraft protection. Prepaid cards require users to load money onto the card in advance, functioning independently of a bank account and typically limiting spending to the preloaded balance. Unlike debit cards, prepaid cards may have activation fees and limited consumer protections, making them suitable for controlled budgeting or users without traditional banking access.

Security Features Compared

Debit cards offer robust security features such as EMV chip technology, PIN authentication, and real-time fraud monitoring, which helps protect against unauthorized transactions. Prepaid cards also include EMV chips and often provide activation requirements and usage limits to reduce risk, but they typically lack overdraft protection and detailed transaction dispute processes found with debit cards. Both cards support secure online and in-store payments, yet debit cards generally benefit from stronger regulatory protections under consumer financial laws.

Fees and Charges Analysis

Debit cards typically involve lower fees as they are linked directly to checking accounts, with most banks offering fee-free transactions and limited overdraft charges. Prepaid cards often carry higher costs, including activation fees, monthly maintenance fees, ATM withdrawal fees, and reload charges, which can accumulate significantly over time. Evaluating these fees is crucial for consumers to avoid unnecessary expenses and select the most cost-effective payment method.

Spending Controls and Budgeting

Debit cards provide direct access to funds in a linked checking account, enabling real-time spending tracking and allowing users to set alerts through banking apps for budget management. Prepaid cards require loading funds in advance, offering built-in spending limits that prevent overspending and facilitate strict budget adherence without the risk of overdrafts. Both card types incorporate spending controls, but prepaid cards offer a more effective tool for users seeking to avoid debt and maintain precise budget boundaries.

Acceptance and Usability

Debit cards are widely accepted at most retail locations, ATMs, and online merchants due to their direct link to a bank account, allowing seamless transactions and access to funds. Prepaid cards, while also accepted at many stores and online platforms, can have limitations such as restrictions on ATM withdrawals or inability to support recurring payments. Both card types offer convenient payment options, but debit cards generally provide broader usability and acceptance in everyday financial activities.

Pros and Cons of Each Card Type

Debit cards offer direct access to your bank account, enabling easy and convenient purchases with no need for prior funding, but they carry the risk of overdraft fees and potential fraud exposure. Prepaid cards require preloading funds, which helps with budgeting and reduces the risk of overspending, yet they often include activation fees, monthly maintenance charges, and limited acceptance compared to debit cards. Both card types provide different levels of security and control, with debit cards linked to personal bank accounts and prepaid cards functioning independently from traditional banking infrastructure.

Which Card Is Right for You?

Choosing between a debit card and a prepaid card depends on your financial habits and needs. Debit cards link directly to your bank account, allowing seamless access to funds with features like overdraft protection and bill payments. Prepaid cards require loading money in advance, offering better spending control and no risk of overspending, making them ideal for budgeting or for users without a bank account.

Debit card Infographic

libterm.com

libterm.com