Cost-benefit analysis evaluates the financial advantages and disadvantages of a project or decision by comparing its total expected costs against potential benefits. This method helps identify whether the anticipated gains justify the expenses, optimizing resource allocation and decision-making efficiency. Explore the rest of the article to learn how cost-benefit analysis can improve your strategic planning.

Table of Comparison

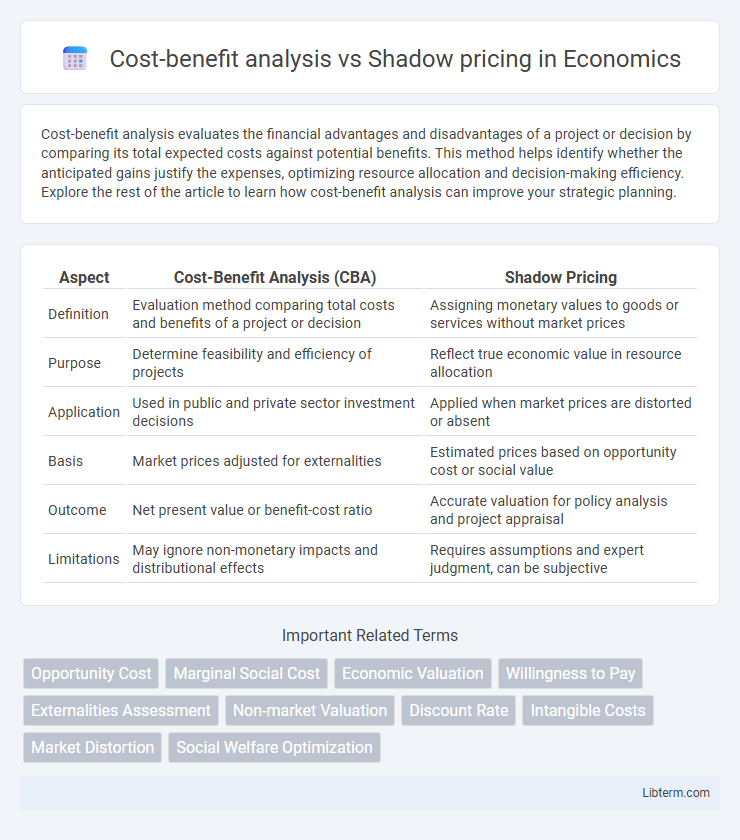

| Aspect | Cost-Benefit Analysis (CBA) | Shadow Pricing |

|---|---|---|

| Definition | Evaluation method comparing total costs and benefits of a project or decision | Assigning monetary values to goods or services without market prices |

| Purpose | Determine feasibility and efficiency of projects | Reflect true economic value in resource allocation |

| Application | Used in public and private sector investment decisions | Applied when market prices are distorted or absent |

| Basis | Market prices adjusted for externalities | Estimated prices based on opportunity cost or social value |

| Outcome | Net present value or benefit-cost ratio | Accurate valuation for policy analysis and project appraisal |

| Limitations | May ignore non-monetary impacts and distributional effects | Requires assumptions and expert judgment, can be subjective |

Introduction to Cost-Benefit Analysis and Shadow Pricing

Cost-benefit analysis evaluates the total expected costs versus benefits of a project to determine its feasibility and economic value, relying on market prices to quantify impacts. Shadow pricing assigns monetary values to goods or services without explicit market prices, reflecting true social opportunity costs and enabling more accurate project appraisals. Integrating shadow pricing within cost-benefit analysis improves decision-making by capturing externalities and non-market factors critical for comprehensive economic evaluation.

Key Principles of Cost-Benefit Analysis

Cost-benefit analysis evaluates projects by comparing total expected costs against anticipated benefits, emphasizing quantifiable financial metrics and opportunity costs. It requires assigning monetary values to both tangible and intangible effects to determine net economic value and maximize social welfare. Accurate discounting of future costs and benefits ensures time-comparable measurements, which distinguishes it from shadow pricing that adjusts prices to reflect true social opportunity costs in market distortions.

Understanding Shadow Pricing: Definition and Importance

Shadow pricing is a technique used to assign monetary values to non-market goods or services, reflecting their true economic worth in cost-benefit analysis. It plays a crucial role in evaluating projects with externalities or intangible impacts by providing a more accurate measure of costs and benefits that are not captured by market prices. Understanding shadow pricing enhances decision-making by incorporating social and environmental factors, leading to more efficient resource allocation.

Main Differences Between Cost-Benefit Analysis and Shadow Pricing

Cost-benefit analysis (CBA) evaluates the overall economic worth of a project by comparing total expected costs with total expected benefits, emphasizing market prices or direct monetary values. Shadow pricing assigns monetary values to goods or services that lack market prices, capturing their true economic value by estimating opportunity costs or social benefits. The main difference lies in CBA's reliance on observable prices and explicit benefits while shadow pricing adjusts or creates values to reflect hidden or non-market impacts, enhancing decision-making accuracy in resource allocation.

When to Use Cost-Benefit Analysis vs. Shadow Pricing

Cost-benefit analysis is ideal for assessing projects with readily quantifiable monetary values, providing a clear comparison of total expected costs and benefits to determine feasibility. Shadow pricing is used when market prices are distorted or unavailable, assigning alternative values to goods or services to reflect their true economic worth in project appraisal. Use cost-benefit analysis for straightforward, market-based decisions and shadow pricing when evaluating social projects or externalities lacking explicit pricing.

Advantages of Incorporating Shadow Prices

Incorporating shadow prices within cost-benefit analysis enhances decision-making accuracy by reflecting the true economic value of goods and services that lack market prices, such as environmental impacts or social costs. Shadow pricing improves resource allocation by capturing externalities and opportunity costs, leading to more efficient and equitable project evaluations. This approach provides policymakers with a clearer understanding of long-term benefits and trade-offs, supporting sustainable development objectives.

Limitations of Cost-Benefit Analysis and Shadow Pricing

Cost-benefit analysis faces limitations such as difficulty in quantifying intangible benefits, potential bias in valuation, and challenges in accounting for distributional effects. Shadow pricing, while useful for assigning monetary values to non-market goods, often relies on assumptions and estimations that may lack accuracy and consistency. Both methods struggle with uncertainty and subjective judgments, which can affect the reliability of economic evaluations in policy and project decision-making.

Real-World Applications: Case Studies

Cost-benefit analysis and shadow pricing are widely applied in infrastructure and environmental projects to evaluate economic efficiency and social impact. For example, transportation projects often use shadow pricing to account for externalities such as pollution and congestion, providing a more accurate social cost estimation beyond market prices. Case studies from renewable energy initiatives reveal that integrating shadow prices in cost-benefit frameworks better captures long-term environmental benefits and opportunity costs, enhancing policy decision-making.

Best Practices for Integrating Both Methods

Integrating cost-benefit analysis and shadow pricing requires establishing clear valuation criteria that reflect both market and non-market values, ensuring comprehensive assessment of project impacts. Best practices involve utilizing shadow prices to assign monetary values to intangible benefits or externalities that traditional cost-benefit analysis might overlook, enhancing decision-making accuracy. Consistent documentation and sensitivity analysis are essential to validate assumptions and improve the robustness of combined evaluations.

Conclusion: Making Informed Economic Decisions

Cost-benefit analysis provides a structured approach to evaluate the financial feasibility of projects by comparing total expected costs and benefits, while shadow pricing assigns monetary values to non-market goods and externalities, enhancing the accuracy of economic evaluations. Combining both methods ensures that decision-makers capture hidden social costs and benefits often overlooked in traditional financial analysis. This integrated approach leads to more informed economic decisions, promoting efficient resource allocation and maximizing social welfare.

Cost-benefit analysis Infographic

libterm.com

libterm.com