An organized market operates under regulated rules and centralized trading platforms that ensure transparency, liquidity, and fair pricing for commodities, securities, or financial instruments. Such structured environments protect investors and facilitate efficient price discovery through standardized contracts and reliable settlement mechanisms. Explore the article to understand how organized markets can impact your trading strategies and investment decisions.

Table of Comparison

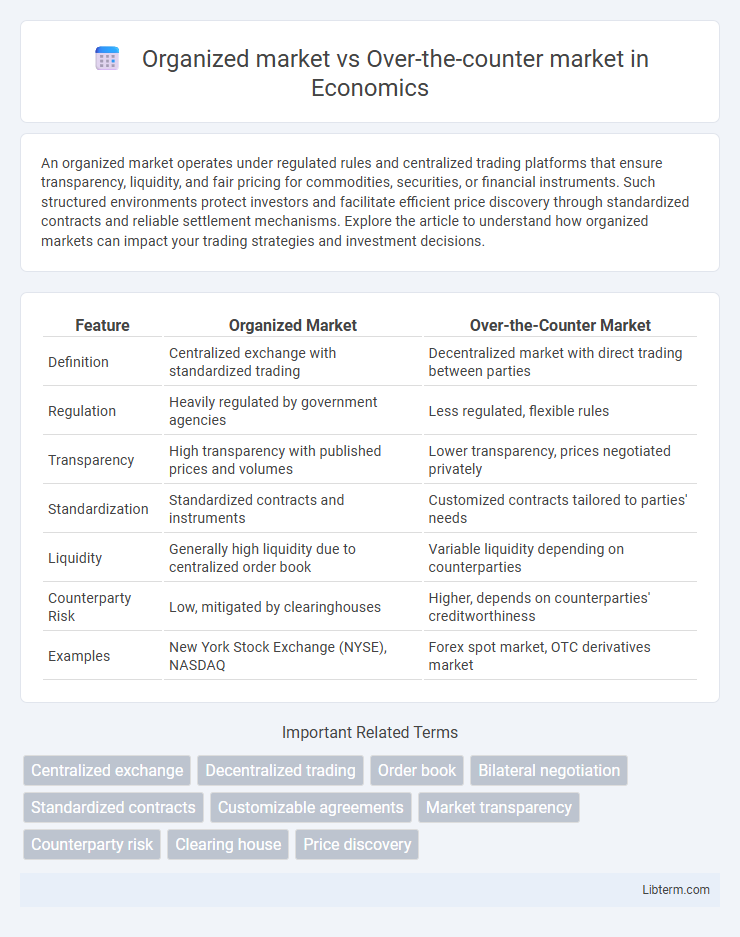

| Feature | Organized Market | Over-the-Counter Market |

|---|---|---|

| Definition | Centralized exchange with standardized trading | Decentralized market with direct trading between parties |

| Regulation | Heavily regulated by government agencies | Less regulated, flexible rules |

| Transparency | High transparency with published prices and volumes | Lower transparency, prices negotiated privately |

| Standardization | Standardized contracts and instruments | Customized contracts tailored to parties' needs |

| Liquidity | Generally high liquidity due to centralized order book | Variable liquidity depending on counterparties |

| Counterparty Risk | Low, mitigated by clearinghouses | Higher, depends on counterparties' creditworthiness |

| Examples | New York Stock Exchange (NYSE), NASDAQ | Forex spot market, OTC derivatives market |

Introduction to Financial Markets

Financial markets consist of organized markets and over-the-counter (OTC) markets, each serving distinct trading needs. Organized markets, such as stock exchanges like the NYSE and NASDAQ, provide centralized platforms with standardized contracts, transparent pricing, and regulatory oversight. In contrast, OTC markets facilitate direct trading of customized financial instruments like derivatives and bonds, offering flexibility but with less transparency and higher counterparty risk.

Definition of Organized Markets

Organized markets, also known as formal exchanges, are centralized platforms where financial instruments such as stocks, bonds, and commodities are traded under strict regulatory supervision and standardized rules. These markets provide transparent price discovery, liquidity, and reduced counterparty risk due to the presence of clearinghouses and regulatory oversight. Examples include the New York Stock Exchange (NYSE) and the Chicago Mercantile Exchange (CME), which facilitate structured trading environments with established trading sessions and market participants.

Definition of Over-the-Counter (OTC) Markets

Over-the-Counter (OTC) markets are decentralized trading platforms where financial instruments such as stocks, bonds, commodities, and derivatives are traded directly between parties without a centralized exchange. Unlike organized markets, OTC trading occurs through dealer networks or electronic platforms, allowing customized contracts and flexible transaction terms. OTC markets facilitate liquidity for securities not listed on formal exchanges, often involving less regulation and higher counterparty risk.

Key Features of Organized Markets

Organized markets feature centralized trading venues such as stock exchanges with standardized contracts and stringent regulatory oversight, ensuring transparency and investor protection. They facilitate high liquidity and efficient price discovery through continuous price quotations and a large number of market participants. Market participants benefit from standardized settlement procedures, clear rules, and real-time information dissemination that reduce counterparty risk.

Key Features of OTC Markets

Over-the-counter (OTC) markets are decentralized platforms where trading occurs directly between parties without a centralized exchange, allowing for greater flexibility in terms and instruments. Key features include less stringent regulatory requirements, a wide range of securities such as stocks, bonds, and derivatives, and continuous price negotiation. OTC markets often cater to smaller or less liquid securities, providing access for companies unable to meet exchange listing standards.

Regulation and Transparency Differences

Organized markets, such as stock exchanges, are highly regulated by governmental bodies like the SEC, enforcing strict transparency through mandatory reporting and standardized trading practices. Over-the-counter (OTC) markets operate with less regulatory oversight, often lacking centralized exchanges and reduced disclosure requirements, resulting in lower transparency. This regulatory disparity impacts investor protection and the reliability of information available for trading decisions in each market type.

Risk Factors in Each Market

Risk factors in organized markets include standardized contracts and regulated environments that reduce counterparty risk but expose participants to market risk due to price volatility and liquidity constraints. Over-the-counter (OTC) markets carry increased counterparty risk as trades are private and less regulated, with a higher chance of default or dispute, alongside potential issues of transparency and price manipulation. Both markets require robust risk management practices, but OTC participants must particularly emphasize credit risk assessment and contractual safeguards.

Liquidity and Accessibility Comparison

Organized markets, such as stock exchanges, offer higher liquidity due to the concentration of buyers and sellers, enabling faster and more efficient trade execution. Over-the-counter (OTC) markets typically exhibit lower liquidity, as transactions occur directly between parties without a centralized exchange, leading to wider bid-ask spreads and potentially longer execution times. Accessibility in organized markets is generally broader, with standardized trading platforms and regulatory oversight, whereas OTC markets require specialized knowledge and are often limited to institutional or accredited investors.

Advantages and Disadvantages: Organized vs OTC

Organized markets offer high transparency, regulated trading environments, and standardized contracts, providing investors with liquidity and reduced counterparty risk. Over-the-counter (OTC) markets provide flexibility with customized contracts and access to less liquid or niche assets but carry higher counterparty risk and lower price transparency. The trade-off between organized exchanges and OTC markets revolves around regulatory oversight, market liquidity, and contract standardization, influencing investor protection and transaction costs.

Conclusion: Choosing the Right Market

Choosing the right market depends on factors like regulatory oversight, transparency, and risk tolerance. Organized markets offer standardized contracts and greater liquidity, making them ideal for investors seeking regulated environments and price stability. Over-the-counter markets provide flexibility and customized agreements, suited for those willing to accept higher counterparty risk in exchange for tailored trading solutions.

Organized market Infographic

libterm.com

libterm.com