A full hedge is a comprehensive risk management strategy that involves taking an opposite position in a related asset to completely offset potential losses. By using a full hedge, you can protect your investments from adverse market movements and maintain portfolio stability. Discover how a full hedge works and when it's the right choice for your financial goals in the rest of this article.

Table of Comparison

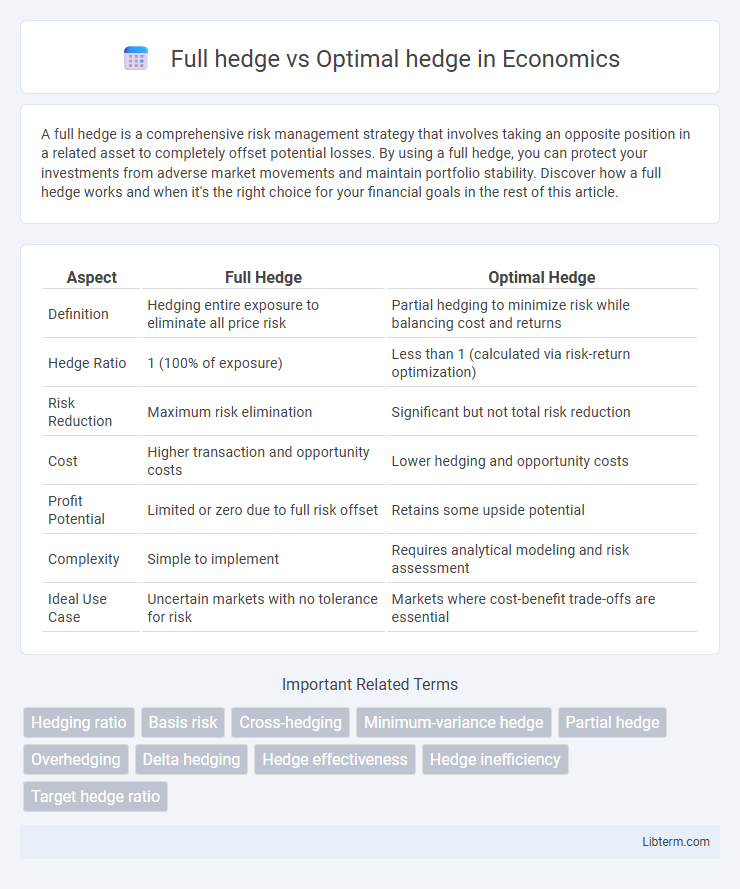

| Aspect | Full Hedge | Optimal Hedge |

|---|---|---|

| Definition | Hedging entire exposure to eliminate all price risk | Partial hedging to minimize risk while balancing cost and returns |

| Hedge Ratio | 1 (100% of exposure) | Less than 1 (calculated via risk-return optimization) |

| Risk Reduction | Maximum risk elimination | Significant but not total risk reduction |

| Cost | Higher transaction and opportunity costs | Lower hedging and opportunity costs |

| Profit Potential | Limited or zero due to full risk offset | Retains some upside potential |

| Complexity | Simple to implement | Requires analytical modeling and risk assessment |

| Ideal Use Case | Uncertain markets with no tolerance for risk | Markets where cost-benefit trade-offs are essential |

Introduction to Hedging Strategies

Full hedge involves covering 100% of a risk exposure to eliminate any potential losses from price fluctuations, commonly used in commodities and currency markets. Optimal hedge balances risk reduction with cost efficiency by partially hedging a position to maximize risk-adjusted returns. Both strategies are fundamental in financial risk management, enabling firms to protect against adverse market movements while considering capital and operational constraints.

Defining Full Hedge: Concepts and Applications

A full hedge involves taking a position in the derivatives market that exactly matches the size and risk exposure of the underlying asset, aiming to completely eliminate price risk. This approach is commonly used by companies to stabilize cash flows and protect profit margins in volatile markets like commodities, currencies, or interest rates. Full hedge applications are critical in industries such as agriculture and energy, where precise risk offset minimizes uncertainty and ensures financial predictability.

What is an Optimal Hedge?

An Optimal Hedge minimizes the overall risk exposure by balancing the costs and benefits of hedging, rather than completely eliminating risk as in a Full Hedge. It uses mathematical models and market data to determine the hedge ratio that maximizes risk reduction with minimal expense. This approach is favored in dynamic markets where over-hedging can lead to unnecessary costs or missed opportunities.

Key Differences: Full Hedge vs Optimal Hedge

Full hedge involves covering 100% of a position to eliminate all exposure to price fluctuations, providing maximum risk protection but potentially limiting profit opportunities. Optimal hedge balances risk reduction and cost efficiency by hedging a portion of the exposure based on factors such as volatility, correlation, and risk tolerance. Key differences include the extent of coverage, cost implications, and flexibility, with full hedge emphasizing complete coverage and optimal hedge focusing on strategic risk management.

Objectives of Full Hedge in Risk Management

A Full hedge aims to eliminate 100% of the exposure to price fluctuations by using financial instruments like futures or options, ensuring complete risk mitigation for the underlying asset. Its primary objective in risk management is to provide certainty in cash flows and protect profit margins from adverse market movements. This approach prioritizes stability over potential gains from favorable price changes, making it ideal for businesses seeking predictable financial outcomes.

The Role of Optimal Hedge Ratios

Optimal hedge ratios balance risk reduction and cost efficiency by adjusting the hedge size relative to the exposure, minimizing the variance of the hedged portfolio. Full hedging involves using a 1:1 ratio between the position and hedge, which can lead to over-hedging or under-hedging if the asset price movements are not perfectly correlated with the hedge instrument. Employing the optimal hedge ratio enhances hedging effectiveness by aligning with the correlation between spot and futures prices, ultimately improving risk management performance.

Advantages and Limitations of Full Hedging

Full hedge offers complete risk elimination by locking in prices or rates, providing certainty in budgeting and financial planning. However, it can limit potential gains if market conditions move favorably and may result in higher costs due to the need for larger collateral or premiums. The rigid nature of full hedging reduces flexibility, making it less adaptive to changing market dynamics compared to optimal hedge strategies.

Benefits and Drawbacks of Optimal Hedging

Optimal hedging balances risk reduction and cost efficiency by partially offsetting exposure, offering more flexibility than a full hedge which eliminates risk completely but at higher expense. This strategy minimizes unnecessary hedging costs and allows participation in favorable market movements while controlling downside risk. However, the drawback lies in residual exposure to market fluctuations, which requires careful monitoring and adjustment to maintain effectiveness.

Practical Considerations When Choosing a Hedging Strategy

Full hedge eliminates all exposure by locking in prices or rates, ideal for risk-averse firms seeking certainty in financial outcomes. Optimal hedge balances risk reduction and cost efficiency, often using partial positions or tailored instruments to maximize economic value. Practical considerations include market liquidity, transaction costs, risk tolerance, and the firm's strategic flexibility to adapt to changing market conditions.

Conclusion: Selecting the Right Hedge Approach

Choosing between a full hedge and an optimal hedge depends on the company's risk tolerance, cost considerations, and market exposure. A full hedge eliminates all price risk but often incurs higher costs and limits potential gains, while an optimal hedge balances risk reduction with cost efficiency by partially offsetting exposure. Businesses seeking maximum protection should consider full hedging, whereas those prioritizing flexibility and cost-effectiveness may prefer the optimal hedge strategy.

Full hedge Infographic

libterm.com

libterm.com