The Fisher effect describes the relationship between nominal interest rates, real interest rates, and expected inflation, explaining how inflation expectations influence interest rates. Understanding this effect helps you anticipate changes in borrowing costs and investment returns as inflation fluctuates. Explore the rest of the article to learn how the Fisher effect impacts your financial decisions.

Table of Comparison

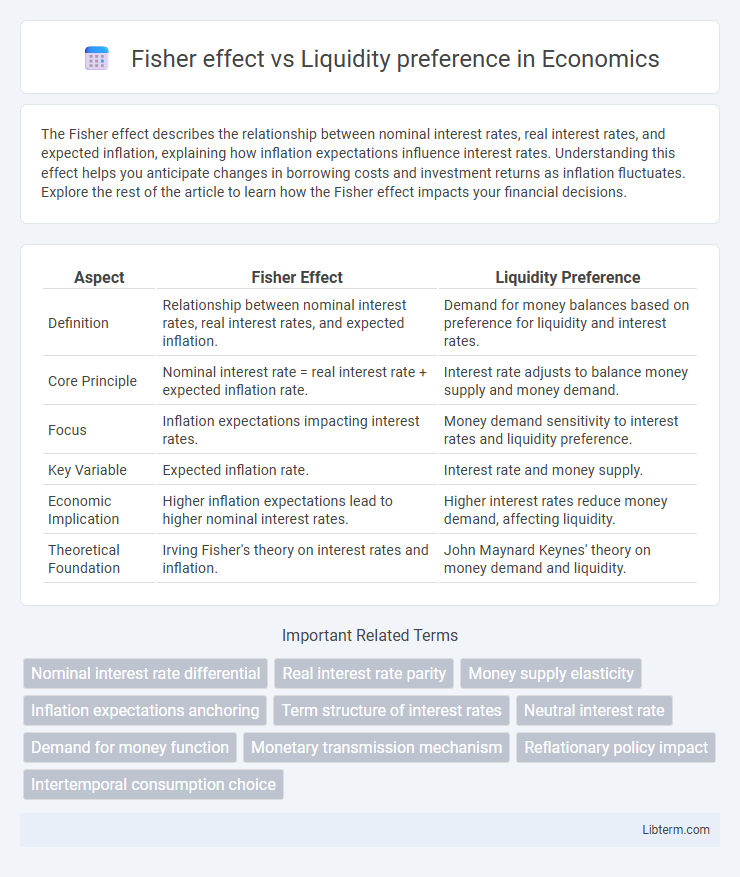

| Aspect | Fisher Effect | Liquidity Preference |

|---|---|---|

| Definition | Relationship between nominal interest rates, real interest rates, and expected inflation. | Demand for money balances based on preference for liquidity and interest rates. |

| Core Principle | Nominal interest rate = real interest rate + expected inflation rate. | Interest rate adjusts to balance money supply and money demand. |

| Focus | Inflation expectations impacting interest rates. | Money demand sensitivity to interest rates and liquidity preference. |

| Key Variable | Expected inflation rate. | Interest rate and money supply. |

| Economic Implication | Higher inflation expectations lead to higher nominal interest rates. | Higher interest rates reduce money demand, affecting liquidity. |

| Theoretical Foundation | Irving Fisher's theory on interest rates and inflation. | John Maynard Keynes' theory on money demand and liquidity. |

Introduction to the Fisher Effect

The Fisher Effect explains the relationship between nominal interest rates, real interest rates, and inflation, stating that nominal rates adjust to expected inflation to maintain consistent real returns. This economic theory, proposed by economist Irving Fisher, highlights how inflation expectations are embedded in interest rates, influencing borrowing and lending decisions. Understanding the Fisher Effect is crucial for interpreting monetary policy impacts and the behavior of financial markets under varying inflation conditions.

Overview of Liquidity Preference Theory

Liquidity Preference Theory posits that investors demand a premium for holding less liquid assets, influencing interest rates based on money supply and demand. Unlike the Fisher Effect, which links nominal interest rates to expected inflation, Liquidity Preference emphasizes cash's desirability for transactions and precautionary motives. This theory explains short-term interest rate fluctuations driven by changes in money market equilibrium rather than solely inflation expectations.

Historical Background of Both Concepts

The Fisher effect, formulated by economist Irving Fisher in the early 20th century, explains the relationship between nominal interest rates, real interest rates, and expected inflation, shaping modern monetary theory. Liquidity preference theory was introduced by John Maynard Keynes during the 1930s Great Depression, emphasizing the demand for money based on liquidity and its influence on interest rates. Both concepts evolved to address different economic conditions, with the Fisher effect focusing on inflation expectations and liquidity preference on money demand during economic downturns.

Key Assumptions of the Fisher Effect

The Fisher Effect is based on key assumptions including a constant real interest rate and rational expectations about inflation, meaning nominal interest rates adjust one-for-one with expected inflation to maintain real returns. It presumes perfect information and markets that efficiently reflect inflation expectations in nominal interest rates. Unlike the Liquidity Preference theory, which emphasizes money demand and short-term interest rate determination, the Fisher Effect centers on the long-term relationship between nominal interest rates and inflation.

Core Principles of Liquidity Preference

The Core Principles of Liquidity Preference revolve around the idea that investors demand higher interest rates for holding less liquid assets to compensate for the risk of not being able to quickly convert those assets into cash. This contrasts with the Fisher effect, which emphasizes the relationship between nominal interest rates, real interest rates, and expected inflation, suggesting that nominal rates adjust to maintain the real rate constant. Liquidity preference theory highlights the importance of money's liquidity and investors' preference for short-term, liquid assets, influencing interest rates independently of inflation expectations.

Mathematical Representation and Formulas

The Fisher effect is mathematically expressed as \( i = r + \pi^e \), where \( i \) is the nominal interest rate, \( r \) is the real interest rate, and \( \pi^e \) is the expected inflation rate. Liquidity preference theory models the nominal interest rate \( i \) as a function of money demand and supply, often represented by the equation \( M/P = L(i, Y) \), where \( M \) is money supply, \( P \) is price level, \( L \) is liquidity preference, and \( Y \) is income. While the Fisher effect focuses on the relationship between inflation and interest rates, liquidity preference incorporates money market equilibrium to explain interest rate determination.

Impact on Interest Rate Determination

The Fisher effect links nominal interest rates directly to expected inflation and real interest rates, asserting that nominal rates rise one-to-one with inflation expectations, which influences long-term interest rate determination. In contrast, the liquidity preference theory emphasizes short-term interest rate setting based on money demand and supply, where higher liquidity preference raises interest rates to balance money markets. Understanding the Fisher effect aids in predicting shifts in inflation expectations' impact on interest rates, while liquidity preference explains fluctuations driven by immediate monetary conditions.

Role of Inflation Expectations

The Fisher effect posits that nominal interest rates adjust one-for-one with expected inflation, reflecting investors' anticipation of inflation in their required returns. Liquidity preference theory emphasizes the demand for money as a function of liquidity needs and interest rates, with inflation expectations influencing money-holding behavior and the opportunity cost of holding cash. Inflation expectations therefore play a crucial role by shaping both nominal interest rates in the Fisher effect and money demand in liquidity preference theory, linking inflation forecasts to financial decision-making.

Practical Applications in Modern Economics

The Fisher effect explains the relationship between nominal interest rates, real interest rates, and expected inflation, guiding central banks in setting inflation targets to stabilize economies. Liquidity preference theory informs monetary policy by highlighting how demand for money balances fluctuates with interest rates, influencing short-term interest rate adjustments and liquidity provision. Practical applications of these theories help policymakers balance inflation control and liquidity management to promote economic growth and financial stability.

Comparative Analysis: Fisher Effect vs Liquidity Preference

The Fisher Effect emphasizes the relationship between nominal interest rates, real interest rates, and expected inflation, suggesting nominal rates adjust primarily to inflation expectations. In contrast, Liquidity Preference theory focuses on the demand for money based on liquidity and interest rates, asserting that people prefer holding cash when rates are low and bond investments when rates rise. While Fisher Effect explains long-term interest rate trends influenced by inflation, Liquidity Preference highlights short-term interest rate fluctuations driven by money demand and supply.

Fisher effect Infographic

libterm.com

libterm.com