A multiplier amplifies the effect of an initial input, making its impact much larger in various fields like economics, electronics, and mathematics. Understanding how a multiplier functions can help you maximize outcomes and improve efficiency in your projects or analyses. Explore the full article to discover how multipliers work and how to leverage them effectively.

Table of Comparison

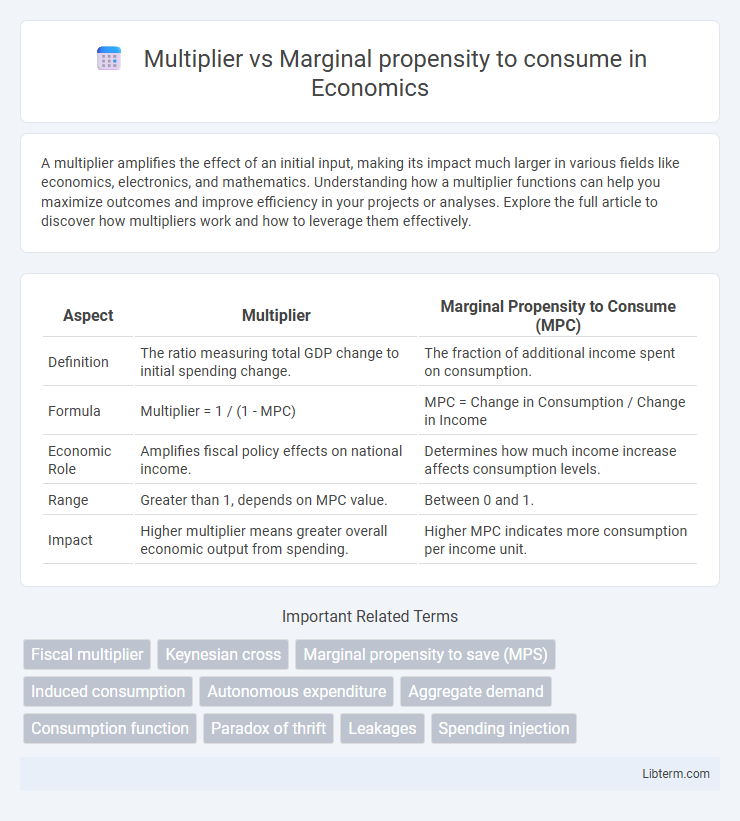

| Aspect | Multiplier | Marginal Propensity to Consume (MPC) |

|---|---|---|

| Definition | The ratio measuring total GDP change to initial spending change. | The fraction of additional income spent on consumption. |

| Formula | Multiplier = 1 / (1 - MPC) | MPC = Change in Consumption / Change in Income |

| Economic Role | Amplifies fiscal policy effects on national income. | Determines how much income increase affects consumption levels. |

| Range | Greater than 1, depends on MPC value. | Between 0 and 1. |

| Impact | Higher multiplier means greater overall economic output from spending. | Higher MPC indicates more consumption per income unit. |

Introduction to Economic Multipliers

Economic multipliers quantify the impact of an initial change in spending on total economic output, measuring how income generated from one dollar of expenditure circulates through the economy. The marginal propensity to consume (MPC) plays a crucial role in determining the size of the multiplier, as it represents the proportion of additional income that households spend rather than save. A higher MPC leads to a larger multiplier effect, amplifying the influence of government spending, investment, or other fiscal actions on GDP growth.

Defining Marginal Propensity to Consume (MPC)

Marginal Propensity to Consume (MPC) measures the fraction of additional income that households spend on consumption rather than saving. It plays a critical role in determining the size of the multiplier effect in macroeconomics, where a higher MPC leads to a greater increase in aggregate demand from an initial change in income. Understanding MPC helps economists predict consumer behavior and the overall impact of fiscal policies on economic growth.

The Fundamental Relationship: Multiplier and MPC

The multiplier measures the total increase in output resulting from an initial change in autonomous spending, directly linked to the marginal propensity to consume (MPC), which quantifies the fraction of additional income spent on consumption. The fundamental relationship is expressed as Multiplier = 1 / (1 - MPC), highlighting how a higher MPC leads to a larger multiplier effect on GDP. This relationship underscores the critical role of consumer behavior in amplifying fiscal stimuli and shaping macroeconomic equilibrium.

The Multiplier Formula Explained

The multiplier formula is defined as 1 divided by (1 minus the marginal propensity to consume, MPC), highlighting how changes in autonomous spending lead to amplified effects on total economic output. A higher MPC means a larger portion of additional income is spent, increasing the multiplier effect and resulting in greater shifts in GDP. Understanding this relationship allows economists to predict the overall impact of fiscal policies on economic growth by analyzing consumption patterns.

Calculating MPC: Step-by-Step

Calculating the marginal propensity to consume (MPC) involves dividing the change in consumption by the change in disposable income, where MPC = DC / DY. Start by identifying the increase in consumption expenditure and the corresponding rise in income over a specific period. This ratio reflects the fraction of additional income that households spend rather than save, a key parameter in Keynesian economics that influences the multiplier effect.

How MPC Influences the Multiplier Effect

The marginal propensity to consume (MPC) directly determines the strength of the multiplier effect by indicating the proportion of additional income spent on consumption rather than savings. A higher MPC results in a larger multiplier value, amplifying the overall increase in aggregate demand from an initial change in spending. This relationship is mathematically expressed by the multiplier formula 1 / (1 - MPC), highlighting that even small variations in MPC can substantially influence economic output and growth.

Practical Examples: Multiplier vs. MPC in Action

The multiplier measures the total economic impact of an initial change in spending, calculated as 1/(1 - MPC), where MPC is the marginal propensity to consume, or the fraction of additional income spent on consumption. For example, if the MPC is 0.8, a $1,000 increase in government spending can lead to a $5,000 increase in total output due to the multiplier effect (1/(1-0.8) = 5). This relationship illustrates how higher MPC values intensify the multiplier effect, making policy interventions more effective in stimulating economic growth.

Factors Affecting MPC and the Multiplier

The marginal propensity to consume (MPC) measures the proportion of additional income that households spend on consumption, significantly influencing the multiplier effect in an economy. Factors affecting MPC include income levels, consumer confidence, wealth, and access to credit, where higher income typically lowers MPC as consumption saturates. The multiplier amplifies the initial change in spending based on MPC; a higher MPC results in a larger multiplier, causing a more pronounced ripple effect through aggregate demand and overall economic output.

Policy Implications: Fiscal Stimulus and Consumption

The multiplier effect measures how fiscal stimulus amplifies initial government spending through increased aggregate demand, while the marginal propensity to consume (MPC) indicates the proportion of additional income that households spend rather than save, directly influencing the size of the multiplier. High MPC values result in stronger consumption responses, enhancing the effectiveness of fiscal stimulus in boosting economic growth and employment. Policymakers targeting fiscal expansion must consider MPC variations across income groups to design stimulus packages that maximize consumption growth and economic recovery.

Key Differences and Summary

The multiplier measures the total impact of a change in autonomous spending on aggregate output, magnifying initial expenditure effects, while the marginal propensity to consume (MPC) quantifies the proportion of additional income spent on consumption. The multiplier value equals 1 divided by (1 minus MPC), linking the two concepts directly but distinguishing the multiplier as an aggregate response and MPC as a behavioral parameter. Understanding these differences is critical for analyzing fiscal policy effectiveness and predicting economic output changes from income variations.

Multiplier Infographic

libterm.com

libterm.com