Competitive equilibrium occurs when supply equals demand in a perfectly competitive market, resulting in an efficient allocation of resources where no participant can be made better off without making another worse off. Prices adjust to reflect the true value of goods and services, balancing producers' willingness to sell with consumers' desire to buy. Explore the rest of this article to understand how competitive equilibrium shapes market dynamics and influences your economic decisions.

Table of Comparison

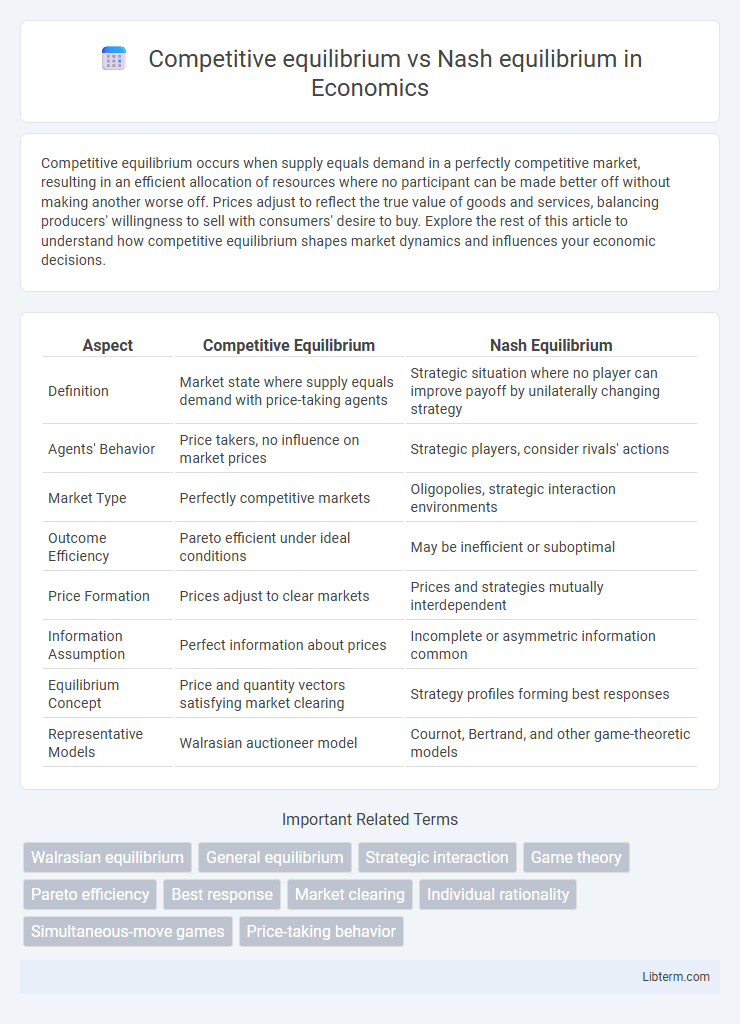

| Aspect | Competitive Equilibrium | Nash Equilibrium |

|---|---|---|

| Definition | Market state where supply equals demand with price-taking agents | Strategic situation where no player can improve payoff by unilaterally changing strategy |

| Agents' Behavior | Price takers, no influence on market prices | Strategic players, consider rivals' actions |

| Market Type | Perfectly competitive markets | Oligopolies, strategic interaction environments |

| Outcome Efficiency | Pareto efficient under ideal conditions | May be inefficient or suboptimal |

| Price Formation | Prices adjust to clear markets | Prices and strategies mutually interdependent |

| Information Assumption | Perfect information about prices | Incomplete or asymmetric information common |

| Equilibrium Concept | Price and quantity vectors satisfying market clearing | Strategy profiles forming best responses |

| Representative Models | Walrasian auctioneer model | Cournot, Bertrand, and other game-theoretic models |

Introduction to Economic Equilibria

Competitive equilibrium occurs when supply equals demand in perfectly competitive markets, ensuring no individual agent can improve their outcome by changing strategies. In contrast, Nash equilibrium arises in strategic settings where each player's strategy is optimal given others' choices, reflecting mutual best responses. Both concepts serve as foundational frameworks in economic theory to analyze stability and efficiency in market interactions and strategic decision-making.

Defining Competitive Equilibrium

Competitive equilibrium occurs when supply equals demand in a perfectly competitive market, with many buyers and sellers acting as price takers, resulting in an efficient allocation of resources. Firms maximize profits by producing where marginal cost equals market price, and consumers maximize utility given budget constraints, ensuring no participant can improve their outcome by changing behavior unilaterally. This equilibrium contrasts with Nash equilibrium, where strategic interactions and individual optimality prevail, but prices need not reflect overall market clearing.

Defining Nash Equilibrium

Nash equilibrium is a solution concept in game theory where no player can improve their payoff by unilaterally changing their strategy, assuming other players' strategies remain fixed. Unlike competitive equilibrium, which arises in perfectly competitive markets with price-taking behavior and ensures market-clearing prices, Nash equilibrium applies to strategic interactions with interdependent decision-making. The key feature of Nash equilibrium is the mutual best response, making it essential in analyzing oligopolies, auctions, and social dilemmas.

Key Assumptions and Foundations

Competitive equilibrium assumes a large number of price-taking agents with perfect information, ensuring no individual can influence market prices, while Nash equilibrium involves strategic decision-making among a finite set of players, each anticipating others' choices. The foundation of competitive equilibrium lies in market clearing and price adjustment mechanisms that balance supply and demand, whereas Nash equilibrium is founded on mutual best responses where no player can unilaterally improve their payoff given others' strategies. Key assumptions in competitive equilibrium include perfect competition and price flexibility, contrasting with Nash equilibrium's focus on strategic interdependence and fixed player actions within games.

Mathematical Formulation of Each Equilibrium

Competitive equilibrium is mathematically characterized by a set of prices and allocations where supply equals demand in each market, subject to agents maximizing their utility or profit given these prices and satisfying budget or feasibility constraints. Nash equilibrium is formulated as a vector of strategies for each player, where no player can increase their payoff by unilaterally changing their strategy, formally expressed as a fixed point of best-response functions. The key difference lies in competitive equilibrium stemming from price-taking behavior in markets, while Nash equilibrium arises from strategic interaction among players with mutual best responses.

Market Structures and Applicability

Competitive equilibrium describes a market structure where numerous buyers and sellers interact, leading to an efficient allocation of resources with prices determined by supply and demand, typically seen in perfectly competitive markets. Nash equilibrium applies to strategic interactions among a limited number of players, where each participant chooses their best response considering others' strategies, commonly observed in oligopolies and game-theoretic frameworks. While competitive equilibrium assumes price-taking behavior with no strategic influence, Nash equilibrium recognizes strategic interdependence, making it particularly suited for analyzing firms in markets with few competitors and strategic decision-making.

Strategic Decision-Making: Individual vs Collective

Competitive equilibrium describes a market outcome where individual firms and consumers optimize their own payoffs assuming prices are given, leading to an efficient allocation of resources without strategic interaction. Nash equilibrium captures strategic decision-making in games where each player's choice depends on anticipating others' actions, resulting in a stable outcome where no player can improve unilaterally. The key distinction lies in competitive equilibrium's emphasis on individual optimization under fixed prices versus Nash equilibrium's focus on interdependent strategies reflecting collective strategic behavior.

Efficiency and Welfare Implications

Competitive equilibrium achieves allocative efficiency by ensuring that supply equals demand at the market-clearing price, maximizing total surplus and promoting optimal resource allocation without individual market power. Nash equilibrium may result in inefficiencies due to strategic behavior and market power, potentially leading to suboptimal outcomes and welfare losses compared to competitive markets. The disparity in welfare implications often highlights the potential for policy interventions to correct market failures arising from Nash equilibria in strategic environments.

Real-World Examples and Applications

Competitive equilibrium occurs in perfectly competitive markets where numerous small firms and consumers interact, leading to an efficient allocation of resources with prices reflecting true supply and demand, as seen in agricultural markets and stock exchanges. Nash equilibrium applies to strategic settings where players consider others' actions, such as oligopolistic firms setting prices or quantities in telecommunications and airline industries. Real-world applications demonstrate competitive equilibrium's role in commodity trading efficiency, while Nash equilibrium guides strategy in markets with few dominant competitors and interdependent decision-making.

Comparative Summary: Competitive vs Nash Equilibrium

Competitive equilibrium occurs in perfectly competitive markets where numerous firms and consumers interact, prices adjust to clear markets, and no individual agent can influence prices, ensuring allocative efficiency. Nash equilibrium applies to strategic settings with a finite number of players whose choices are interdependent, resulting in stable strategy profiles where no player benefits from unilaterally changing their action. Comparative analysis highlights that competitive equilibrium relies on price-taking behavior and market-clearing prices, while Nash equilibrium emphasizes strategic decision-making without guaranteed market efficiency.

Competitive equilibrium Infographic

libterm.com

libterm.com