Output gap measures the difference between an economy's actual output and its potential output at full capacity. A positive output gap indicates overheating and inflation pressure, while a negative output gap signals underperformance and economic slack. Discover how understanding the output gap can help you assess economic health and policy effectiveness in the rest of this article.

Table of Comparison

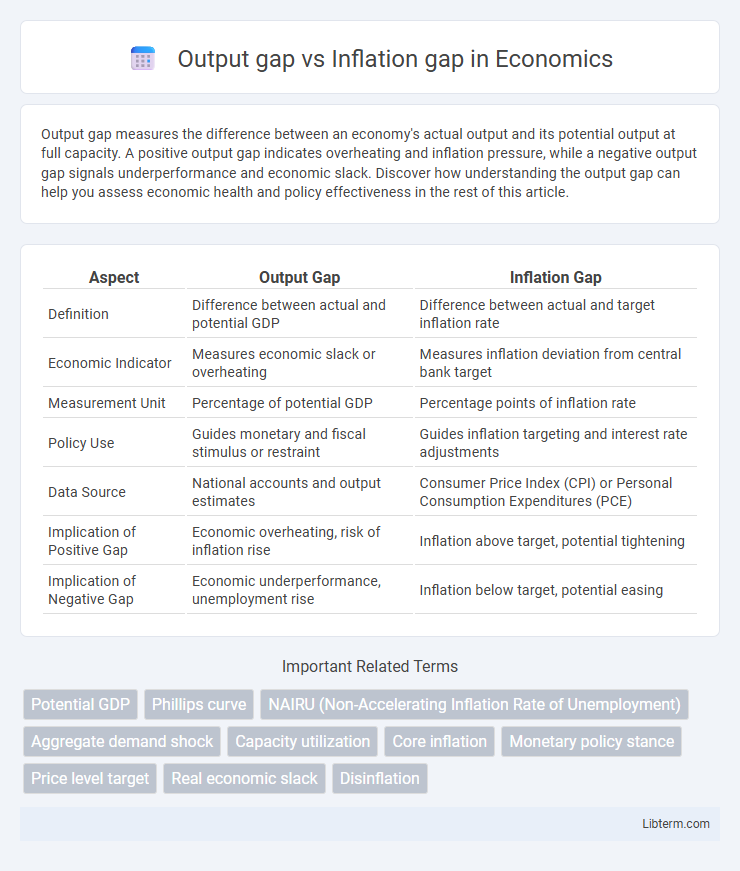

| Aspect | Output Gap | Inflation Gap |

|---|---|---|

| Definition | Difference between actual and potential GDP | Difference between actual and target inflation rate |

| Economic Indicator | Measures economic slack or overheating | Measures inflation deviation from central bank target |

| Measurement Unit | Percentage of potential GDP | Percentage points of inflation rate |

| Policy Use | Guides monetary and fiscal stimulus or restraint | Guides inflation targeting and interest rate adjustments |

| Data Source | National accounts and output estimates | Consumer Price Index (CPI) or Personal Consumption Expenditures (PCE) |

| Implication of Positive Gap | Economic overheating, risk of inflation rise | Inflation above target, potential tightening |

| Implication of Negative Gap | Economic underperformance, unemployment rise | Inflation below target, potential easing |

Understanding the Output Gap

The output gap measures the difference between actual GDP and potential GDP, indicating whether an economy is operating above or below its full capacity. A positive output gap suggests overheating with demand exceeding supply, leading to upward pressure on inflation, while a negative output gap signals underutilized resources and downward inflation pressure. Understanding the output gap is crucial for policymakers to gauge inflationary risks and adjust monetary policy to stabilize economic growth.

Defining the Inflation Gap

The inflation gap measures the difference between actual inflation and the target inflation rate set by central banks, reflecting the deviation from desired price stability. Unlike the output gap, which quantifies the difference between actual and potential economic output, the inflation gap directly indicates inflationary pressures or deflationary risks in the economy. Central banks monitor the inflation gap closely to adjust monetary policy for maintaining price stability and supporting sustainable economic growth.

Measuring Output Gap: Methods and Challenges

Measuring the output gap involves estimating the difference between actual and potential economic output, commonly using methods such as the production function approach, the Hodrick-Prescott filter, and the structural vector autoregression (SVAR) model. Key challenges include accurately determining potential output due to structural changes in the economy, data revisions, and the influence of short-term economic fluctuations that obscure trend estimation. Precise measurement of the output gap is crucial for understanding its relationship with the inflation gap and guiding monetary policy decisions.

Calculating Inflation Gap: Key Indicators

The inflation gap is calculated by measuring the difference between actual inflation and target inflation rates, often derived from consumer price index (CPI) data or the personal consumption expenditures (PCE) price index. Key indicators for calculating the inflation gap include core inflation rates, inflation expectations, and real-time inflation data from central banks such as the Federal Reserve or the European Central Bank. These metrics help economists assess monetary policy effectiveness and guide adjustments to interest rates aimed at stabilizing price levels.

Economic Implications of Output Gap

The output gap measures the difference between actual and potential economic output, serving as a key indicator of economic health and inflationary pressures. A positive output gap often signals an overheating economy, leading to demand-pull inflation, while a negative output gap indicates underutilized resources and suppressed inflation. Policymakers monitor the output gap to adjust monetary and fiscal policies, aiming to stabilize inflation and promote sustainable growth.

Inflation Gap and Monetary Policy

The inflation gap, defined as the difference between actual inflation and target inflation, directly influences central banks' monetary policy decisions aimed at stabilizing prices. When the inflation gap widens above the target, monetary authorities often implement contractionary policies, such as raising interest rates, to reduce inflationary pressures. Precise measurement of the inflation gap helps optimize policy tools for achieving inflation targets and sustaining economic growth.

Interaction Between Output Gap and Inflation Gap

The interaction between the output gap and inflation gap is crucial in macroeconomic analysis, as a positive output gap--where actual GDP exceeds potential GDP--typically leads to upward pressure on inflation due to increased demand. Conversely, a negative output gap signals underutilized resources, often resulting in below-target inflation or deflationary pressures. Central banks monitor these gaps closely to implement monetary policies that stabilize both economic growth and price levels.

Output Gap vs Inflation Gap: Key Differences

The output gap measures the difference between actual and potential economic output, indicating whether an economy is underperforming or overheating. The inflation gap, by contrast, reflects the difference between actual inflation and target inflation rates, highlighting deviations from price stability goals. Whereas the output gap directly relates to economic activity levels, the inflation gap focuses on discrepancies in price changes and monetary policy effectiveness.

Policy Responses to Output and Inflation Gaps

Monetary and fiscal policy responses to output gaps typically involve stimulus measures such as lowering interest rates or increasing government spending to boost economic activity during negative output gaps, while contractionary policies may be applied to cool an overheating economy in positive output gaps. Inflation gaps, defined by the divergence between actual inflation and target inflation, prompt central banks to adjust policy instruments like interest rates to anchor inflation expectations and maintain price stability. Effective management of both gaps requires finely tuned policy tools to balance growth objectives with inflation control, ensuring sustainable economic performance.

Real-World Examples and Case Studies

The output gap measures the difference between actual and potential GDP, while the inflation gap reflects the deviation of actual inflation from target inflation rates. For instance, during the 2008 financial crisis, the U.S. experienced a large negative output gap, leading to lower inflation rates, highlighting the inverse relationship between output gaps and inflation gaps. Similarly, Japan's persistent output gap and deflation since the 1990s illustrate how prolonged economic slack can sustain an inflation gap below zero despite monetary easing efforts.

Output gap Infographic

libterm.com

libterm.com