Pareto efficiency represents an economic state where resources are allocated in a way that no individual can be made better off without making someone else worse off, highlighting optimal distribution and resource use. Understanding this concept can help you analyze decisions and policies for maximum overall benefit without unintended harm. Explore the rest of the article to dive deeper into how Pareto efficiency impacts economics and decision-making.

Table of Comparison

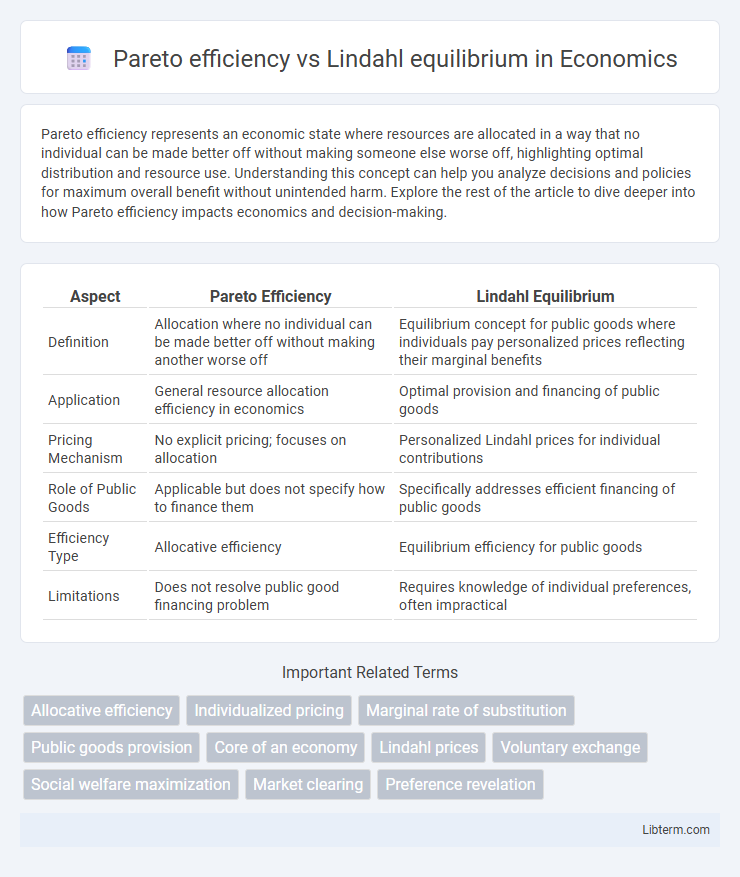

| Aspect | Pareto Efficiency | Lindahl Equilibrium |

|---|---|---|

| Definition | Allocation where no individual can be made better off without making another worse off | Equilibrium concept for public goods where individuals pay personalized prices reflecting their marginal benefits |

| Application | General resource allocation efficiency in economics | Optimal provision and financing of public goods |

| Pricing Mechanism | No explicit pricing; focuses on allocation | Personalized Lindahl prices for individual contributions |

| Role of Public Goods | Applicable but does not specify how to finance them | Specifically addresses efficient financing of public goods |

| Efficiency Type | Allocative efficiency | Equilibrium efficiency for public goods |

| Limitations | Does not resolve public good financing problem | Requires knowledge of individual preferences, often impractical |

Introduction to Pareto Efficiency and Lindahl Equilibrium

Pareto efficiency occurs when resources are allocated in a way that no individual can be made better off without making someone else worse off, representing optimal distribution in economics. Lindahl equilibrium extends this concept by addressing public goods provision, assigning personalized prices to individuals based on their marginal benefits, ensuring efficient funding and consumption without free-rider problems. Both concepts are fundamental in welfare economics, with Pareto efficiency emphasizing allocation optimality and Lindahl equilibrium focusing on equitable cost-sharing in public goods scenarios.

Defining Pareto Efficiency: Key Concepts

Pareto efficiency, a fundamental concept in welfare economics, occurs when no individual's situation can be improved without worsening another's, ensuring optimal resource allocation. It defines an allocation where resources are distributed in a manner that maximizes overall social welfare without making any participant worse off. In contrast, Lindahl equilibrium extends this idea by seeking efficient public good provision through personalized pricing, aligning individual contributions with marginal benefits in a Pareto-efficient manner.

Understanding Lindahl Equilibrium: An Overview

Lindahl equilibrium represents a state in public economics where individuals pay personalized prices for public goods, aligning their marginal benefits with the provision cost, achieving efficient resource allocation. Unlike Pareto efficiency, which broadly describes allocations where no one can be made better off without making someone else worse off, Lindahl equilibrium specifically addresses the challenge of financing public goods in a way that reflects individual valuations. This equilibrium ensures voluntary participation and efficient provision, highlighting perfect internalization of externalities in public good markets.

Historical Background and Theoretical Foundations

Pareto efficiency, introduced by Vilfredo Pareto in the early 20th century, is a foundational concept in welfare economics emphasizing allocations where no individual can be better off without making someone else worse off. The Lindahl equilibrium, developed by Erik Lindahl in the 1910s, builds on public goods theory by proposing personalized pricing mechanisms that reflect individuals' marginal benefits to achieve efficient public good provision. Both concepts rely on the assumption of complete information and rational agents, with Pareto efficiency focusing on optimal resource allocation and Lindahl equilibrium addressing the challenge of financing non-excludable goods.

Mathematical Formulations: Pareto vs. Lindahl

Pareto efficiency is defined mathematically by the condition that no individual's utility can be increased without decreasing another's utility, formalized as a state where the allocation \( \mathbf{x}^* \) satisfies \( u_i(\mathbf{x}^*) \geq u_i(\mathbf{x}) \) for all \( i \) without making any \( u_j(\mathbf{x}^*) < u_j(\mathbf{x}) \). Lindahl equilibrium characterizes a market outcome with personalized prices \( p_i \) where each individual maximizes utility given these prices, and public goods are financed through individual budget constraints \( p_i \cdot x = T_i \), such that the sum of these prices equals the marginal cost, \( \sum_i p_i = MC \). The mathematical distinction lies in Pareto efficiency representing an optimal allocation in a social welfare context, while Lindahl equilibrium provides an implementable pricing mechanism that achieves efficiency by aligning private incentives with social costs.

Efficiency in Resource Allocation: Comparative Analysis

Pareto efficiency ensures resources are allocated so that no individual can be made better off without making someone else worse off, highlighting optimal resource distribution under given preferences. Lindahl equilibrium extends this concept by incorporating individualized prices for public goods, enabling efficient financing through personalized tax shares that reflect marginal benefits. Comparing the two, Pareto efficiency addresses allocation feasibility, while Lindahl equilibrium provides a practical mechanism for achieving efficient public goods provision through balanced cost-sharing.

Public Goods Provision: Applications of Lindahl Equilibrium

Lindahl equilibrium offers a solution for efficient public goods provision by assigning personalized prices reflecting individual valuations, ensuring Pareto efficient outcomes where no one can be made better off without making someone else worse off. This approach aligns individual incentives with social optimality through voluntary contributions, addressing free-rider problems common in public goods scenarios. Applications of Lindahl equilibrium include funding public infrastructure, environmental conservation projects, and collective decision-making in public service provision.

Pareto Optimality in Market Economies

Pareto efficiency in market economies occurs when resources are allocated in a way that no individual can be made better off without making someone else worse off, representing an optimal distribution of goods and services. The Lindahl equilibrium refines this concept by assigning personalized prices for public goods, ensuring voluntary contributions align with individual valuations and achieving Pareto optimality in collective consumption. Understanding Pareto optimality helps economists evaluate market outcomes for efficiency and fairness, especially when dealing with public goods and externalities.

Limitations and Criticisms of Each Approach

Pareto efficiency often faces criticism for neglecting equity aspects since it only ensures that no one can be made better off without making someone else worse off, potentially leading to highly unequal outcomes. Lindahl equilibrium, while addressing public goods provision by assigning personalized prices, is limited by the impracticality of accurately determining individual valuations and preference revelation, which can induce strategic manipulation. Both approaches struggle with real-world application complexities, including informational constraints and the challenge of incorporating fairness into efficient resource allocation.

Practical Implications and Real-World Examples

Pareto efficiency ensures that no individual can be made better off without making someone else worse off, often applied in resource allocation within markets to maximize overall welfare. Lindahl equilibrium addresses public goods by assigning personalized prices to individuals based on their marginal benefits, leading to efficient financing and provision of such goods as national defense or public broadcasting. In practice, Lindahl pricing remains theoretical due to information challenges, whereas Pareto efficiency guides policymakers in evaluating trade-offs in healthcare distribution and environmental regulations.

Pareto efficiency Infographic

libterm.com

libterm.com