A multi-factor model uses multiple variables or factors to explain the returns of an investment, helping to identify the sources of risk and return more precisely than single-factor models. By analyzing factors such as market risk, size, value, and momentum, investors can better understand how different elements influence portfolio performance. Explore the rest of the article to discover how a multi-factor model can enhance your investment strategy.

Table of Comparison

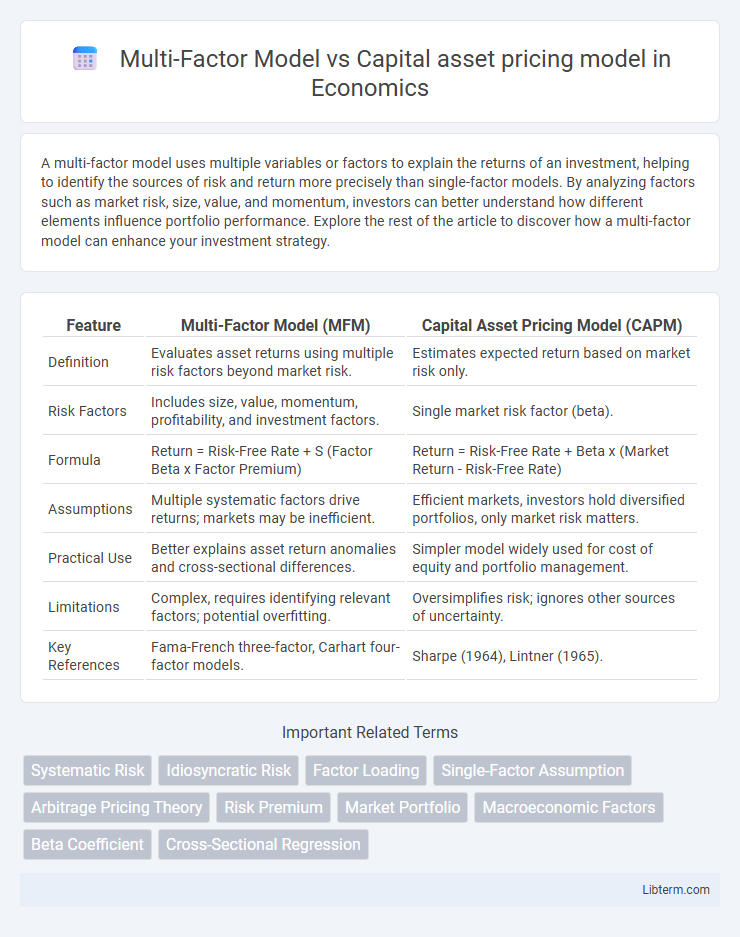

| Feature | Multi-Factor Model (MFM) | Capital Asset Pricing Model (CAPM) |

|---|---|---|

| Definition | Evaluates asset returns using multiple risk factors beyond market risk. | Estimates expected return based on market risk only. |

| Risk Factors | Includes size, value, momentum, profitability, and investment factors. | Single market risk factor (beta). |

| Formula | Return = Risk-Free Rate + S (Factor Beta x Factor Premium) | Return = Risk-Free Rate + Beta x (Market Return - Risk-Free Rate) |

| Assumptions | Multiple systematic factors drive returns; markets may be inefficient. | Efficient markets, investors hold diversified portfolios, only market risk matters. |

| Practical Use | Better explains asset return anomalies and cross-sectional differences. | Simpler model widely used for cost of equity and portfolio management. |

| Limitations | Complex, requires identifying relevant factors; potential overfitting. | Oversimplifies risk; ignores other sources of uncertainty. |

| Key References | Fama-French three-factor, Carhart four-factor models. | Sharpe (1964), Lintner (1965). |

Introduction to Asset Pricing Models

Multi-factor models capture multiple sources of risk by incorporating various factors like size, value, and momentum, enhancing the explanatory power of asset returns beyond the single systematic risk factor used in the Capital Asset Pricing Model (CAPM). CAPM estimates expected returns based on the asset's sensitivity to market risk, represented by beta, assuming a linear relationship between risk and return. Multi-factor models provide a more nuanced framework by accounting for diverse risk premia, improving portfolio management and asset valuation accuracy.

Overview of the Capital Asset Pricing Model (CAPM)

The Capital Asset Pricing Model (CAPM) quantifies the relationship between expected return and systematic risk using the beta coefficient, representing an asset's sensitivity to market movements. CAPM assumes a single-factor market portfolio as the source of risk, emphasizing the trade-off between risk and return in a simplified framework. This model enables investors to estimate the cost of equity by incorporating the risk-free rate, beta, and expected market return.

Core Assumptions of CAPM

The Capital Asset Pricing Model (CAPM) assumes that investors are rational and risk-averse, markets are frictionless with no taxes or transaction costs, and all investors have homogeneous expectations about asset returns, variances, and covariances. CAPM further presumes the existence of a risk-free rate and that asset returns are driven by a single market factor representing systematic risk. In contrast, Multi-Factor Models relax these assumptions by incorporating multiple sources of systematic risk beyond the market factor, capturing a broader range of factors influencing asset returns.

Basics of Multi-Factor Models

Multi-Factor Models enhance the Capital Asset Pricing Model (CAPM) by incorporating multiple risk factors such as size, value, and momentum to explain asset returns more accurately. These models use factors derived from macroeconomic variables or firm-specific characteristics to capture diverse sources of systematic risk beyond the single market factor in CAPM. By addressing multifaceted influences on asset prices, Multi-Factor Models provide a more comprehensive framework for portfolio risk assessment and expected return estimation.

Key Differences Between CAPM and Multi-Factor Models

The Capital Asset Pricing Model (CAPM) relies on a single factor--the market risk premium--to explain asset returns, whereas Multi-Factor Models incorporate multiple systematic risk factors such as size, value, and momentum to better capture the complexity of return drivers. CAPM assumes a linear relationship between expected returns and beta, while Multi-Factor Models allow for additional variables that explain variations in returns beyond market risk alone. Empirical evidence shows Multi-Factor Models often provide higher explanatory power and improved risk-adjusted performance predictions compared to the simplistic framework of CAPM.

Advantages and Limitations of CAPM

The Capital Asset Pricing Model (CAPM) offers the advantage of simplicity and ease of use by relying on a single factor, beta, to explain asset returns, making it a foundational tool in finance for estimating expected returns and assessing risk. However, CAPM's limitation lies in its reliance on assumptions such as market efficiency and a single risk factor, which often results in oversimplification and inaccurate predictions in diverse market conditions. Multi-factor models address these limitations by incorporating multiple systematic risk factors, improving explanatory power and providing a more comprehensive understanding of asset pricing.

Strengths and Weaknesses of Multi-Factor Models

Multi-factor models improve asset pricing accuracy by incorporating multiple systematic risk factors beyond market risk, capturing dimensions like size, value, and momentum that CAPM overlooks. These models offer enhanced explanatory power and better risk management for diverse portfolios but require more complex data estimation and may face overfitting challenges. Their reliance on correctly identifying relevant factors also introduces the risk of model misspecification and increased computational demands compared to the single-factor CAPM.

Empirical Performance: CAPM vs Multi-Factor Models

Multi-Factor Models outperform the Capital Asset Pricing Model (CAPM) in empirical performance by explaining a larger portion of the cross-sectional variance in asset returns through multiple risk factors such as size, value, and momentum. Empirical studies demonstrate that CAPM's single beta factor often fails to capture anomalies and provides less accurate expected returns compared to Multi-Factor Models like the Fama-French three-factor or Carhart four-factor models. The enhanced explanatory power of Multi-Factor Models leads to better risk-adjusted performance evaluation and portfolio management decisions in real-world financial markets.

Practical Applications in Portfolio Management

Multi-Factor Models offer enhanced risk assessment and return forecasting by incorporating multiple sources of systematic risk such as size, value, and momentum factors, providing portfolio managers with a nuanced understanding of asset behavior compared to the singular market risk factor in the Capital Asset Pricing Model (CAPM). These models improve portfolio construction by enabling more precise factor-based exposure targeting and risk diversification, leading to optimized asset allocation strategies. CAPM remains useful for estimating expected returns based on market risk but often underperforms in explaining variations in asset returns, limiting its effectiveness in complex portfolio management scenarios.

Choosing the Right Model for Asset Pricing

Selecting the appropriate asset pricing model depends on the complexity and factors influencing the investment portfolio. Multi-Factor Models incorporate multiple systematic risk factors--such as size, value, and momentum--providing a nuanced risk-return analysis, ideal for diversified portfolios or specific asset classes. The Capital Asset Pricing Model (CAPM) uses a single market risk factor, making it simpler but less precise for portfolios affected by multiple sources of risk.

Multi-Factor Model Infographic

libterm.com

libterm.com