A mixed economy balances elements of both capitalism and socialism, integrating private enterprise with government regulation to promote economic stability and growth. This system aims to leverage the efficiency of markets while addressing social welfare through public policies and interventions. Explore the rest of the article to understand how a mixed economy impacts Your financial opportunities and societal well-being.

Table of Comparison

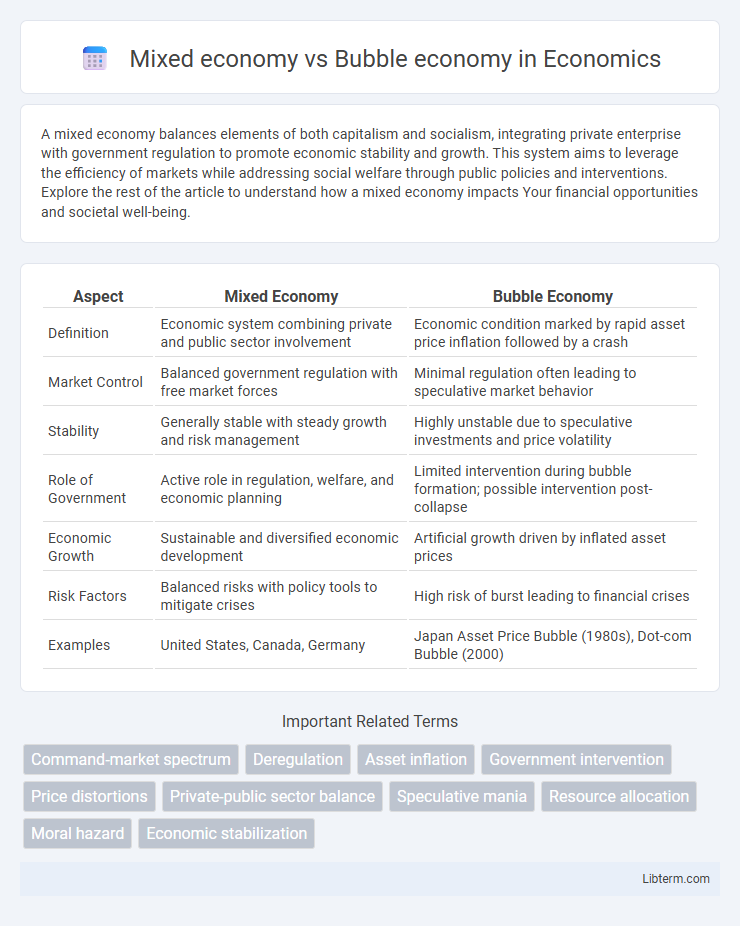

| Aspect | Mixed Economy | Bubble Economy |

|---|---|---|

| Definition | Economic system combining private and public sector involvement | Economic condition marked by rapid asset price inflation followed by a crash |

| Market Control | Balanced government regulation with free market forces | Minimal regulation often leading to speculative market behavior |

| Stability | Generally stable with steady growth and risk management | Highly unstable due to speculative investments and price volatility |

| Role of Government | Active role in regulation, welfare, and economic planning | Limited intervention during bubble formation; possible intervention post-collapse |

| Economic Growth | Sustainable and diversified economic development | Artificial growth driven by inflated asset prices |

| Risk Factors | Balanced risks with policy tools to mitigate crises | High risk of burst leading to financial crises |

| Examples | United States, Canada, Germany | Japan Asset Price Bubble (1980s), Dot-com Bubble (2000) |

Introduction to Mixed Economy and Bubble Economy

A mixed economy combines elements of both market and planned economies, enabling private enterprise alongside significant government intervention to regulate markets and provide public goods. This system aims to balance economic efficiency with social welfare, reducing market failures and promoting sustainable growth. In contrast, a bubble economy is characterized by rapid asset price inflation driven by speculative investment, leading to unsustainable valuations and potential market crashes.

Key Characteristics of a Mixed Economy

A mixed economy combines elements of both capitalism and socialism, featuring private enterprise alongside significant government intervention to regulate markets and provide public goods. Key characteristics include a balance between free market operations and state control, aiming to promote economic efficiency, social welfare, and reduce income inequality. Unlike a bubble economy driven by speculative investments and unsustainable asset price inflation, a mixed economy focuses on stable growth and equitable resource distribution.

Defining Features of a Bubble Economy

A bubble economy is characterized by rapid escalation of asset prices driven by speculative demand rather than intrinsic value, leading to unsustainable growth and eventual market collapse. It often features excessive credit expansion, high leverage, and investor overconfidence, creating distortions in resource allocation and financial instability. Unlike a mixed economy, which balances private enterprise and government intervention for sustainable development, a bubble economy lacks this equilibrium, resulting in economic volatility and systemic risk.

Historical Examples of Mixed Economies

The United States during the New Deal era exemplifies a mixed economy, balancing government intervention with free-market principles to recover from the Great Depression. Post-war Japan also illustrates a mixed economy, combining state-guided industrial policy with capitalist market dynamics to achieve rapid economic growth. In contrast, a bubble economy, such as Japan's asset price bubble of the late 1980s, is characterized by unsustainable speculation and inflated asset prices leading to economic collapse.

Notable Instances of Bubble Economies

Notable instances of bubble economies include the Dutch Tulip Mania of the 1630s, the South Sea Bubble in 1720, and the more recent US housing bubble leading to the 2008 financial crisis. These events are characterized by speculative investment inflating asset prices far beyond intrinsic values, followed by sharp market corrections causing widespread economic disruption. In contrast, mixed economies balance market freedom and government intervention, aiming to prevent such extreme market failures through regulation and policy oversight.

Economic Stability: Mixed Economy vs Bubble Economy

A mixed economy promotes economic stability through diversified markets and government regulation that mitigates risks of rapid market fluctuations. In contrast, a bubble economy is characterized by inflated asset prices driven by speculative investments, resulting in heightened volatility and potential economic crashes. Sustainable growth in a mixed economy contrasts sharply with the boom-and-bust cycles typical of a bubble economy, underscoring the importance of balanced economic structures for long-term stability.

Growth Drivers in Mixed and Bubble Economies

Growth drivers in mixed economies typically include a balance of private sector innovation, government intervention, and regulatory frameworks that foster sustainable development and market stability. In contrast, bubble economies experience rapid growth fueled primarily by speculative investments, asset price inflation, and excessive credit expansion, often detached from fundamental economic indicators. Mixed economies benefit from diversified economic activities and policy measures that mitigate risks, while bubble economies are vulnerable to abrupt corrections due to overvalued assets and market exuberance.

Government Intervention: Role and Impact

Government intervention in a mixed economy balances market freedom with regulation to ensure stability, equitable resource distribution, and protection against monopolies. In contrast, a bubble economy often results from insufficient or poorly timed government intervention, leading to speculative asset inflation and eventual market collapse. Effective policy measures in a mixed economy mitigate boom-bust cycles, whereas lack of oversight exacerbates the risks inherent in bubble economies.

Risks and Rewards: Comparative Analysis

A mixed economy balances private enterprise with government intervention, reducing risks of market failures while offering rewards such as economic stability and diversified growth opportunities. In contrast, a bubble economy, driven by speculative asset price surges, carries high risks of sudden market crashes and financial instability but can generate rapid wealth accumulation and short-term economic booms. Understanding these contrasting economic models highlights how mixed economies aim for sustainable growth, whereas bubble economies are prone to volatility and systemic financial crises.

Lessons Learned and Policy Implications

Mixed economies balance market freedom with government intervention, fostering sustainable growth and reducing income inequality by regulating monopolies and providing social safety nets. Bubble economies reveal risks of speculative asset inflation and economic instability, emphasizing the need for robust financial regulation and macroprudential policies to prevent market overheating. Effective economic policies should blend proactive regulation in financial markets with targeted social programs to maintain economic equilibrium and protect vulnerable populations.

Mixed economy Infographic

libterm.com

libterm.com