A flat tax system applies a single constant tax rate to all levels of income, simplifying the tax code and potentially increasing transparency. It eliminates brackets and deductions, creating a straightforward approach that can encourage economic growth and reduce compliance costs. Discover how a flat tax could impact your finances and the broader economy by reading the rest of this article.

Table of Comparison

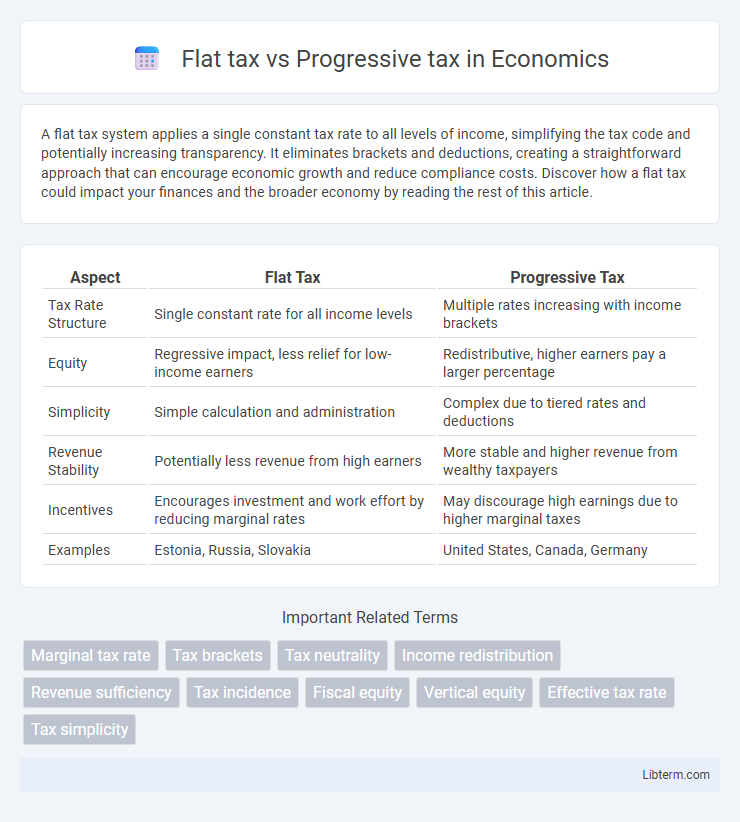

| Aspect | Flat Tax | Progressive Tax |

|---|---|---|

| Tax Rate Structure | Single constant rate for all income levels | Multiple rates increasing with income brackets |

| Equity | Regressive impact, less relief for low-income earners | Redistributive, higher earners pay a larger percentage |

| Simplicity | Simple calculation and administration | Complex due to tiered rates and deductions |

| Revenue Stability | Potentially less revenue from high earners | More stable and higher revenue from wealthy taxpayers |

| Incentives | Encourages investment and work effort by reducing marginal rates | May discourage high earnings due to higher marginal taxes |

| Examples | Estonia, Russia, Slovakia | United States, Canada, Germany |

Understanding Flat Tax Systems

Flat tax systems impose a single constant tax rate on all income levels, simplifying tax filing and reducing administrative costs. This approach aims to encourage economic growth by eliminating higher marginal tax rates that can discourage investment and work effort. Critics argue flat taxes may disproportionately benefit higher earners while reducing government revenue needed for social programs.

Key Features of Progressive Taxation

Progressive taxation imposes higher tax rates on higher income brackets, ensuring that individuals with greater earnings contribute a larger percentage of their income in taxes. This system aims to reduce income inequality by redistributing wealth and funding social programs that benefit lower-income groups. Key features include graduated tax rates, tax brackets, and deductions that adjust tax liability according to the taxpayer's ability to pay.

Historical Background of Flat and Progressive Taxes

Flat tax systems trace their roots to early 20th-century reforms, with notable implementation in Eastern European countries like Estonia during the 1990s to simplify taxation and promote economic growth. Progressive taxation has a longer history, originating in the 19th century, with the United States introducing its first federal income tax in 1913, designed to impose higher rates on wealthier individuals to address income inequality. Both tax structures evolved in response to changing economic theories and social policies aimed at balancing revenue needs with fairness and efficiency.

Economic Impact of Flat Tax vs Progressive Tax

A flat tax system, applying a single tax rate to all income levels, tends to simplify tax compliance and can stimulate investment by increasing post-tax income for high earners, which may boost economic growth but risks increasing income inequality. Progressive tax structures impose higher rates on higher income brackets, promoting income redistribution and funding public services that support social welfare and human capital development, potentially enhancing overall economic productivity. Empirical studies indicate that while flat taxes may encourage entrepreneurship, progressive taxes can stabilize economies by reducing disparities and fostering consumer demand through increased disposable income for lower and middle-income groups.

Tax Fairness: Which System is More Equitable?

Flat tax applies a single tax rate to all income levels, promoting simplicity but often criticized for disproportionately benefiting higher earners. Progressive tax increases rates with income, aiming to reduce income inequality by taxing wealthier individuals at higher percentages. Studies show progressive taxation generally achieves greater tax fairness by aligning tax burden with taxpayers' ability to pay.

Effects on Income Inequality

A flat tax system applies a single tax rate to all income levels, often decreasing the tax burden on higher earners and potentially widening income inequality by limiting government revenue for redistributive programs. Progressive tax rates increase tax percentages as income rises, enabling wealth redistribution that can reduce income inequality by funding social services and public investments targeting lower-income groups. Studies indicate that countries with progressive tax systems generally experience lower levels of income inequality compared to those relying primarily on flat tax structures.

Administrative Simplicity: Flat vs Progressive Tax

Flat tax systems offer significant administrative simplicity by implementing a single tax rate across all income levels, reducing complexity in calculation, filing, and enforcement. Progressive tax systems require multiple tax brackets and rates, increasing administrative burden due to the need for precise income categorization and additional compliance measures. This complexity often results in higher costs for tax authorities and taxpayers alike, complicating verification and increasing potential for errors.

Global Examples of Tax Models

Flat tax systems, such as those in Estonia and Russia, apply a uniform tax rate across all income levels, promoting simplicity and transparency in tax administration. Progressive tax models, seen in countries like the United States and Sweden, impose higher tax rates on higher income brackets to enhance income redistribution and reduce inequality. Both tax structures impact government revenue, economic growth, and social equity differently, reflecting diverse national fiscal priorities and economic strategies.

Policy Debates and Public Opinion

Policy debates on flat tax versus progressive tax center around economic equity and efficiency, with proponents of flat tax arguing for simplicity and stimulation of growth, while advocates of progressive tax emphasize fairness and wealth redistribution. Public opinion tends to vary by income level and political affiliation, often showing greater support for progressive taxation among lower-income groups and Democrats, whereas higher-income earners and Republicans may favor flat tax structures for reduced tax burdens. Empirical studies suggest that public attitudes reflect concerns about social justice, government revenue needs, and economic impacts of taxation policies.

Choosing the Right Tax System for Economic Growth

Choosing the right tax system for economic growth involves evaluating flat tax and progressive tax models based on their impact on investment incentives and income distribution. Flat tax systems offer simplicity and encourage investment by applying a uniform rate, potentially boosting entrepreneurship and economic expansion. Progressive tax systems aim to reduce income inequality and fund public services, which can enhance social stability but may deter high earners from additional income generation.

Flat tax Infographic

libterm.com

libterm.com