Recession refers to a significant decline in economic activity lasting for months or even years, characterized by decreased GDP, rising unemployment, and reduced consumer spending. Understanding the causes and effects of recessions can help you prepare and adapt your financial strategies effectively. Explore the rest of this article to learn how to navigate the challenges of a recession and safeguard your economic well-being.

Table of Comparison

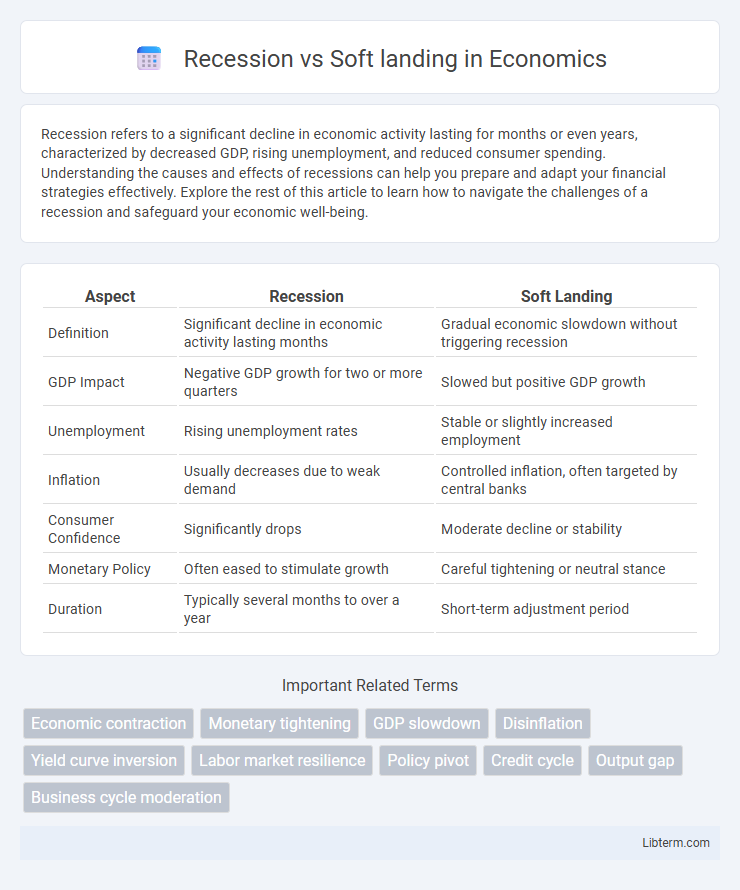

| Aspect | Recession | Soft Landing |

|---|---|---|

| Definition | Significant decline in economic activity lasting months | Gradual economic slowdown without triggering recession |

| GDP Impact | Negative GDP growth for two or more quarters | Slowed but positive GDP growth |

| Unemployment | Rising unemployment rates | Stable or slightly increased employment |

| Inflation | Usually decreases due to weak demand | Controlled inflation, often targeted by central banks |

| Consumer Confidence | Significantly drops | Moderate decline or stability |

| Monetary Policy | Often eased to stimulate growth | Careful tightening or neutral stance |

| Duration | Typically several months to over a year | Short-term adjustment period |

Understanding Recession and Soft Landing

A recession is defined as a significant decline in economic activity across the economy lasting more than a few months, typically identified by a drop in GDP, employment, and retail sales. A soft landing occurs when an economy slows down just enough to curb inflation without triggering a recession, maintaining steady growth and low unemployment. Policymakers aim for a soft landing to avoid the adverse effects of recession while stabilizing economic expansion.

Key Differences Between Recession and Soft Landing

A recession is defined by a significant decline in economic activity lasting more than a few months, characterized by falling GDP, rising unemployment, and reduced consumer spending. In contrast, a soft landing occurs when an economy slows its growth to prevent overheating without entering a recession, maintaining stable employment and moderate GDP growth. Key differences include the depth of economic contraction, duration of negative impact, and overall market confidence, with recessions causing widespread economic distress while soft landings allow for controlled adjustments.

Economic Indicators to Watch

Key economic indicators to watch when distinguishing a recession from a soft landing include GDP growth rates, unemployment levels, and inflation trends. A recession typically features consecutive quarters of negative GDP growth, rising unemployment rates above natural levels, and deflationary or disinflationary pressures. In contrast, a soft landing exhibits slowing but positive GDP growth, stable or slightly increased employment, and controlled inflation, signaling an economy that avoids contraction while easing overheating risks.

Causes of Recession vs Soft Landing

Recession is primarily caused by significant declines in consumer spending, high unemployment rates, and tightening monetary policies that reduce economic activity. In contrast, a soft landing occurs when central banks strategically slow down economic growth to curb inflation without triggering a contraction or a surge in job losses. Key factors in a soft landing include gradual interest rate hikes and stable demand that prevent abrupt downturns in GDP or investment.

Historical Examples and Lessons

Historical examples of recessions, such as the Great Depression of the 1930s and the 2008 Global Financial Crisis, highlight severe economic contractions characterized by high unemployment and widespread business failures. Soft landings, exemplified by the Federal Reserve's managed slowdown in the mid-1990s, demonstrate successfully avoiding recession while slowing growth and controlling inflation. Key lessons emphasize the importance of timely monetary policy adjustments and cautious fiscal measures to steer economies away from deep recessions toward sustainable growth trajectories.

Impact on Financial Markets

Recession typically triggers widespread declines in stock prices, increased volatility, and a flight to safe-haven assets such as government bonds and gold, reflecting investor fear and uncertainty. In contrast, a soft landing--characterized by slowed economic growth without entering a deep downturn--leads to more stable or gradually adjusted financial markets, with moderate corrections in equities and controlled bond yield movements. Central banks' monetary policies during these periods heavily influence market reactions, as rate cuts often support recovery in recessions while cautious tightening may occur during soft landings.

Effects on Employment and Wages

Recession typically causes significant rises in unemployment rates and downward pressure on wages due to decreased demand for labor and cost-cutting measures by employers. In contrast, a soft landing allows employment levels to stabilize or experience minor fluctuations, with wages maintaining steady growth as businesses adjust more gradually to economic shifts. Understanding these distinctions highlights the critical impact of economic conditions on labor market dynamics and income stability.

Role of Central Banks and Policymakers

Central banks and policymakers play a critical role in steering the economy towards a soft landing by adjusting interest rates, managing inflation expectations, and deploying targeted fiscal measures to sustain growth while avoiding a recession. They utilize monetary policy tools such as quantitative easing or tightening to influence liquidity and credit conditions, aiming to balance supply-demand dynamics without triggering high unemployment or asset bubbles. Effective communication and forward guidance from central banks are essential in shaping market expectations and maintaining financial stability during economic transitions.

Business Strategies in Each Scenario

In a recession, businesses prioritize cost-cutting measures, such as reducing operational expenses and streamlining workforce, to maintain liquidity and survive declining demand. During a soft landing, companies focus on strategic investments and innovation to capitalize on stable market conditions while cautiously managing risks. Adapting marketing strategies to consumer sentiment shifts and optimizing supply chain efficiency are critical in both scenarios for sustaining competitive advantage.

Preparing for Economic Uncertainty

Preparing for economic uncertainty involves understanding the differences between a recession and a soft landing, with a recession indicating a significant decline in economic activity and a soft landing representing a controlled slowdown without contraction. Businesses and investors should focus on diversifying portfolios, maintaining strong liquidity, and implementing risk management strategies to withstand potential market volatility. Strategic planning that includes stress testing financial models and monitoring key economic indicators like GDP, unemployment rates, and consumer spending can enhance resilience during economic fluctuations.

Recession Infographic

libterm.com

libterm.com