Economic Value Added (EVA) measures a company's financial performance by calculating the value created beyond the required return on its capital. This metric helps investors and managers assess whether the business is generating sufficient profit to cover its cost of capital and create shareholder wealth. Discover how understanding EVA can enhance your investment decisions and drive superior financial results by reading the rest of the article.

Table of Comparison

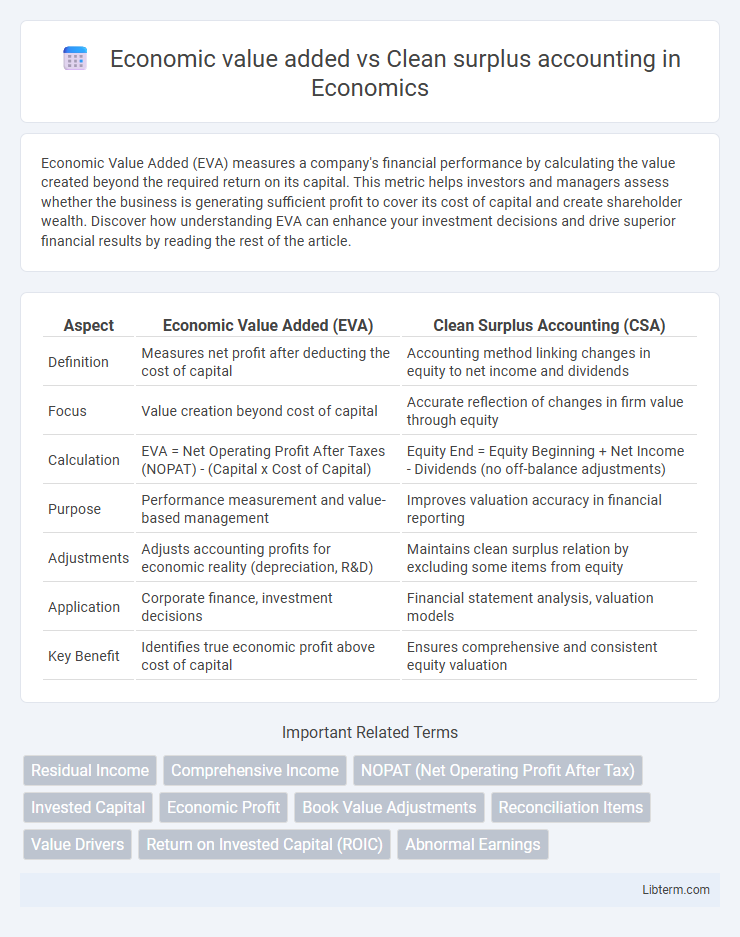

| Aspect | Economic Value Added (EVA) | Clean Surplus Accounting (CSA) |

|---|---|---|

| Definition | Measures net profit after deducting the cost of capital | Accounting method linking changes in equity to net income and dividends |

| Focus | Value creation beyond cost of capital | Accurate reflection of changes in firm value through equity |

| Calculation | EVA = Net Operating Profit After Taxes (NOPAT) - (Capital x Cost of Capital) | Equity End = Equity Beginning + Net Income - Dividends (no off-balance adjustments) |

| Purpose | Performance measurement and value-based management | Improves valuation accuracy in financial reporting |

| Adjustments | Adjusts accounting profits for economic reality (depreciation, R&D) | Maintains clean surplus relation by excluding some items from equity |

| Application | Corporate finance, investment decisions | Financial statement analysis, valuation models |

| Key Benefit | Identifies true economic profit above cost of capital | Ensures comprehensive and consistent equity valuation |

Introduction to Economic Value Added (EVA)

Economic Value Added (EVA) measures a company's financial performance by calculating the value created beyond the required return of its capital investors, emphasizing economic profit rather than accounting profit. EVA is derived by subtracting the cost of capital from net operating profit after taxes (NOPAT), providing a clear indicator of value creation. This metric aligns managerial decisions with shareholder value, contrasting with clean surplus accounting, which focuses on changes in equity excluding transactions with owners.

Understanding Clean Surplus Accounting

Clean Surplus Accounting (CSA) is an accounting framework that connects net income with changes in book value, excluding transactions with shareholders such as dividends and stock issuances, offering a comprehensive measure of a firm's true economic performance. Unlike Economic Value Added (EVA), which focuses on residual income after deducting a capital charge, CSA emphasizes the accounting identity linking earnings and equity changes, providing a foundation for valuation models. Understanding CSA enables analysts to assess firm value more accurately by reconciling reported earnings with changes in equity, highlighting the economic reality beyond traditional accounting figures.

Key Differences Between EVA and Clean Surplus Accounting

Economic Value Added (EVA) measures a firm's financial performance by calculating net operating profit after taxes minus the capital charge, emphasizing value creation beyond cost of capital. Clean Surplus Accounting (CSA) maintains that all changes in equity come from earnings and dividends, ensuring the accounting equation remains intact without direct adjustments to equity. The key difference lies in EVA's focus on economic profit and capital costs, while CSA centers on the integrity of equity measurement through consistent accounting adjustments.

Calculation Methods for EVA and Clean Surplus

Economic Value Added (EVA) is calculated by subtracting the company's weighted average cost of capital (WACC) multiplied by invested capital from the net operating profit after taxes (NOPAT). Clean Surplus accounting adjusts the net income by excluding transactions with shareholders, linking changes in equity directly to comprehensive income and dividends to reflect true economic profits. EVA emphasizes capital charge deductions, while Clean Surplus accounting relies on equity reconciliation, making EVA more focused on cash flow efficiency and Clean Surplus on accounting consistency.

Advantages of Economic Value Added

Economic Value Added (EVA) provides a clearer measure of company performance by focusing on value creation above the cost of capital, aligning management decisions with shareholder wealth maximization. Unlike Clean Surplus Accounting, which integrates accounting adjustments that may obscure economic reality, EVA emphasizes operational efficiency and capital cost recovery, offering a more actionable metric for performance evaluation. Companies using EVA benefit from improved capital budgeting, performance-based compensation, and enhanced strategic planning, driving long-term sustainable growth.

Benefits of Clean Surplus Accounting

Clean Surplus Accounting enhances financial transparency by incorporating changes in equity that bypass the income statement, providing a more comprehensive view of a firm's true economic performance. This method improves valuation accuracy by aligning reported earnings with changes in the book value, aiding investors in assessing sustainable profitability and growth prospects. Clean Surplus Accounting also facilitates better predictive power for future cash flows, supporting more informed decision-making compared to Economic Value Added, which primarily focuses on capital costs without fully capturing equity fluctuations.

Impact on Financial Performance Analysis

Economic Value Added (EVA) and Clean Surplus Accounting offer distinct approaches to financial performance analysis; EVA measures residual income after deducting cost of capital, emphasizing value creation for shareholders. Clean Surplus Accounting focuses on the comprehensive income reconciliation, ensuring all changes in equity are reflected in earnings, enhancing accuracy in book value assessments. The choice between EVA and Clean Surplus significantly affects performance metrics, investor evaluations, and management decision-making processes.

Limitations of Both Approaches

Economic Value Added (EVA) faces limitations such as sensitivity to cost of capital estimates and potential manipulation of accounting profits, which can distort true economic performance. Clean Surplus Accounting (CSA) struggles with incomplete income measurement since it excludes certain gains and losses from net income, leading to possible misrepresentation of firm value. Both methods depend heavily on accounting data accuracy and can be affected by subjective judgments, reducing their reliability for investment decision-making.

Practical Applications in Business Decision-Making

Economic Value Added (EVA) provides a precise measure of a company's true economic profit by accounting for the cost of capital, enabling businesses to make informed investment and operational decisions that enhance shareholder value. Clean surplus accounting ensures comprehensive equity measurement by incorporating all gains and losses directly into shareholders' equity, facilitating accurate residual income evaluations for performance assessment and valuation. Combining EVA with clean surplus principles allows managers to identify value-creating activities and optimize capital allocation, improving strategic planning and performance monitoring.

Conclusion: Choosing the Right Framework

Economic value added (EVA) offers a clear measure of a company's true economic profit by incorporating the cost of capital, making it ideal for performance evaluation and value-based management. Clean surplus accounting focuses on linking changes in equity to comprehensive income, providing a transparent basis for valuation and financial analysis. Choosing the right framework depends on whether the goal is to assess economic profitability through capital costs (favoring EVA) or to ensure accounting accuracy and equity reconciliation (favoring clean surplus accounting).

Economic value added Infographic

libterm.com

libterm.com