Sustainable borrowing ensures that your debt remains manageable and aligned with your long-term financial goals, preventing excessive interest burdens and financial stress. It involves assessing your repayment ability, choosing appropriate loan terms, and avoiding over-leveraging. Explore the rest of the article to learn strategies for borrowing responsibly and maintaining financial health.

Table of Comparison

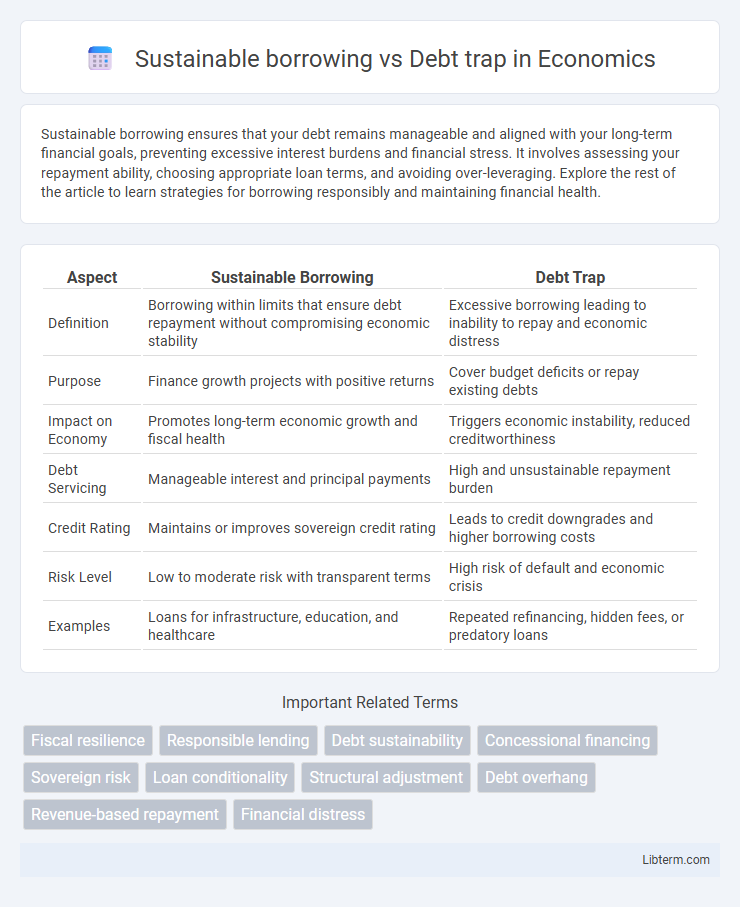

| Aspect | Sustainable Borrowing | Debt Trap |

|---|---|---|

| Definition | Borrowing within limits that ensure debt repayment without compromising economic stability | Excessive borrowing leading to inability to repay and economic distress |

| Purpose | Finance growth projects with positive returns | Cover budget deficits or repay existing debts |

| Impact on Economy | Promotes long-term economic growth and fiscal health | Triggers economic instability, reduced creditworthiness |

| Debt Servicing | Manageable interest and principal payments | High and unsustainable repayment burden |

| Credit Rating | Maintains or improves sovereign credit rating | Leads to credit downgrades and higher borrowing costs |

| Risk Level | Low to moderate risk with transparent terms | High risk of default and economic crisis |

| Examples | Loans for infrastructure, education, and healthcare | Repeated refinancing, hidden fees, or predatory loans |

Understanding Sustainable Borrowing

Sustainable borrowing involves strategically acquiring debt to finance growth without compromising financial stability or future repayment capacity, ensuring loans align with realistic revenue projections and economic conditions. It emphasizes transparent terms, manageable interest rates, and prudent fiscal policies to avoid overleveraging and maintain creditworthiness. Understanding sustainable borrowing is crucial for preventing a debt trap, where excessive or poorly structured debt leads to escalating repayments and financial distress.

Defining the Debt Trap

A debt trap occurs when borrowers take on excessive debt they cannot repay, leading to a cycle of borrowing to service existing loans and worsening financial instability. Sustainable borrowing involves maintaining debt at manageable levels relative to income and revenue, ensuring repayment capacity without compromising long-term economic growth. Understanding the debt trap emphasizes the importance of prudent debt management to avoid excessive interest burdens and fiscal distress.

Key Differences Between Sustainable Borrowing and a Debt Trap

Sustainable borrowing involves obtaining funds with a clear repayment plan aligned with economic growth, ensuring that debt levels remain manageable and support long-term financial stability. In contrast, a debt trap occurs when borrowing exceeds repayment capacity, leading to escalating interest burdens and dependency on new loans to service existing debt. Key differences include the borrower's ability to generate sufficient income to meet obligations and the strategic use of debt to finance productive investments versus borrowing driven by short-term needs or mismanagement.

Signs of Sustainable Debt Management

Sustainable debt management is characterized by a country's ability to meet its debt obligations without compromising economic growth or social development, evidenced by maintaining a debt-to-GDP ratio within manageable limits and ensuring debt servicing costs do not exceed government revenues. Key signs include robust fiscal policies, transparent public financial management, and a diversified economy that supports consistent revenue generation. Monitoring debt composition for concessional loans and extending maturities further signals prudent borrowing practices and reduces the risk of falling into a debt trap.

Warning Indicators of a Debt Trap

Warning indicators of a debt trap include rapidly increasing debt-to-GDP ratios, reliance on short-term high-interest loans, and a consistent inability to meet debt servicing obligations without restructuring. Persistent budget deficits and declining foreign exchange reserves further signal unsustainable borrowing patterns that jeopardize economic stability. Monitoring these factors helps distinguish responsible fiscal management from predatory lending scenarios leading to a debt trap.

Economic and Social Impacts of Sustainable Borrowing

Sustainable borrowing supports economic growth by financing infrastructure, education, and healthcare without compromising future fiscal stability, thereby reducing poverty and inequality. It encourages responsible debt management that maintains creditworthiness and investor confidence, fostering long-term development. Social impacts include improved public services and employment opportunities, enhancing overall quality of life and promoting inclusive prosperity.

Consequences of Falling Into a Debt Trap

Falling into a debt trap can lead to severe economic instability, including reduced fiscal space for essential public services and increased vulnerability to external shocks. Unsustainable borrowing drives up debt servicing costs, diverting resources from development projects and exacerbating poverty. The long-term consequences often include credit rating downgrades, loss of investor confidence, and potential defaults that destabilize national economies.

Strategies to Ensure Sustainable Borrowing

Implementing strict debt management frameworks and maintaining transparent fiscal policies are essential strategies to ensure sustainable borrowing, preventing countries from falling into a debt trap. Prioritizing borrowing for productive investments that generate economic growth and increase revenue enables repayment capacity without compromising future fiscal stability. Regular debt sustainability assessments and engaging with multilateral creditors can also mitigate risks by aligning borrowing with long-term economic development goals.

Policymaker Roles in Preventing Debt Traps

Policymakers play a critical role in preventing debt traps by enforcing strict borrowing limits and promoting transparency in loan agreements to ensure sustainable debt levels. Implementing rigorous debt sustainability assessments and prioritizing concessional financing helps safeguard national economies from excessive repayment burdens. Strengthening institutional capacity for debt management and fostering international cooperation also enhance the ability to avoid unsustainable debt accumulation.

Building Financial Resilience for the Future

Sustainable borrowing emphasizes managing debt within one's repayment capacity, promoting long-term financial stability and avoiding excessive interest burdens. It supports building financial resilience by prioritizing loans that contribute to income-generating assets or essential investments, thereby strengthening future cash flows. In contrast, falling into a debt trap occurs when borrowing exceeds repayment ability, leading to a cycle of escalating debt and financial vulnerability that undermines future economic security.

Sustainable borrowing Infographic

libterm.com

libterm.com