The house money effect describes the tendency for people to take greater risks with money they perceive as gained unexpectedly or not part of their original wealth. This phenomenon often leads individuals to make decisions they might avoid if they were using their own earned funds, impacting investment and gambling behaviors. Explore the rest of this article to understand how the house money effect influences your financial choices.

Table of Comparison

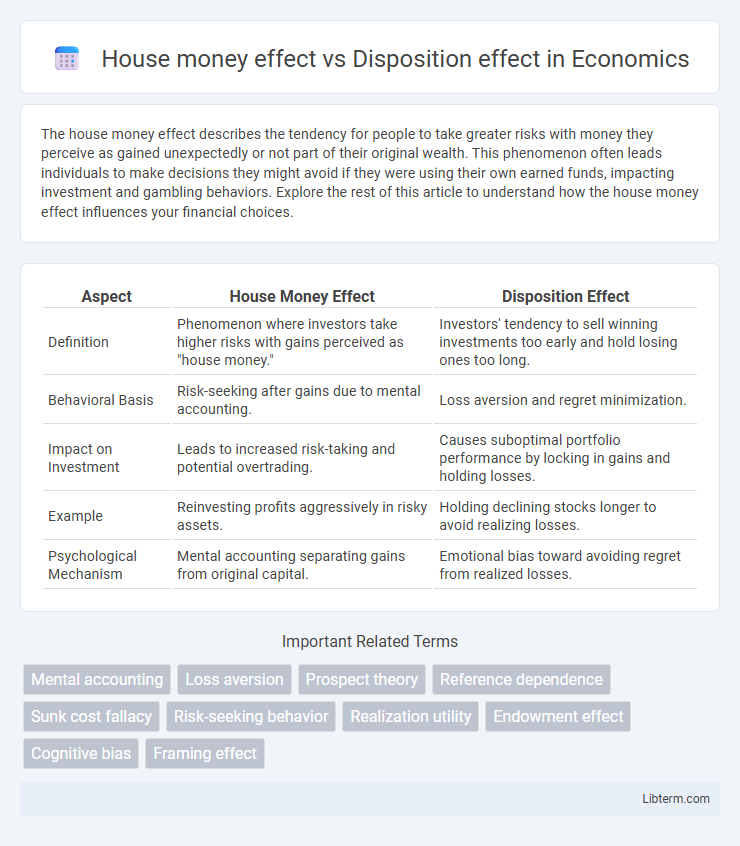

| Aspect | House Money Effect | Disposition Effect |

|---|---|---|

| Definition | Phenomenon where investors take higher risks with gains perceived as "house money." | Investors' tendency to sell winning investments too early and hold losing ones too long. |

| Behavioral Basis | Risk-seeking after gains due to mental accounting. | Loss aversion and regret minimization. |

| Impact on Investment | Leads to increased risk-taking and potential overtrading. | Causes suboptimal portfolio performance by locking in gains and holding losses. |

| Example | Reinvesting profits aggressively in risky assets. | Holding declining stocks longer to avoid realizing losses. |

| Psychological Mechanism | Mental accounting separating gains from original capital. | Emotional bias toward avoiding regret from realized losses. |

Introduction to House Money Effect and Disposition Effect

The House Money Effect describes investors' tendency to take greater risks with profits already gained, treating them as if they belong to the "house" rather than their own capital. The Disposition Effect involves investors' propensity to sell winning investments too early while holding onto losing investments too long, driven by emotional biases and loss aversion. Both effects illustrate how behavioral biases influence financial decision-making, deviating from rational market theories.

Defining the House Money Effect

The house money effect describes investors' tendency to take greater financial risks after experiencing prior gains, treating these gains as "house money" rather than their own capital. This behavioral finance bias contrasts with the disposition effect, where investors prematurely sell winning investments to lock in gains and hold onto losing investments to avoid realizing losses. Understanding the house money effect helps explain risk-seeking behavior in markets following profitable trades or unexpected windfalls.

Understanding the Disposition Effect

The Disposition Effect refers to investors' tendency to sell winning assets prematurely while holding onto losing ones, driven by loss aversion and regret avoidance. In contrast, the House Money Effect involves increased risk-taking with gains perceived as "house money," yet the Disposition Effect highlights emotional biases affecting decision-making and portfolio performance. Understanding the Disposition Effect requires examining how psychological factors disrupt rational trading strategies, leading to suboptimal investment outcomes.

Psychological Foundations of Both Effects

The house money effect arises from individuals perceiving prior gains as less valuable, leading to increased risk-taking behavior with "house money" rather than their original capital. In contrast, the disposition effect is driven by loss aversion and mental accounting, causing investors to prematurely sell winning assets while holding onto losers to avoid realizing losses. Both effects stem from cognitive biases influencing risk perception and emotional responses to gains and losses in financial decision-making.

Key Differences Between House Money and Disposition Effects

The House Money Effect describes investors taking more risks with profits already gained, perceiving them as "house money" or a buffer against losses. The Disposition Effect involves investors' tendency to sell winning investments too early while holding onto losing investments in hope of a rebound. Key differences lie in risk behavior and decision timing: House Money Effect emphasizes increased risk-taking from mental accounting of gains, whereas Disposition Effect highlights reluctance to realize losses due to loss aversion.

Real-Life Examples and Case Studies

The House Money Effect influences investors to take higher risks with profits gains, as seen in stock traders who double down on winning positions, mistaking them for "house money." In contrast, the Disposition Effect causes investors to hold losing stocks too long while selling winners prematurely, evidenced by studies in retirement fund portfolios where investors frequently lock in small gains but avoid realizing losses. Real-life examples from behavioral finance reveal that traders engaging in the House Money Effect often increase portfolio volatility, whereas the Disposition Effect leads to suboptimal investment strategies and lower long-term returns.

Impact on Investor Behavior and Decision-Making

The House Money Effect leads investors to take higher risks with gains perceived as "house money," often increasing speculative behavior and reducing risk aversion after profits. In contrast, the Disposition Effect causes investors to irrationally hold losing investments too long while quickly selling winners, driven by loss aversion and regret avoidance. Both biases skew rational decision-making, resulting in suboptimal portfolio management and inconsistent risk assessment.

Implications for Financial Markets

The house money effect leads investors to take greater risks with gains perceived as "house money," increasing trading volume and market volatility. In contrast, the disposition effect causes investors to hold losing stocks too long and sell winners prematurely, which can reduce market efficiency and delay price discovery. Both biases influence asset prices and liquidity, highlighting the need for behavioral considerations in financial market models.

Strategies to Overcome These Behavioral Biases

To mitigate the House Money Effect, investors should implement disciplined risk management strategies, such as setting predefined stop-loss orders and adhering to strict portfolio rebalancing schedules. Overcoming the Disposition Effect requires adopting objective decision-making frameworks, including using algorithmic trading tools that trigger automatic sell signals based on fundamental metrics rather than emotional attachment. Incorporating behavioral finance training and routinely reviewing past investment decisions helps reinforce awareness and counteract biases that lead to suboptimal trading outcomes.

Conclusion: Navigating Behavioral Pitfalls in Investing

Investors facing the house money effect often take greater risks with perceived "free" gains, while those under the disposition effect prematurely sell winners to avoid regret and hold losers too long, impairing portfolio growth. Recognizing these biases allows investors to implement disciplined strategies, such as setting predefined exit points and focusing on long-term goals rather than short-term emotional reactions. Overcoming these behavioral pitfalls enhances decision-making, leading to improved risk management and investment returns.

House money effect Infographic

libterm.com

libterm.com