An auction market is a competitive environment where buyers and sellers openly bid to determine the price of goods or services, often leading to fair market value through transparent price discovery. This dynamic system is widely used in various sectors, from real estate to financial markets, ensuring that your trades or purchases reflect true market demand. Explore the rest of the article to understand how auction markets operate and how you can benefit from them.

Table of Comparison

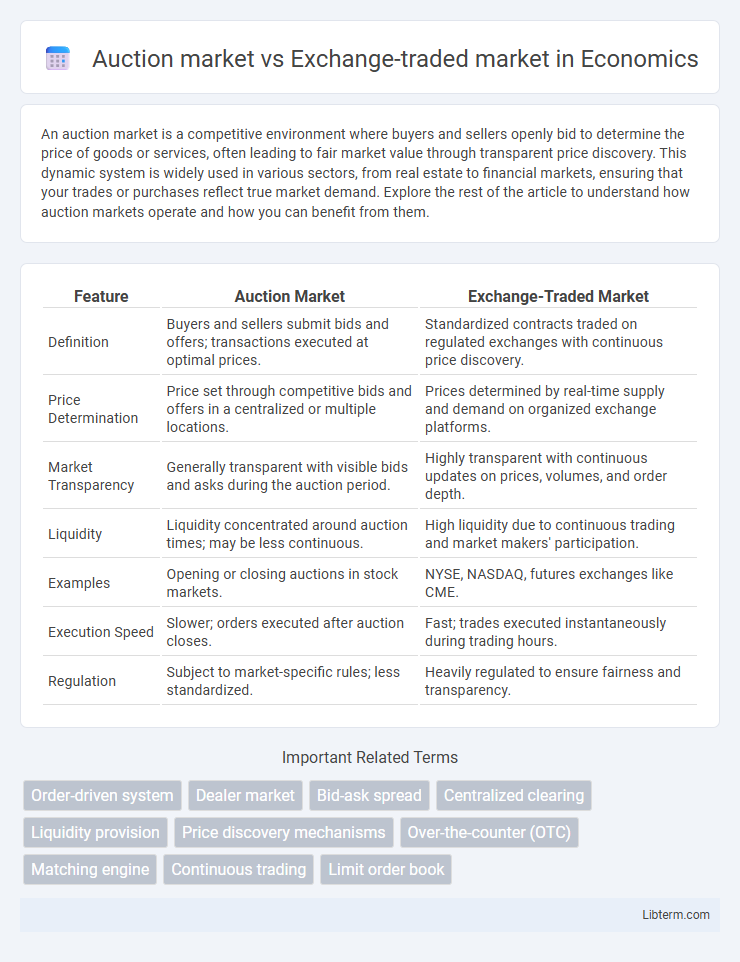

| Feature | Auction Market | Exchange-Traded Market |

|---|---|---|

| Definition | Buyers and sellers submit bids and offers; transactions executed at optimal prices. | Standardized contracts traded on regulated exchanges with continuous price discovery. |

| Price Determination | Price set through competitive bids and offers in a centralized or multiple locations. | Prices determined by real-time supply and demand on organized exchange platforms. |

| Market Transparency | Generally transparent with visible bids and asks during the auction period. | Highly transparent with continuous updates on prices, volumes, and order depth. |

| Liquidity | Liquidity concentrated around auction times; may be less continuous. | High liquidity due to continuous trading and market makers' participation. |

| Examples | Opening or closing auctions in stock markets. | NYSE, NASDAQ, futures exchanges like CME. |

| Execution Speed | Slower; orders executed after auction closes. | Fast; trades executed instantaneously during trading hours. |

| Regulation | Subject to market-specific rules; less standardized. | Heavily regulated to ensure fairness and transparency. |

Understanding Auction Markets

Auction markets facilitate the direct interaction of buyers and sellers who submit competitive bids and offers, enabling price discovery through real-time negotiation. Prominent examples include stock exchanges like the New York Stock Exchange (NYSE), where order books match buy and sell orders based on price and time priority. This price formation mechanism contrasts with dealer markets, emphasizing transparency and efficient allocation of securities in auction markets.

Defining Exchange-Traded Markets

Exchange-traded markets are centralized platforms where securities, commodities, or derivatives are bought and sold through standardized contracts and regulated processes ensuring transparency and liquidity. Unlike auction markets, which rely on direct bids and offers between participants, exchange-traded markets use order books and market makers to facilitate efficient price discovery and execution. Major examples of exchange-traded markets include the New York Stock Exchange (NYSE) and the Chicago Mercantile Exchange (CME).

Key Differences Between Auction and Exchange-Traded Markets

Auction markets involve buyers and sellers submitting bids and offers simultaneously, enabling price discovery through direct interaction, while exchange-traded markets operate with centralized order books where trades execute automatically at the best available prices. Auction markets often feature open outcry or electronic bidding, promoting transparency and competitive pricing, whereas exchange-traded markets rely on standardized contracts and regulated exchanges to facilitate liquidity and reduce counterparty risk. The key differences lie in price determination methods, market structure, and trading mechanisms influencing efficiency and participant behavior.

Price Discovery Mechanisms

Auction markets rely on open outcry or electronic matching of buy and sell orders, where prices are determined by the highest bid and lowest ask, facilitating direct competition among participants that sharpens price discovery. Exchange-traded markets use continuous trading with standardized contracts and central order books, allowing real-time price adjustments based on supply and demand dynamics. The auction market's transparent bidding process contrasts with the exchange-traded market's liquidity-driven price formation, both mechanisms ensuring efficient alignment of asset values to market information.

Liquidity and Market Participants

Auction markets typically offer higher liquidity due to direct interaction between buyers and sellers, allowing for competitive price discovery. Market participants in auction settings include individual investors, brokers, and dealers who actively negotiate prices in real time. Exchange-traded markets provide structured liquidity with standardized contracts and centralized order books, attracting institutional investors, market makers, and retail traders who benefit from transparent pricing and regulated environments.

Trading Processes and Order Execution

Auction markets involve buyers and sellers interacting directly through a bidding process, where orders are aggregated and matched periodically, resulting in a single price that clears the market. Exchange-traded markets, such as stock exchanges, facilitate continuous trading with real-time order matching using electronic systems, enabling immediate execution based on price-time priority. The auction market emphasizes price discovery through concentrated bidding sessions, while exchange-traded markets prioritize liquidity and rapid execution through continuous order flow.

Transparency and Regulation

Auction markets offer higher transparency as all bids and offers are visible to participants, allowing price discovery through open competition. Exchange-traded markets operate under stringent regulatory frameworks established by entities like the SEC, which enforce rules to protect investors and maintain market integrity. Regulatory oversight of exchange-traded markets ensures standardized procedures, promoting fairness and reducing the risk of manipulation compared to less regulated auction markets.

Cost Structure and Fees

Auction markets typically have lower direct fees as transactions occur between buyers and sellers in a single venue, reducing intermediary costs. Exchange-traded markets often involve higher fees due to the use of intermediaries, market makers, and regulatory compliance, including listing fees and trading commissions. The cost structure in exchange-traded markets also incorporates clearing and settlement fees, which are generally absent or minimal in auction markets.

Risks and Volatility Comparison

Auction markets often exhibit higher price volatility due to the direct interaction between buyers and sellers, leading to rapid price changes during the bidding process. Exchange-traded markets provide greater liquidity and transparency, which generally reduce price volatility and mitigate counterparty risk through standardized contracts and regulatory oversight. However, exchange-traded markets may still face risks related to systemic shocks and market-wide fluctuations despite their structured environments.

Choosing the Right Market for Investors

Auction markets offer investors the advantage of price discovery through direct bidding among participants, which can lead to competitive pricing in less liquid assets. Exchange-traded markets provide higher liquidity, standardized contracts, and greater transparency, making them ideal for investors seeking ease of entry and exit with reduced counterparty risk. Selecting the right market depends on the investor's preference for liquidity, price transparency, and the nature of the asset being traded.

Auction market Infographic

libterm.com

libterm.com